Bitcoin whales withdraw 280 million dollars: a bullish sign?

Bitcoin withdrawals of hundreds of millions of US dollars from the main exchanges have caused great attention to the encryption community.

However, if Bitcoin fails to break the barrier of $ 86,000, price correction is still a real possibility, especially amid investor confidence.

Bitcoin whales withdraw hundreds of millions in BTC

Data from x account OlchaINDATANERD On April 17, it reveals that many large bitcoin whales carried out large withdrawals from the top stock exchanges. Galaxy Digital 554 BTC, approximately $ 76.74 million, withdrawn from OKX and Binance.

Abraxas Capital 1,854 BTC, with a value of about $ 157.26 million, was withdrawn from Binance and Kaken.

Two other whales, which were identified by 1MNQX and 1BERU addresses, withdrew 545.5 BTC ($ 45.5 million) and 535.2 BTC ($ 45.44 million) from Coinbase, respectively. In one day, more than $ 280 million from bitcoin was removed from the stock exchanges.

Such clouds of bitcoin whales, such as those written by Galaxy Digital and Abraxas Capital, indicate a strategy to move BTC to cold storage. This is usually seen as a thunderbolt sign, which reduces the pressure pressure and reflects the expectations of future prices.

An increase in bitcoin buyers for the first time

A report from Glassnode sheds light on a sharp rise in Bitcoin buyer for the first time. This flow for new investors can pay short -term price gains. However, LTHS holders temporarily stopped their accumulation, indicating caution amid the increasing market fluctuation.

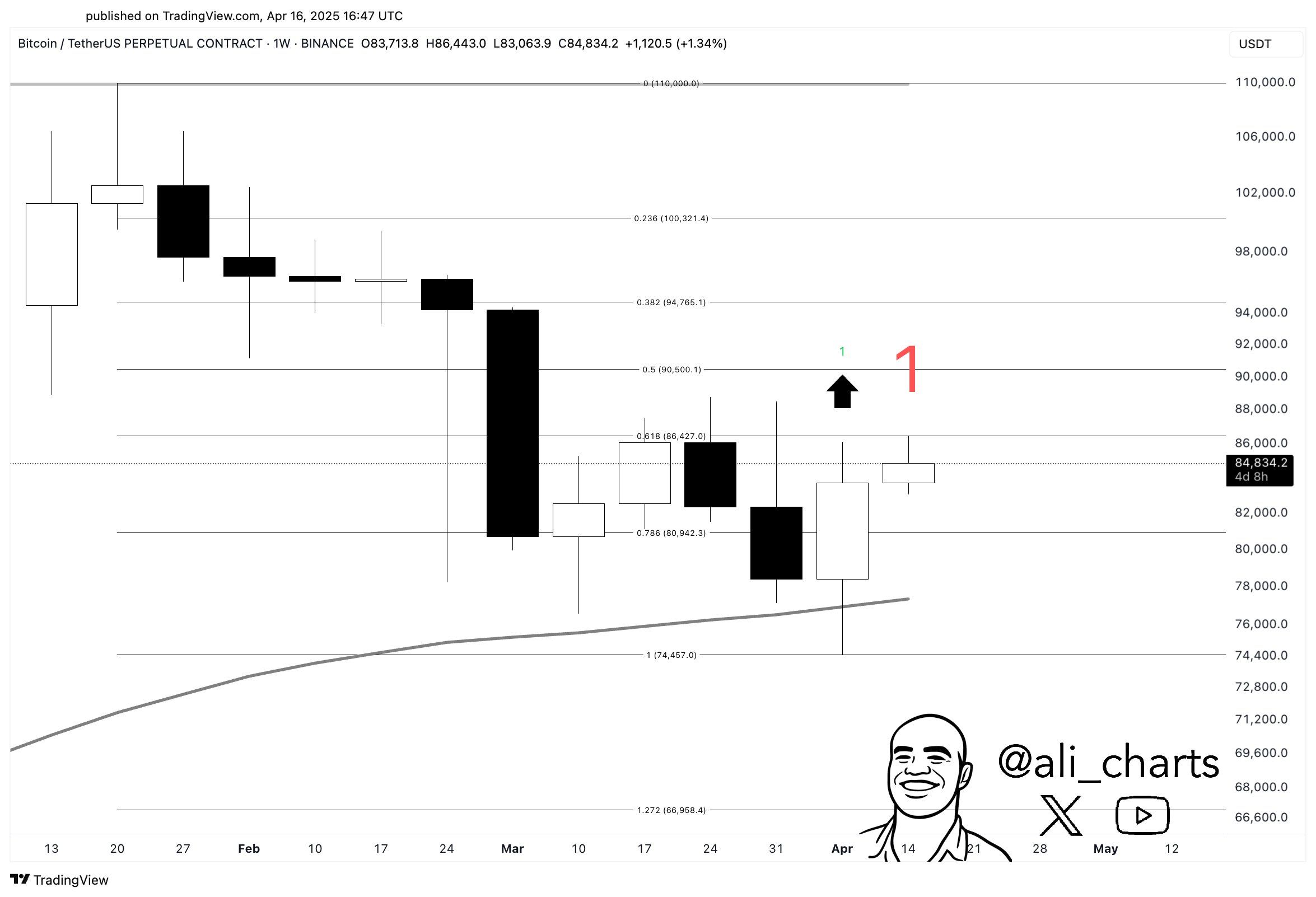

In a post on X, Ali analyst ALI used the TD technical indicator to predict the Bitcoin price. TD Serial Serial Signal Signal Bitcoin Weekly.

If Bitcoin is constantly closed for $ 86,000, it is possible that increased prices. Currently, bitcoin hovers over $ 80,000, indicating growth capabilities. However, exceeding the level of resistance of $ 86,000 is necessary to confirm the bullish direction.

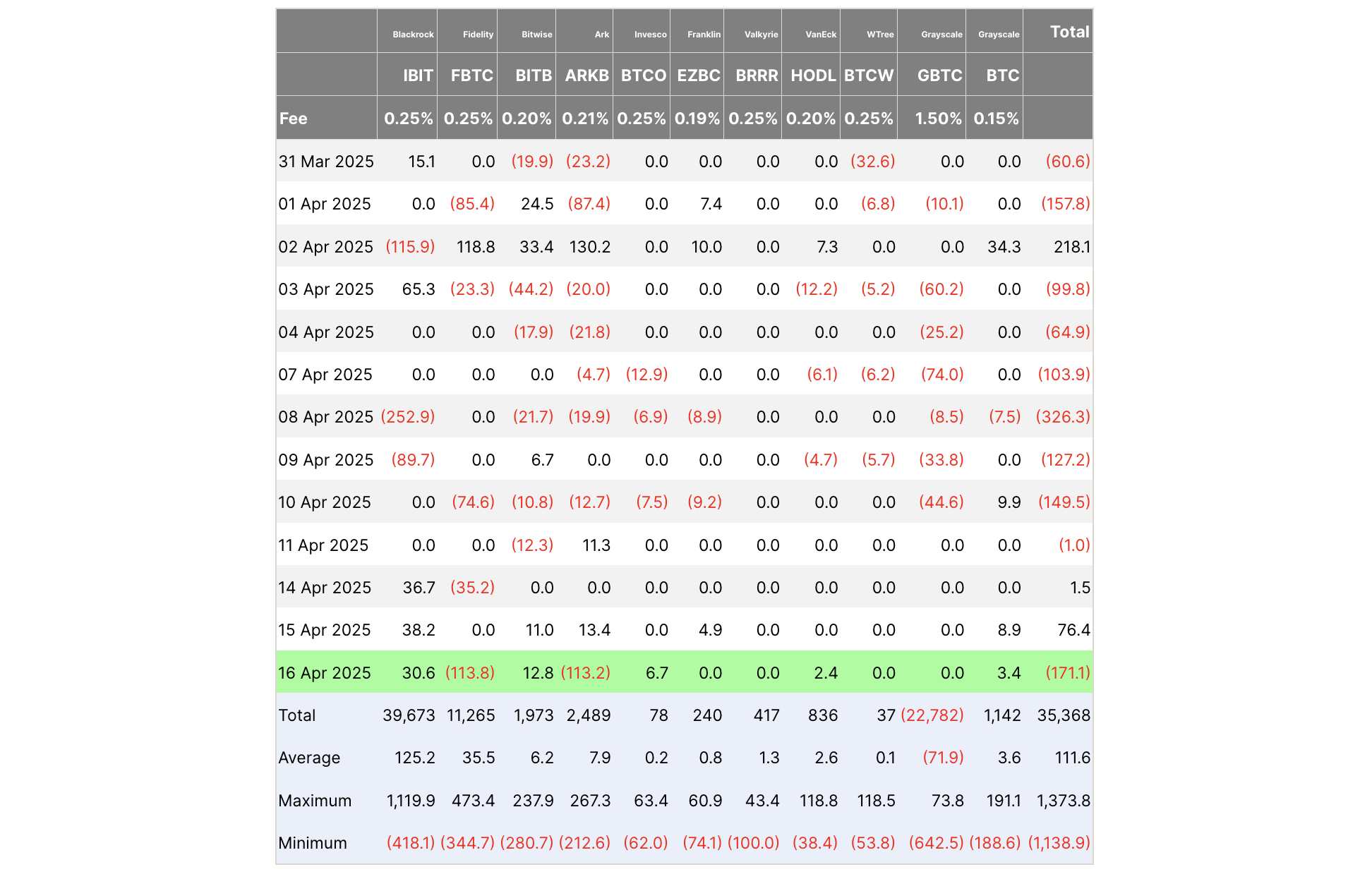

Despite the accumulation of the last whale, not all signals are positive. The flows to the investment funds circulated in Bitcoin have significantly decreased. This decline indicates the weakening of the investor’s confidence, which may exert down low prices on prices without new incentives.

In addition, data from Lookonchain It indicates that more than $ 1.26 billion in Bitcoin was not separated from Babylon. If this capital returns to the stock exchanges, the pressure pressure may increase, making it difficult for bitcoin to violate the key resistance levels.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.