Bitcoin to 10 million dollars? Experts predict explosive growth by 2035

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

In a new post entitled The Mustard Seed, Joe Burnett – Market Research Director at Unchained – a thesis of Bitcoin imagines up to $ 10 million per currency by 2035. letter It takes a long point of view, focusing on “time to make time” in terms of its poll as bitcoin, technology and human civilization can stand after a decade from now.

The Burnett’s argument revolves around two main transformations, as it claims that this is the stage of unprecedented migration of global capital to Bitcoin: (1) “The Great Flow of Capital” into a balance with an absolute scarcity, and (2) “accelerating the technology of deviation” as AI and robots wander in the entire industries.

A long -term perspective on bitcoin

Most economic comments are enlarged in the next profit report or immediate fluctuation. On the other hand, The Mustard Seed clearly announces its mission: “Unlike most of the financial comments that adhere to the next quarter or next year, this message takes a long vision – deep transformations before it becomes unanimous.”

At the heart of Burnetta’s expectations, there is a note that the global financial system – represents about 900 trillion dollars of total assets – continuous risks of “mitigating or reducing value”. Bonds, currencies, stocks, gold and real estate each have expansionary or enlarged ingredients for their store function:

- Gold (20 trillion dollars): approximately 2 % annually canceled, which increases supply and slowly reduces its scarcity.

- Real estate ($ 300 trillion): It expands by 2.4 % a year due to the new development.

- Shares ($ 110 trillion): The company’s profits are constantly eroded by competition and saturation of the market, which contributes to the risk of value reduction.

- Fixed income and Fiat (230 trillion dollars): structurally, is subject to inflation, which reduces the purchase strength over time.

Burnett describes this phenomenon as the capital “searching for a low energy state”, which is similar to the water that expands in the waterfall. In his opinion, all the bitcoin assets categories were “effective rewards” effectively to reduce or reduce value. Wealth managers can distribute capital between real estate, bonds, gold or stocks, but each category with a mechanism can be eroded by real value.

Related reading

Enter Bitcoin, with a solid hat of 21 million Quinn. Bornet believes that this digital origin is the first cash tool that is unable to reduce or reduce value from the inside. The offer is fixed. The demand, if it grows, can be translated directly into prices. Michael Sailor said: “The capital is naturally looking for the lowest possible energy – completely with the flow of water down. Before Bitcoin, the wealth had no real escape from mitigating or reducing value. The wealth stored in each of the asset category was a bonus in the market, or stimulating mitigation or reducing value.”

Burnett says, as soon as Bitcoin is widely recognized, the game has changed to customize the capital. It is very similar to the discovery of a much less exploited tank than the current water basins, and global wealth supplies found a new outlet – one that cannot be strengthened or mitigated.

To clarify the unique supply dynamics of Bitcoin, mustard seeds are parallel to the half -cycle. In 2009, miners received 50 BTC per block – Niagra Falls in full strength. As of today, the bonus decreased to 3.125 BTC, which reminds us of the flow of the fall over and over again until it is dramatically reduced. In 2065, Bitcoin supplies will be small compared to its total size, reflecting a waterfall that has been reduced to a line.

Although Burnett admits that he is trying to determine the global Bitcoin dependence depends on unconfirmed assumptions, it indicates two models: the Energy Law model that displays $ 1.8 million per BTC by 2035 and the Michael Bitcoin model, which indicates $ 2.1 million per BTC by 2035.

He opposes that these expectations may be “very conservative” because they often assume decrease in revenue. In a world of accelerating technological adoption – and increasing awareness of Bitcoin characteristics – PRICE goals can significantly exceed these models.

Racing of contraction technology

The second main catalyst for bitcoin oud capabilities, depending on mustard seed, is the contraction caused by artificial intelligence, automation and robots. These innovations quickly increase productivity, reduce costs, make goods and services more abundant. By 2035, Bournette believes that global costs in many major sectors can be subject to significant discounts.

“Speedfactories” Adidas cut off the production of sport shoes from months to days. The scaling of 3D printing lines and the AI’s assembly lines can reduce the costs of manufacturing by 10x. 3D printed houses already rise by 50x faster at a much lower costs. The advanced supply chain, along with artificial intelligence logistics, can make housing quality 10x. Independent ride clouds may reduce 90 % by removing employment costs and improving efficiency.

Burnett asserts that, under FIAT, the natural contraction is often “artificial repression”. Monetary policies – such as persistent inflation and motivation – price payment, and the effect of real technology on reducing costs.

On the other hand, Bitcoin will allow the contraction to “operate its path” and increase the purchase strength for their holders as goods become more expensive. As he put it: “A person holds 0.1 BTC today (about 10,000 dollars) can witness an increase in the purchase capacity of 100x or more by 2035 where goods and services become significantly cheaper.”

To clarify how supply growth is eroded from a valuable store over time, Burnett has reconsidered the performance of gold since 1970. It appears that the nominal price of gold from $ 36 an ounce to about $ 2900 an ounce in 2025, but this price gain has been continuously reduced with an increase of 2 % in the total gold supply. For five decades, the global stock of gold has doubled almost three times.

If Gold supplies are fixed, its price will reach $ 8,618 an ounce by 2025, according to Burnett accounts. These supplies have strengthened the scarcity of gold, and perhaps the demand and price were paid above $ 8618.

Related reading

In contrast, Bitcoin accurately includes unprecedented supply. Any new request will not stimulate an additional currency, and therefore the price should pay the highest directly.

Burnett Bitcoin’s expectations of $ 10 million by 2035 means the total market value of $ 200 trillion. Although this number seems huge, it indicates that it represents only about 11 % of global wealth – assuming that global wealth is still expanding at an annual rate of approximately 7 %. From this distinctive point, the customization of about 11 % of the world’s assets may not be called mustard seeds “the best long -term store of value”. “Each of the previous store has permanently expanded the offer to meet the order. Bitcoin is the first cannot.”

A major part of the puzzle is a budget for bitcoin: miners revenue. By 2035, Bitcoin’s block support will decrease to 0.78125 BTC per block. At $ 10 million for coin, miners can earn $ 411 billion in total revenue every year. Since miners sell bitcoin they earn to cover costs, the market will have to accommodate $ 411 billion in newly absent BTC annually.

Burnett is parallel to the global wine market, which amounted to $ 385 billion in 2023, and is expected to reach 528 billion dollars by 2030. If the “secular” sector like wine can maintain the level of demand for consumers, the leading digital store insurance industry in the world of the value that amounts to a similar range, as it argues, is fine.

Despite the general awareness that Bitcoin has become a prevailing, Burnett highlights a less than an amount: “The number of people around the world with $ 100,000 or more in Bitcoin is only 400,000 … i.e. 0.005 % of the world’s population – 5 out of 100,000 people.”

Meanwhile, studies may show that about 39 % of Americans have a level of “direct or indirect” exposure to Bitcoin, but this number includes any breakage ownership-such as the detention of bidcoin-related shares or investment funds circulated through joint investment funds and pension plans. Real adoption, large is still a specialist. “If Bitcoin is the best long -term savings technology, we expect anyone with great savings to carry a large amount of bitcoin. However, no one does.”

Burnett emphasizes that the road to $ 10 million does not require bitcoin to replace all money all over the world – only to “absorb a percentage of global wealth.” It is claimed that the investor strategy is simple but not trivial: ignoring the short -term noise, focusing on the multi -year -old horizon, and behaves before the global awareness of the global Bitcoin characteristics becomes. “Those who can see short -term fluctuations and focus on the largest image will get to know Bitcoin as the most frequent bet and ignore in global markets.”

In other words, it is related to the “front deportation of capital deportation” while the Bitcoin user base is still relatively small and the vast majority of traditional wealth in ancient origins remains.

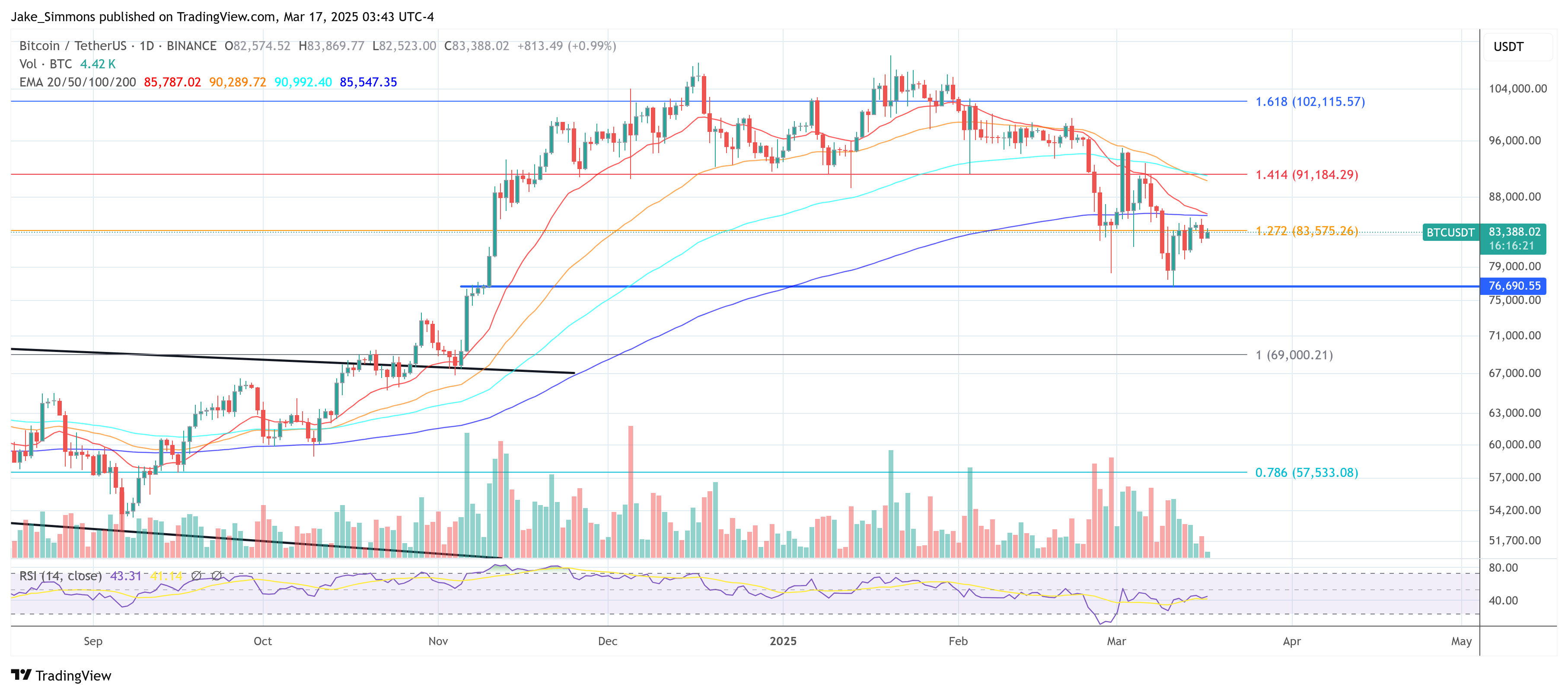

At the time of the press, BTC was traded at $ 83,388.

Distinctive image created with Dall.e, Chart from TradingView.com