Bitcoin whales again in the “complete power” of the gathering, reveals Glassnode

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Glassnode has unveiled the chain level, how the large bitcoin investors have bought during this rise in prices so far.

The degree of accumulation suggests a strong purchase of huge whales

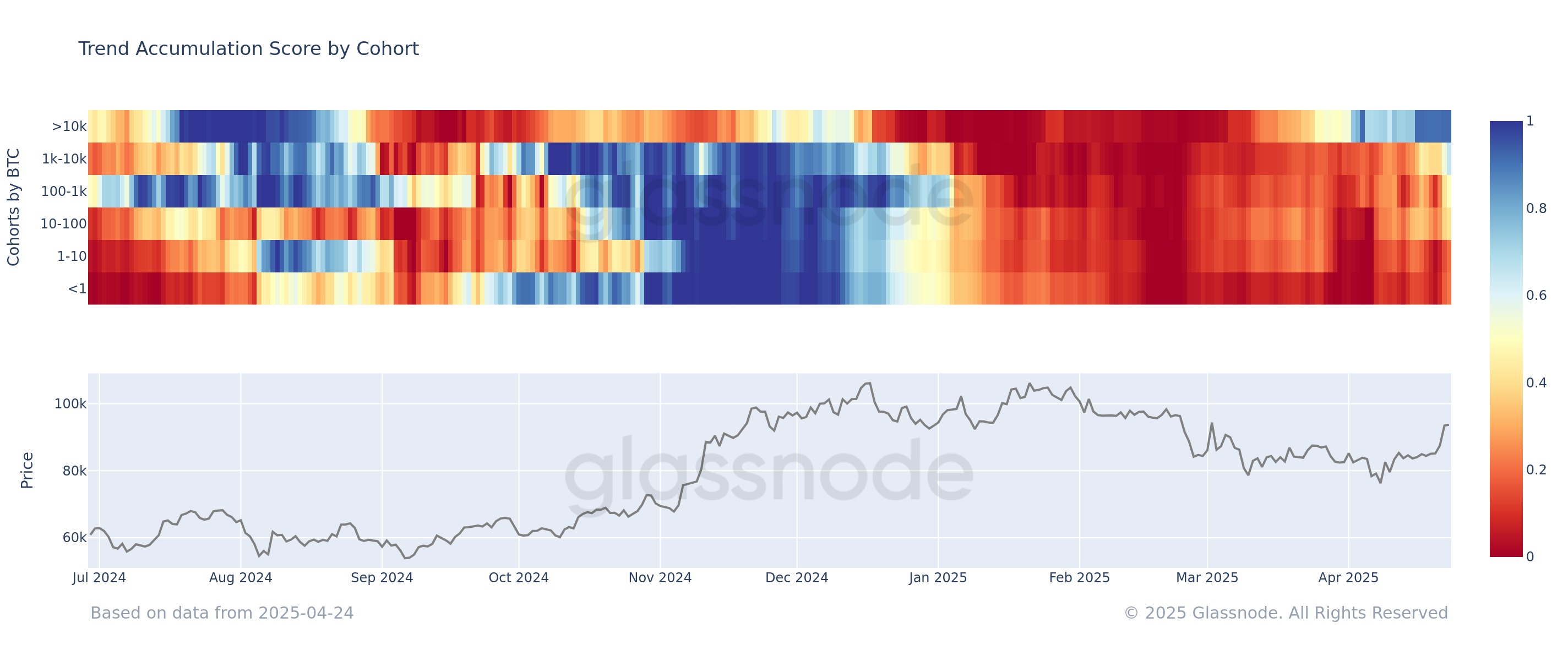

In new mail On X, Glassnode discuss on how to change the degree of accumulation of Ducumulation Trend trends for various Bitcoin Investor collections recently. “The degree of accumulation” indicates an indication of the chain that mainly tells us whether BTC holders buy or sell.

The scale calculates its value not only by taking advantage of the balance changes that occur in investor portfolios, but also the size of the governor themselves. This means that large addresses have a higher weight in the index value.

Related reading

When the degree of accumulation is greater than 0.5, it indicates that the large investors (or a large number of young owners) participate in the accumulation. The closer the scale to 1.0, the stronger this behavior.

On the other hand, the index of less than 0.5 means that investors distribute or not make any purchase. On this side of the scale, the zero mark acts as an extremist point.

In the context of the current topic, the degree of direction of joint accumulation in the entire Bitcoin market is not important, but rather the separate degrees of various investor groups.

There are two main ways to divide pregnant groups: time contract and balance size. Here, the dust is based on the last classification. Below is the graph that the Analysis Company shares the trend in the degree of accumulation of these groups during the past year.

As shown in the graph above, the Bitcoin market as a whole was in a distribution state during the past few months, but one group began to withdraw from the rest last month: Holders of 10,000 BTC.

Investors who carry between 1000 and 10,000 BTC are popularly known as whales, so these investors, who are more fragile, can be called huge whales.

From the graph, it is clear that the rest of the market continued to sell this month, but the huge whales, which were already abandoning their distribution, were prohibited to buy instead. They only strengthened their behavior, as the scale now has now reached a almost perfect degree of 0.9.

Whales have also turned recently, as the result was 0.7 for them. Consequently, it appears that adult investors as a whole accumulate Bitcoin during the last recovery gatherings.

Related reading

Among the rest of the market, sharks (100 to 1000 BTC) are the closest to catching whales, with accumulation sessions at 0.5. Investors are still the smallest ending in distribution.

The current style is somewhat similar to what he witnessed again in December 2024, as the huge whales in Bitcoin began participating in the strong distribution before the rest.

Bitcoin price

Bitcoin crossed over the level of 94,000 dollars earlier, but it seems that the currency has seen withdrawal since then with the return of its price at 92,600 dollars.

Distinctive image from Dall-I, Glassnode.com, Chart from TradingView.com