Bitcoin tests resistance near ATH, as analysts are $ 120,000, leads Kaia Altcoins

Bitcoin Bulls tried to overcome its highest levels today, as the momentum returned across the market amid the bullish developments on the total front.

Crypto Bulls found a new foot as the total value on the market rose to $ 2.6 trillion, as it returned to the heights that were last seen in late May.

Meanwhile, the Fear and Granding Index rose seven points to 64, as it acquired a decisive turn in feelings towards the levels of “greed”.

With the high appetite for global risks, traders appear to be chasing momentum through majors and Qu9.

Why does Bitcoin rise?

The latest increase in Bitcoin comes in the wake of the increasing optimism that the United States and China are approaching the end of the long -term trade confrontation, a geopolitical development historically a broader market.

A statement issued by US President Donald Trump on the social truth confirmed that a “commercial agreement” has been pending the final approval of Chinese President Xi Jinping.

One of the main pressure points, rare Earth exports, now looks less volatile, as both sides indicate the cancellation of the escalation.

Although the future contracts for shares responded with caution, digital assets have interacted more decisively.

For encryption markets, the probability of decreased geopolitical friction translates into a contraction of the regular risks, which opens the door to renewable capital flows.

Reducing commercial hostile business paves the way for a more supportive Macro environment. This is especially difficult for Bitcoin, which is still very sensitive to liquidity shifts and an investor risk appetite.

As a hybrid origin, a line between speculative growth and total hedging, Bitcoin sharply responded to a possible turning point in the dynamics of global politics.

The possibility of trade decision in the United States-China, which causes investors to rotate the capital again to the assets of risk, as many expect that sleeping institutional flows will enter the market.

With fears of a decline in escalation, Bitcoin regains its attractiveness of a high -end entry -to -definition recklessness, the elasticity of politics, and the adoption of long -term digital assets.

The momentum was further strengthened by notes from Chinese Deputy Minister of Trade Lee Chenggang, who confirmed that the two countries reached a “agreement in principle” and participated in “frank and in -depth” talks during negotiations in London.

This adds credibility to Trump’s statements and indicates a coordinated effort towards the completion of the deal.

For encryption markets, timing is very important. The assembly is in line with broader risks in global markets, increasing open interest in Bitcoin’s future, and promoting basics.

With the overall opposite winds and a sense of rapidly, Bitcoin may enter a new stage of discovering prices.

Will Bitcoin rise again?

Market analysts seem to be increasingly confident that Bitcoin is about to restore its highest level ever, indicating a technical preparation indicating that the acceleration of prices is close.

At the time of writing this report, BTC was trading less than 2 % less than its highest level ever for more than $ 111,000, and the main resistance test amid a climate momentum.

The famous analyst Jill indicated that the monthly Bitcoin scheme “seems ready for acceleration”, indicating that the market may be preparing for continuous penetration.

It expects an immediate raising about $ 120,000 if the level of $ 108,000 turns to support, with the possibility of forming the highest cycle ranging from 140,000 dollars to 150,000 dollars.

He chanted similar feelings by MEN Capital, who argued that the last break exceed $ 106,500 raised the current gathering.

He believes that another batch exceeding $ 110,500 can determine the way for the highest new levels ever, although some short -term monotheism may be required before this happens.

“The first period of monotheism usually lasts a few days. Then, we will get the next penetration above ATH,” Bobby said in the X publication recently.

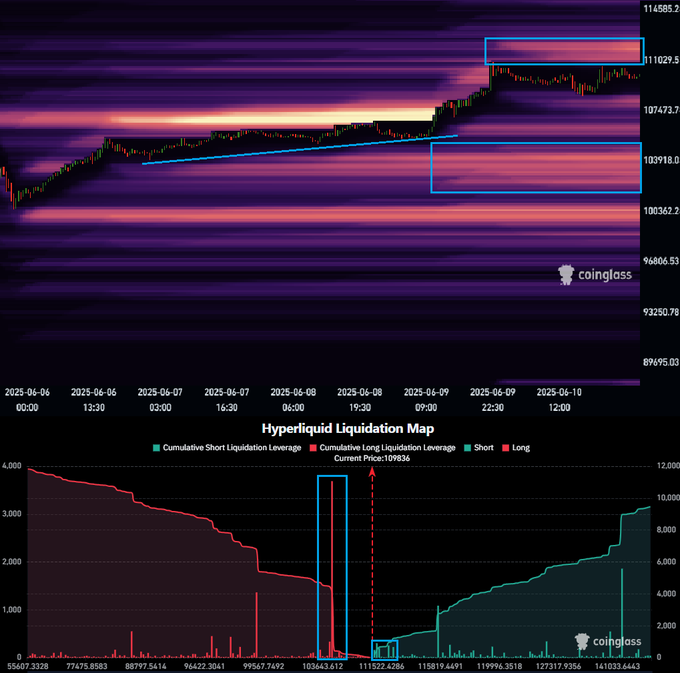

Data on the series supports a bullish thesis. The BTC/USDT recycling map on Binance shows a heavy focus of the positions learned near the $ 112,000 sign, which is now working both resistance and a potential motivation.

The collapse here may raise what traders indicate as a liquidation pressure, forcing the sellers quickly to go out and push the price towards the next liquidity set at 114,000 dollars.

However, according to Alphabtc analyst, it may require more unification before a decisive break above the $ 110,000 sign. see below.

BTC’s immediate upward goal remains $ 120,000, according to most analysts on X.

Some have pointed out the outbreak of a conversation over a descending sorry structure on the daily chart, a pattern often associated with the affirmation of upscale repercussions.

Altcoins see renewed momentum

While reducing the overall opposite winds and appetizing risk, Altcoins has begun to gain an attractive that some analysts consider the early signal for the upcoming Altcoin season.

Historically, the new bitcoin head is often followed by a capital that flows to Altcoins, and many standards now indicate a similar rotation.

Bitcoin dominance remains 64-65 %, however the Altcoin season index quietly increased to the lows, a hidden sign but tells that investors have begun to expand their exposure.

As risk morale improves, traders seem more ready to rotate to Altcoins in search of a higher height.

Sharp, analyst, referred to the pseudonym to an escalating spoiler that is formed on altcoin dominance, and is now close to the main collapse level. He pointed out that a similar structure had previously gathered a strong altcoin in November.

Over the past 24 hours, the Altcoin market ceiling has increased by 3 % to $ 1.4 trillion at the time of this report.

ETHEREUM, a leader in Altcoin, increased by market, by 3.5 % throughout the day, trading $ 2,840, and its highest level since February 24, while Altcoins has recorded another large such as XRP and Solana (SOL), Dogecoin (Doga) and Cardano (ADA) gains ranging from 1-5 % while you see you (TRX) was an exception of 1 %.

Kaya (Kaya) stood as a pioneering day between the best 99 altcoins with 23.3 % gains, while SPX6900 (SPX) and Jito (JTO) followed, and gained gains of 18.8 % and 13.3 %, respectively.

Kaya’s gains came today as excitement grew around her plan to launch Stablecoin in South Korea after recently launched the original USDT on the KAIA series.

Some momentum was also nourished by possible partnership news with the Japanese giant line.

SPX6900 has reached the highest new level ever at $ 1.62, with support from an increase in the accumulation of whales, and the broader shift in the market morale resulting from Bitcoin’s recovery.

Likewise, Ghetto gathered with no certain catalyst that leads this move away from momentum in the wider market.

Post -Bitcoin tests the resistance near ATH, as analysts are 120 thousand dollars, Kaia Altcoins appeared first on Invezz