Bitcoin to rise to $ 130,000 after that? What the number of wave says

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

A week after the procedure volatile prices, Bitcoin again Return About $ 106,000 price level. However, data on the series show that investors are still cautious, with the Crypto Fear & Greed index in the neutral area.

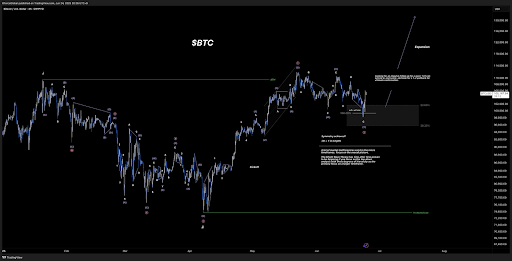

On the other hand, the technical analysis of the actions of the bitcoin price on the time frame scheme for 4 hours shows that his behavior that has completed a great correction, one, shows one. This paves the way A large raising to $ 130,000.

Bitcoin wave correction 2 may be complete

According to XFORCEGLOAL, an encryption analyst Joint Elliott Wave Chart on the x social platform, the last bitcoin correction is fit to accurately in the complete WXY style. The second wave, which started after the highest level at all times 111,814 dollars on May 22 and formed the corrective structure, is now regained to the expected Fibonacci range between 23.6 % and 38.2 %. It is worth noting that the ideal minimum goal for this correction movement was in the area of $ 90,000, and Bitcoin achieved that situation with Withdrawal to less than 98,200 dollars During the weekend.

Related reading

The most important thing was to keep the macro wave structure. Instead of drawing a The deeper withdrawal to 0.618 to 0.886 levels of Fibonacci, which is often distinguished for market recovery, preserves the analysis on the idea that this was the correction of the wave 2 within a greater bullish motivation.

This distinction is important. If the WXY correction has already been completed and we get rid of the wave 2, then the next logical step in the Elleott wave sequence is the third wave. According to the Elliott Wave analysis, the third wave is often the most exciting in terms of expansion of prices. Consequently, its results can pay bitcoin to new horizons much higher than the last highlands ever.

Why $ 130,000 is a realistic goal for Bitcoin

The artistic projection of the analyst appears on the Bitcoin time frame scheme for 4 hours, the expected wave track It extends to more than 111,800 dollarsWith an expansion arrow, up to $ 130,000. This is the step of expansion and is based on a similar projection of wave 1.

Related reading

In the accompanying scheme, the analyst represents the main pivot area between $ 98,000 and 102,000 dollars as a COWT C.

This means that confirmation of the upper number also depends on the price that makes a new local rise higher than the current range and then decline without violating the last levels. If this structure is operated, the market is likely to be in Early stages of strong The third wave.

Bitcoin has already achieved 8 % profit after a decrease to $ 9,200 after American air strikes in Iranian nuclear sites. The most important upward step came on Tuesday, June 24, when Reports on the ceasefire in the Middle East Bitcoin pushed nearly 4 %. At the time of this report, Bitcoin is traded at $ 106,330.

Distinctive photo of Pixabay, Chart from TradingView.com