Bitcoin supports less than $ 78,000, with cost basis sets turned about $ 95,000

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Bitcoin price has worked over the past 48 hours He saw that approaching The price level of $ 80,000 again, with the risk of collapse to the negative side. Consider the data on the series It should not be broken.

Related reading

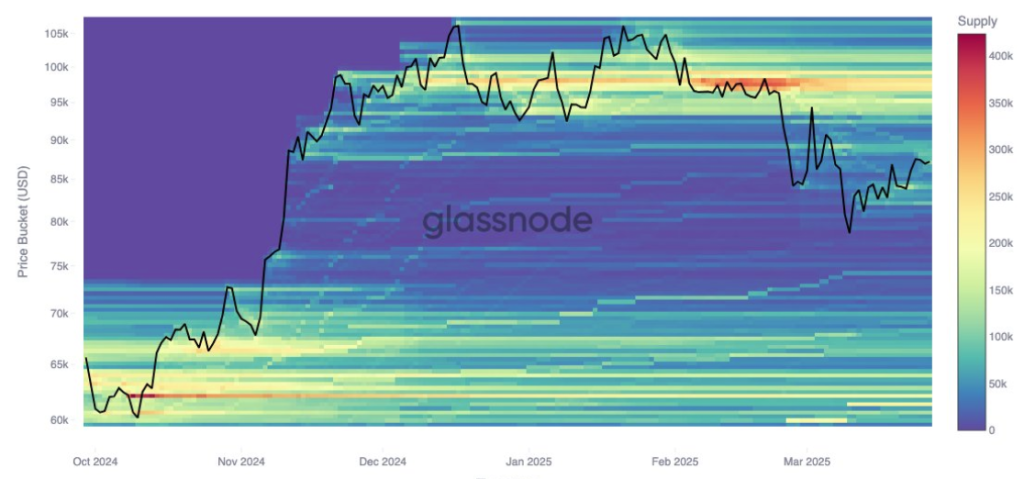

In particular, analyzes of the series from Glassnode indicate a thinning of support at the level of 78,000 dollars, where there are minimal basis groups only. This insight follows a sharp step that witnessed that smart merchants wear approximately 15,000 Bitcoin on March 10 before they went out at a local summit worth $ 87,000.

The support pillow rises with groups ranging between 80,000 and 84,000 dollars

Bitcoin began in March with crazy crash that he witnessed, which is less than 77,000 dollars on March 10 and 11. Most of the month was spent by Bitcoin on the recovery of this level, eventually reaching $ 8,8500 last week.

It is interesting, Data on the series from Glassnode explains that some Bitcoin merchants benefited from the accident And bought About 15000 BTC in this depression. However, many addresses of this same group that was sold at the local summit of $ 87,000, leaving behind a depleted insulating area that no longer provides the same price.

Bitcoin’s most powerful foundations were launched steadily to the top of $ 78,000 throughout the month, although the most prominent support levels sit between $ 80,920 and 84100 dollars. Nearly 20,000 BTC was obtained at $ 80,920, 50,000 BTC at 82,090 dollars, and another 40,000 BTC at about 84,100 dollars. These new accumulations are now the new areas of confidence among new buyers that may offer pillows for the last market decline.

At the time of this report, Bitcoin is traded at $ 83,120, which means that it has lost a region of 40,000 BTC about $ 84100. This puts responsibility on $ 82.090, and then, the price level of $ 80,920. However, if the correction sharpens more, it will not be even after $ 78,000 Siklet support again At $ 74,000 and 71,000 dollars, where the purchase of condemnation occurred in the long run, estimated at 49,000 BTC and 41,000 BTC, respectively.

image From x: Glassnode

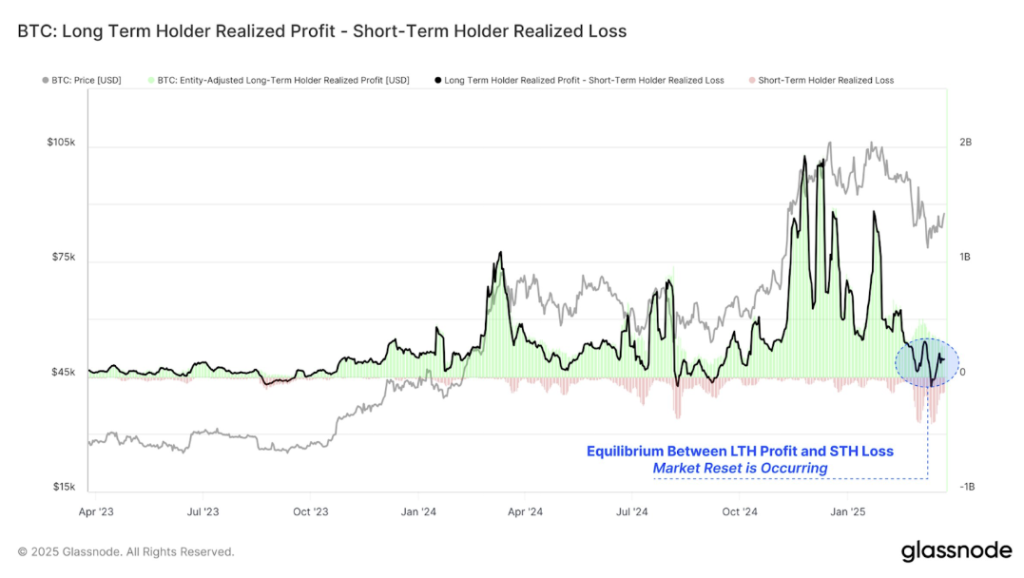

95,000 dollars on the basis of cost grows the mass with the demand for cooling

With the continued support to rise gradually, The resistance seems to escape Near the mark of $ 95,000. Investor cost data shows an increase of 12000 BTC at this level since March 24.

This means that some investors are now expecting to form above 95,000 dollars, and the sales activity may become more clear if prices are approaching that region. This resistance, along with support levels, can see bitcoin confined to a short -term narrowing range.

Related reading

Glassnode data This confirms this Their long -term holders (headlines that were holding Bitcoin for more than 150 days) were the main source of profits for a period of time. Achieving the profits of long -term holders corresponding to nearly Losses to bear The short -term merchants who kept Bitcoin for less than 155 days.

image From x: Glassnode

Distinctive image from Tech Research online, graph from Tradingvief