Bitcoin Top says it has not yet ended with the failure of the equivalent signals

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Although Prices withdrawal The last market fluctuation, an encrypted analyst expected that Bitcoin (BTC) may still have room for another Harmony. The analyst cited the historically higher reliable indicators that indicate that the market has not reached the top yet, even with the failure of the equivalent signals to run an increase.

There is no sign of the top of the Bitcoin cycle – so far

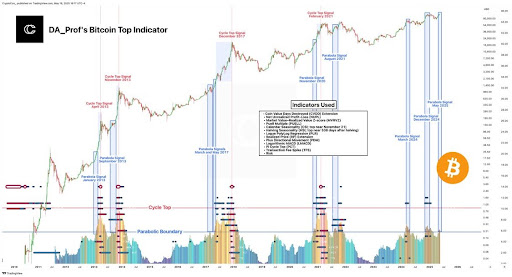

In a conversation mail On X (Twitter previously), Crypto Con Market expert participated in a comprehensive technical analysis rooted in the signs of the highest bitcoin cycle that was developed by Da_prof. The accompanying graph revealed that the current market path in Bitcoin has not yet reached “”Top cycleThe region – a region that has continuously coincided with the main market peaks in the past.

Related reading

The Da Prof technical index model collects visions of thirteen standards throughout the series and the market. This multi -factor approach successfully predicted the design of the last session in 2013, 2017 and 2021, making it a valuable tool in determining the long -term market shift points.

According to Crypto Con,, The current price procedure for Bitcoin Technical readings indicate that the leading cryptocurrency may still prepare for Final ATH Rally. The analyst emphasizes that any peak of a possible session in 2025 will likely not appear only when Bitcoin enters a critical area that was identified through the convergence of these thirteen advanced indicators.

The scales used in the DA Prof Index Form include:

- CVDs value days were destroyed

- NUPL net profit loss (NUPL)

- The market value of the market value Z-snow (Mvrvz)

- Calendar season (CSI: above November 21)

- Multiple Boyle (Boyle)

- Seasonal half (HSI: 538 days after the half event)

- Logue Polylog (PLR) slope

- Extension of the price, RP

- In addition to the direction movement (PDM)

- LMACD (LMACD)

- PI Top (PCT)

- High transaction fees (TFS)

- risk

Crypto Con observed that it is historically, when these indicators are converging in the red area, which is represented by the group of indicators in the lower heat map section of the plan, the price of Bitcoin witnessed an exciting peak followed by a Significant crash.

However, in the current cycle, none of the Da Profes measures entered the area. Instead, readings through the lower ranges of the model remain relatively silent, indicating that the market euphoria has not yet reached Extremist session.

Early equivalent signs indicate, but there is no peak on the horizon

Although the first Bitcoin indicators of Da Prof remain far -fetched, the equivalent signals, which is another main feature for the Crypto Con analysis, did not flash only once three times in this course. These signs are historically related to the early stages of Bitcoin explosive gatherings Experienced during the previous bull markets.

Related reading

However, despite these alerts, Bitcoin has failed to enter the real equivalent collapse stage until now in 2025. Crypto Con indicated that the Parapeola signal in May 2025 is particularly noticeable, coinciding with Bitcoin crossing the equivalent of the index.

This breach, associated with the absence of the DA Prof index, creates an unusual setting. With an emphasis on this anomalies, Cryptoard asked a rhetorical question: “There is no training course + equivalent signal =?” – The hint of that The true biopsy of Bitcoin Perhaps he is still in the foreground.

Distinctive image from Adobe Stock, Chart from TradingView.com