Bitcoin trades a discount for the past month, indicating the pressure pressure – what does this mean

Este artículo también está disponible en estñol.

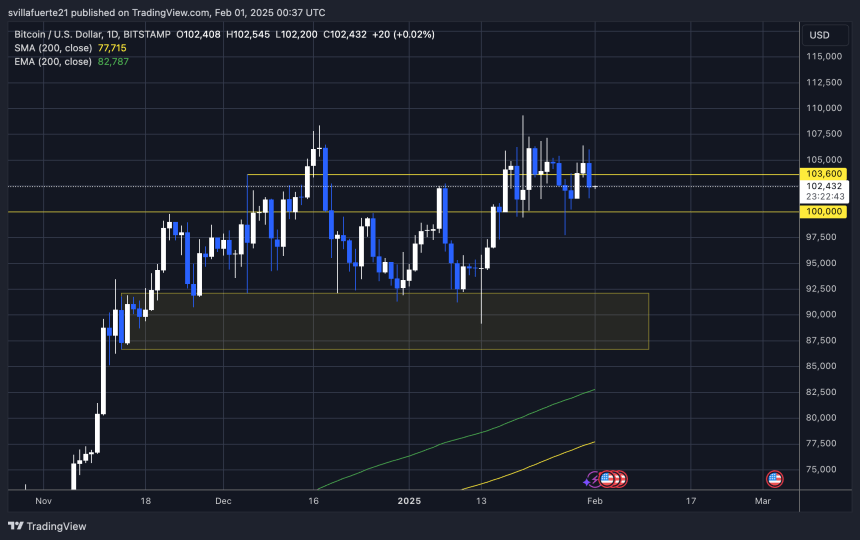

The fluctuation remains the standard in the Bitcoin market, with aggressive fluctuations in the past few days. On Monday, BTC fell to 97 thousand dollars before it risen to 106 thousand dollars yesterday. However, the price has been recovered since then and is now reinforcing about $ 102,000, making investors on the edge of the abyss around its next step.

Related reading

The best DAAN analysts shared major visions of Coinglass, and revealed that Bitcoin was often circulated with Coinbase’s discount last month, as shown in the Coinbase Premium. This means that other instant exchanges are BTC pricing higher than Coinbase, indicating an increase in the pressure pressure from American investors. Coinbase usually indicates a strong request from the institutions of the institutional and ETF, which enhances the upscale feelings. However, with a flat index, the American market looks unresolved.

With Bitcoin incorporating without high levels at all, traders closely monitor whether they can restore the main resistance levels or face another wave of sales pressure. If BTC violates more than 106 thousand dollars again, he may follow a test of the highest level ever. However, the loss of the support level of $ 100,000 may lead to more negative and extension. The coming days will be decisive in determining the next stage of Bitcoin.

Bitcoin at a decisive level where the market is waiting for the next step

Bitcoin at a pivotal moment after failing to re -test it at all (ATH) and is now seeking support to provide the next station. The level of $ 110,000 is still the main psychological goal above ATH, and as soon as the BTC collapses and holds above it, the entire market can enter a new upward stage.

Related reading

Despite the last upscale momentum, BTC struggled to obtain a clear outbreak, which led to uncertainty among investors. Analysts remain divided – some see as a natural unification before Bitcoin takes its next large movement, while others worry about deeper correction if BTC fails to get the main support levels.

Share the best analysts Dan Main visions from CoinglassAnd he revealed that Bitcoin was often circulated by Coinbase’s discount last month. This means that BTC is less expensive on the base of metal currencies compared to other immediate exchanges, indicating that the pressure pressure comes mainly than American investors.

Historically, the Coinbase premium referred to a strong institutional demand, especially from the traded investment funds and the main financial players. However, with the current index, the American market looks careful. In order for BTC to confirm an upward outbreak, seizing $ 102,000 and recovering $ 106,000 is very important. If Bitcoin loses these levels, a re -test of $ 100,000 may be an imminent dollar, which delays the outbreak of prices.

Bitcoin price is less than the main levels

Bitcoin is currently trading at $ 102,400, indicating signs of unification as the price remains limited between resisting 106 thousand dollars and support levels of $ 100,000. This range has selected short -term Bitcoin movements, and the collapse is likely to dictate in either direction the next direction.

The collapse of less than $ 100,000 may lead to more monotheism or even a deeper correction, which delays the bullish penetration of Bitcoin. If BTC fails to keep this psychological level, the pressure pressure may increase, which led the prices to a decrease before any attempt to recover.

On the other hand, the restoration and preparation of more than 106 thousand dollars will be a major emerging signal, indicating that the discovery of prices is imminent. This would wipe the Bitcoin path to test its height (ATH) and target the mark of $ 110,000, which may lead to a new gathering.

Related reading

Currently, uncertainty remains the dominant topic as the market is waiting for a decisive step to confirm the short -term direction. With increased volatility, traders closely monitor these main levels, knowing that the clean collapse or collapse will determine the tone of the main step next to Bitcoin.

Distinctive image from Dall-E, the tradingView graph