Bitcoin whale activity extends as the consumer price index in the United States is alluded upon when cooling is enlarged

Bitcoin (BTC) is once again the headlines of newspapers as it approaches its highest level ever, driven by bullish whale behavior and encouraging macroeconomic indicators.

Currently traded about $ 107,865, the cryptocurrency has briefly crossed the sign of $ 110,000 after issuing inflation data in the most enlarged United States, and re -optimistic the investor and hint at a possible outbreak in the coming weeks.

At the heart of this momentum, there is the behavior of the adult BTC owners, whose recent actions indicate increasing confidence in more bullish direction instead of the imminent market summit.

Whales that bear tightness with prices approaching their highest levels

Although sitting by only 2.82 % lower than a standard level of more than $ 111,000, Bitcoin data on the series reveals that the two main holders, referred to as whales, do not rush abroad.

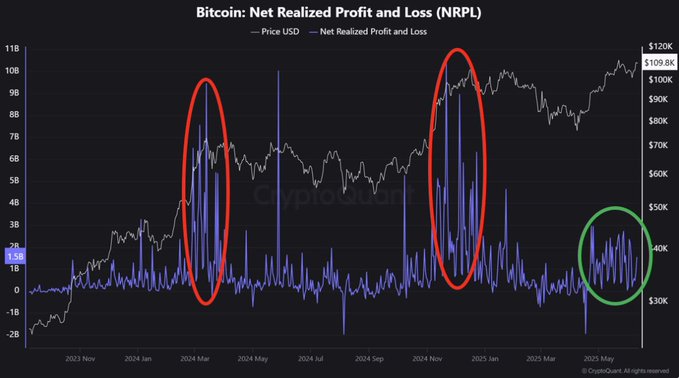

According to the analyzes of the series of Cryptoquant, these entities show control, with a little evidence of the activity of achieving the typical profits that accompany the stages of the peak market.

Analyst Dan Checks Assure Whales seem to be awaiting a more joyful market environment before the start of large -scale sales, a behavior that corresponds to the previous emerging market peaks.

Bitcoin-near the highlands at all, but there is no profit “the whales do not show any intention to their profits at the price level and are likely to wait for higher prices, as the market height and the shape of the bubble are heated, before making their movements.” – By Dancoininvertor

Their reluctance to get out of positions at these levels indicate that they expect higher assessments in the future, a feeling that supports the idea of Bitcoin’s entry into the stage of discovering more extensive prices.

The exchange flows remain silent even though Bitcoin is approaching ATH

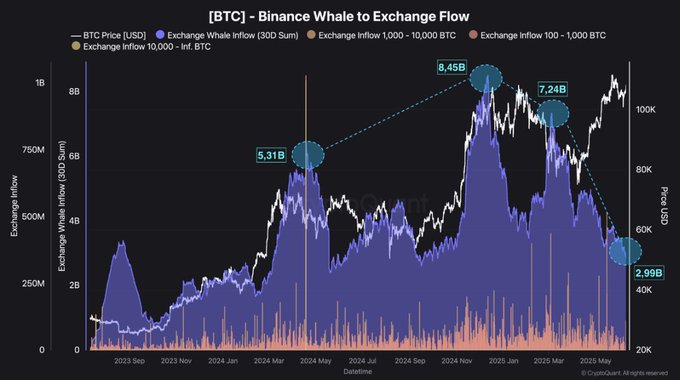

By increasing the promotion of upscale expectations, the most prominent Cryptoquant Darkfost analyst, wrong exchange flows, especially on Binance, even with bitcoin forgery with its highest historical levels.

A strong bullish sign of Binance! “Today, however, the flows are about 3 billion dollars only and continue to decline, indicating that these whales prefer to continue.” – By Darkfost_COC

Full analysis

Cryptoquant.com/insights/quikk …

Historically, the exchange of flows from senior holders tend to rise when bitcoin approaches or exceeds the main resistance levels, which often indicates a desire to achieve profits.

However, the current data tells a different story, as Binance flows hover about 3 billion dollars, much lower than $ 5.3 billion, observed in early 2024 and even beyond the tops of $ 8.45 billion in previous sessions.

This trend declining in whale flows strongly indicates that adult players choose to stick instead of selling, pointing to the constant belief in more upward trend.

Such behavior has significant effects, as whale activity often affects the liquidity of the market and can predict broader moral attacks among institutional investors.

Inf were the inflation enhances BTC momentum ascending

In addition to Bitcoin’s Tailwinds is the latest consumer price index data (CPI), which indicates a slowdown in inflation in the United States for the month of May 2025.

According to the released CPI data, the main consumer price index increased by only 0.1 %, as it decreased less than 0.2 % expected, while the basic consumer price index – except for food and energy – also increased by only 0.1 %, compared to expectations by 0.3 %.

These numbers not only enhance the narration of inflation, but also increase the probability of interest rates from the Federal Reserve later this year.

According to CME Fedwatch toolMarket participants are now expecting discounts in 2025, with the first to arrive in September and another in December.

Low interest rates tend to prefer assets on risk such as Bitcoin, and the encryption market has already begun in this transformation with a renewed bullish enthusiasm.

The last Golden Cross formation adds to optimism BTC ascending

From an artistic point of view, Bitcoin (BTC) also stoned striking technical signals, with a golden cross on the weekly chart.

This style is often seen, as the moving average exceeded 50 days above the moving average for 200 days, as a reliable indicator on the continuous upward budget.

In addition, according to analysts such as Jelle, Bitcoin is prepared to lift after the last penetration and re -test.

Go out.

#Bitcoin

All eyes are at the BOJ meeting next week, which is expected to happen just days before the FOMC meeting in the United States.

According to Arthur Hayes, co -founder of Bitmex, if Boj delayed QT and restarted QE in its meeting in June, risk assets like Bitcoin (BTC) will fly.

I do not think that the normal Japanese parts will agree. If Boj delayed QT, and the QE specified in June, risk assets will fly in June. LFG $ BTC

So, what should the BTC holders expect?

The rapprochement of inflation in cooling, the central bank’s expectations, and the behavior of a firm whale creates a strong mixture of Bitcoin’s potential rise.

With the abundance of retail, it is still largely absent, and the market has shown signs of healthy unification, Bitcoin may have a lot of climbing space.

Since the whales carry fixed and improved conditions, it seems that the stage is specific to the cryptocurrency currency, and may exceed it, which is the highest level in the near term.

The activity of the post -Bitcoin whale extends, as the US consumer price index is sample when the cooling is enlarged first on Invezz