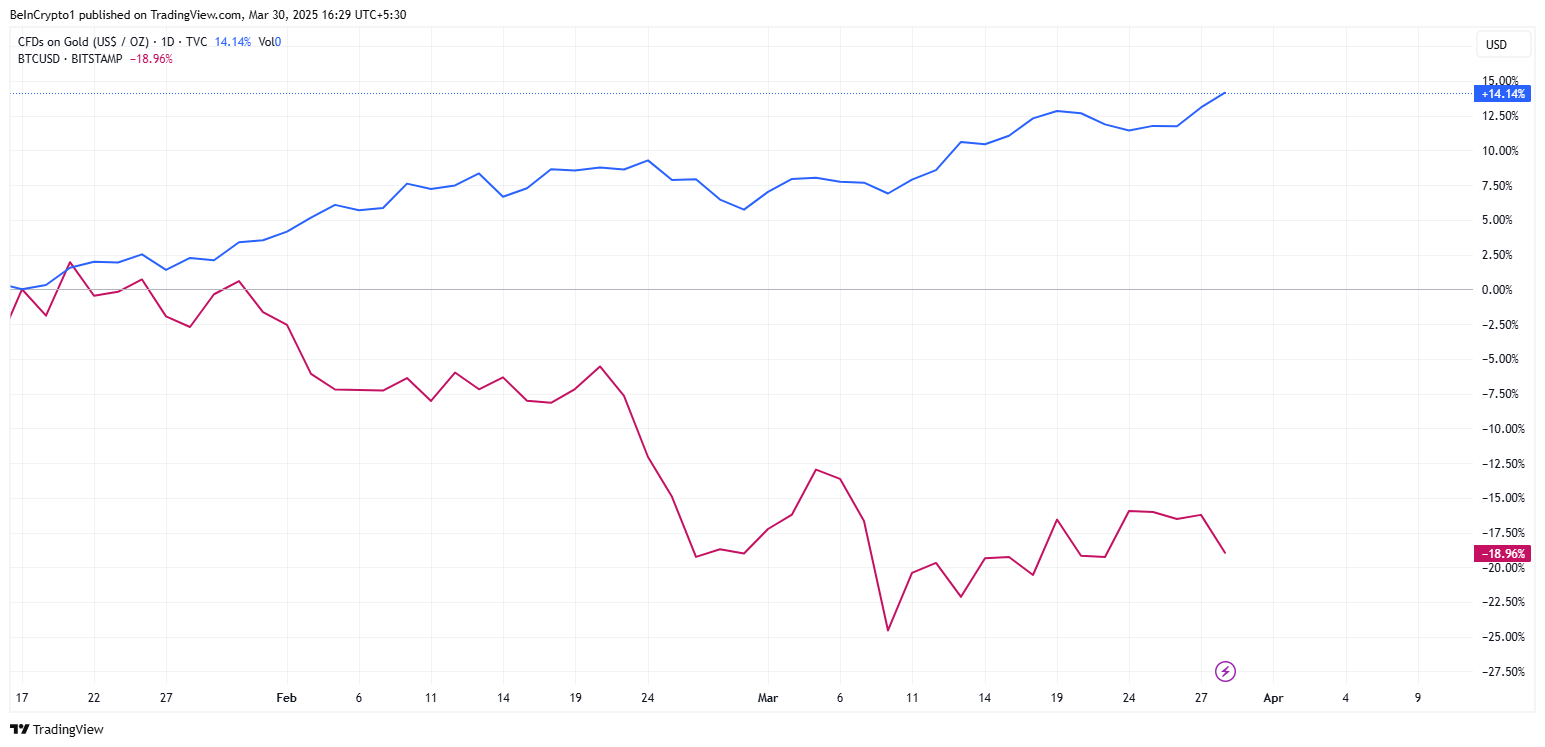

Gold excels over Bitcoin amid the chaos of the Trump trade war

Bitcoin (BTC) has long been described as “digital gold”. However, since the global economy suffers from an escalation of trade war tensions under Trump’s second state, institutional investors flee to the real thing.

A recent survey of Bank of America (BOFA) found that 58 % of the fund managers view gold as the best performance sanctuary in a commercial war-which led to the preference of Bitcoin by only 3 %.

Bitcoin’s status faces a realistic examination

Gold proves its dominance as the origin of the preferred crisis, while Bitcoin is struggling to keep it. This comes amid the high geopolitical risks, bloating of deficit in the United States, and uncertainty in the capital journey.

“In a recent survey of Bank of America, 58 % of the fund managers said that gold is better in a commercial war. This compares only 9 % of treasury bonds for 30 years and 3 % for Bitcoin.” male.

For years, bitcoin defenders defended this as a hedge against economic instability. However, in the volatile macro environment in 2025, Bitcoin is struggling to gain full confidence of institutional investors.

The Bank of America’s poll reflects this situation, with long -term US Treasury bonds and even the US dollar loses the call as commercial wars and a financial dysfunction that shakes market confidence.

The deficit crisis in the United States – which is now expected to exceed $ 1.8 trillion – has increased confidence in traditional safe havens such as US Treasury.

“This is what happens when the global reserve currency is no longer behaving as a global reserve currency,” Trader Mockery In a post.

However, instead of looking at Bitcoin as an alternative, institutions choose an overwhelming gold, and double the purchases of material gold to registration levels.

Burns in front of the institutional adoption of bitcoin

Despite the fixed and decentralized supply, short -term bitcoin fluctuations remain a major obstacle to institutional adoption as a real origin for safe.

While some merchants still look at Bitcoin as a long -term value of value, it lacks the immediate liquidity and attractiveness that gold empties during crises.

Moreover, President Trump is expected to announce a new tariff on “Liberation Day”. Experts comments the event as a potential operator of extreme market fluctuations.

“The second of April is like the election night. It is the biggest event per year with a size of size. Propagate.

Historically, trade tensions pushed capital to safe armed assets. With this announcement on the horizon, investors put themselves again, in favor of gold on Bitcoin.

“Gold is no longer a hedge against inflation; it is treated as a hedge against everything: geopolitical risks, cancellation of defeat, financial imbalance, and now, arms trade. When 58 % of the fund managers say that gold is the supreme match, it helps it. Note.

Although Bitcoin’s struggle to pick up the flow of safe institutions in 2025, his long -term novel remains intact.

Specifically, the global reserve currency system changes, US debt fears stop, and monetary policies continue to transform. Despite all this, the Bitcoin value proposal as control is still relevant.

However, in the short term, its fluctuations and lack of institutional adoption are widespread as the hedge of the crisis means that gold takes the initiative.

For Bitcoin believers, the main question is not whether Bitcoin will one day challenge gold but to the period that institutions will adopt as safety origin.

Until then, the king’s gold remains undisputed in times of economic turmoil. Meanwhile, Bitcoin (traded BTC boxes though) are fighting to prove their place in the following financial transformation.

“The demand for ETF was real, but some were purely for arbitration … There was a real demand for BTC, not as much as we thought,” Kyle Chassé analyst He said newly.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.