Bitcoin to “Less brutality” or a new ATH break in Q2: Expert

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

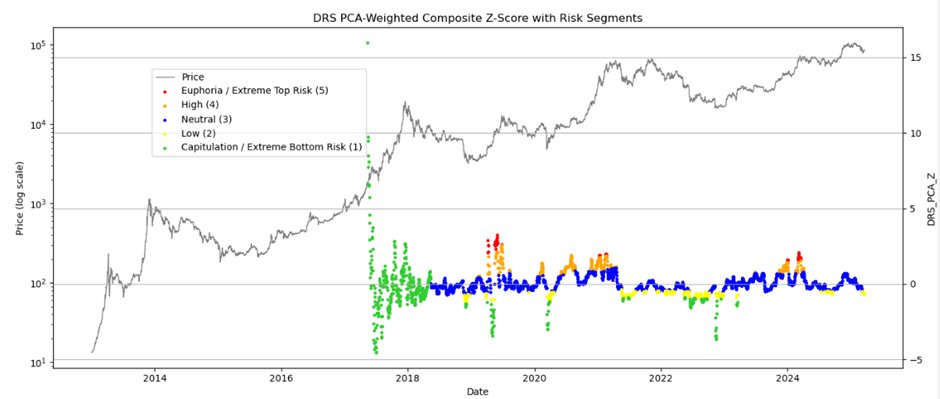

Jimmy Kots, the real vision analyst for encryption, seemed a flagrant warning to Bitcoin in the coming months. Quoted from the new Bitcoin derivatives model (DRS), Courts confirms that the price of the leading cryptocurrency faces one of two sharp result: severe contraction or increase to new levels at all (ATH).

Outlook Bitcoin Q2

in Suspension Participated by Courts via X Today, highlights his “first pass” in the DRS model, noting that the latest condition in the market “Cat 5 Euphoria” in the second quarter of 2024 followed by a decline of about 30 %. It contrasts with this with a similar episode in 2019, which witnessed a 50 % decrease – to 70 % if Covid shock is calculated.

Related reading

“If we look back at Q1 2024, CAT 5 EUPHORIA -which I returned to my return at that time (in February 2024) -I am still surprised that the withdrawal was only -30 %.

Courts emphasizes that 2019 is a better measure of the current market conditions of 2021. The logical basis is noticed, that the Rally 2019 preceded a major global expansion of liquidity. By 2021, Bitcoin was already estimated at 12x of its lowest levels while liquidity all over the world grew by 30 %, reflecting a completely different Macro environment.

Related reading

Evaluating the current risk level of the market, Courts notes that the Bitcoin DRS scale has slipped into the “low -risk quantity”, an area it says provides minimal predictive energy for future prices. “So, where are we now?

Global liquidity is high

COUTTS then emphasizes the capabilities of Global Cidhality to create another gathering in Bitcoin. He believes that the turning point coming in global liquidity – which is driven by the need to stimulate severe debt economies – is likely to feed the derivative market, which is counted four times larger than the immediate market.

“This is not my view though. Global liquidity is ready to influence the reshaping of the derivative market (4X), which is likely to give up bitcoin to the new ATHS by May (or the end of the second quarter for additional filling).”

There is another major vision from the COUTTS centers on the global liquidity index, which he says was shrinking for an unprecedented extension. “This represents the longest contraction in the global liquidity index in the history of Bitcoin-three years of promise (measured by peak). Previous tightening episodes (2014-2016 and 2018-2019) <2 years old. How long will it continue?"

He argues that renewed injection of liquidity is inevitable, noting that governments-especially governments that have debt rates to gross domestic product exceeding 100 %-will be difficult to re-finance if the nominal GDP fails to increase the costs of increased interest. “The debt -based system will explode and spices. Spices must flow.”

At the time of the press, BTC was traded at $ 87,703.

Distinctive image created with Dall.e, Chart from TradingView.com