Bitcoin stuck less than 105 thousand dollars amid macro, WiF and PI seizure of Altcoin lights

Bitcoin has held a company over the sixth mark this week, with the support of an optimistic market with caution, although the momentum stopped by the weekend with the failure of the new stimuli to appear.

The wider market growth continued, as the maximum Crypto market increased by 2.4 % to $ 3.42 trillion by Friday.

The feelings are just cool, as the Crypto Fear and Greed index decreased two points, but it remained firmly in the greed area in 71.

Most of the leading altcoins ended in green, with a few modest losses consisting of one number one during a seven -day period.

What happened with Bitcoin this week?

A large part of the price procedures for this week has been dictated by changing the total economic conditions, with early gains that they feed by improving geopolitical feelings.

On Monday, May 12, Bitcoin rose to the highest level during the day 105,525 dollars after the United States and China signed the agreement to escalate the tariff in Geneva.

The deal, which came into effect on May 14, witnessed that both countries reduce the mutual tariffs for each of them to 10 % for 90 days, a decrease from the previous rates of 145 % and 125 %.

Reducing commercial tensions helped revive the appetite of risk across financial markets, and raise encrypted currencies along with stocks.

The assembly gained more traction on Tuesday after the issuance of US Consumer Prices Index (CPI) in April.

The inflation was cooled to 2.3 % on an annual basis, while the monthly gains got 0.2 %, both of which are in line with expectations.

The most soft print helped calm fears of tightening the stretching of the Federal Reserve, giving the origins of the risk of another leg.

However, the Al -Sawomi momentum fade by Thursday after the US Product Product Index (PPI) showed an unexpected monthly decrease by 0.5 % in April, and challenged economists’ expectations by 0.2 %.

The decrease, fully driven by a 0.7 % slide in services, represents the most contraction since the series began in 2009.

Bitcoin withdrew to about 102,655 dollars after the report, which paid previous gains.

The markets turned into caution before the Federal Reserve President Jerome Powell’s statements later that day.

While Powell again affirmed the central bank’s commitment with the aim of inflation of 2 %, it was suggested that the Federal Reserve to review the consensus statement in the coming months to reflect the economic uncertainty and better sophisticated policy expectations.

By Friday, Bitcoin remained above $ 102,000, but showed signs of procrastination, as traders formed mixed signals of inflation and policy comment data.

Will Bitcoin rise?

According to market monitors, Bitcoin’s ability to seize more than $ 100,000 has strengthened its support in the short term, but the lack of a decisive outbreak kept traders on the edge of the abyss.

Onchain Analytics Swissblock in a publication on May 16 noted that Bitcoin “is currently stuck in the range of 101.5 thousand dollars to 104 thousand dollars” after two failed attempts to break a higher break.

He added that without a strong move before the weekend, a decisive decision is likely to be delayed until next week.

Others chanted similar feelings. Santiment market intelligence provider has noticed a shift in circulating psychology, pointing to a slight increase in homosexual expectations after repeated rejection at $ 105,000.

However, the company indicated that the increasing fear and the depletion of patience among the retail participants in the historical point of view is a contradictory upright sign.

Technical analysts are also closely monitoring the main exchanges.

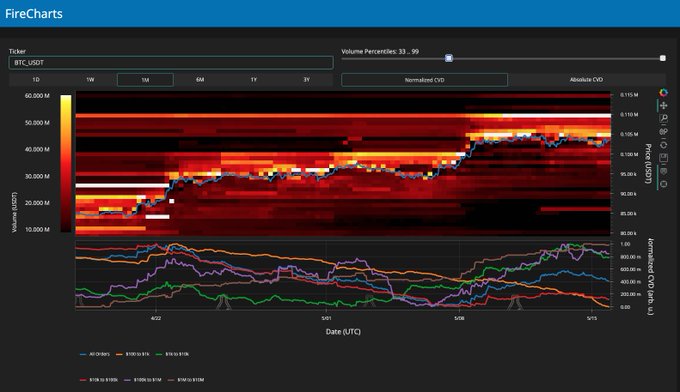

According to the material indicators, large liquidity blocks of ASK gathered between $ 105,000 and $ 110,000 on Binance, which led to the effective rise in bitcoin in the absence of a strong catalyst. see below.

Unless we have a dangerous catalyst, I do not expect to see a sustainable outbreak of ATH lands until BTC takes a legitimate support test at $ 100,000, and Firechars shows that the request book commensurate with this with the requirement of stacking and offers to move down. Of course we also have gold

The company expects a more sustainable step towards its highest levels ever after a confirmed testing test around the level of $ 100,000.

However, they warned the merchants against staying careful, as they informed the range from 98,000 to 100,000 dollars as a critical area to monitor possible negative tests, while cautiously of short pressure and bull traps that can appear in the current low liquidity environment.

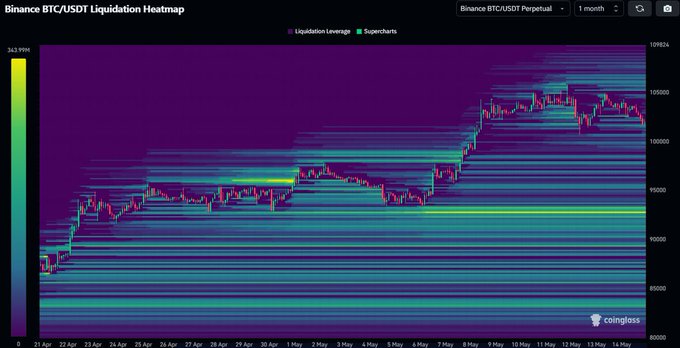

In the event of a withdrawal from the current levels, the trading of the independent trader Dan Chipiro indicated to $ 93,000 as a major level of viewing, noting that Bitcoin is currently trading away from the main liquidity groups. see below.

$ BTC Very far from any large liquidity groups. The price has not been traded for a long time here after the initial pressure of the short pants, there are not many new situations that were built around this area. The main level to search for will be its highest local levels that exceed 106 thousand dollars

The founder of MN Capital Michael Van De Poppe highlighted $ 98,000 as a “decisive zone to stick to” in order to maintain rising momentum.

Others, like Sodlytic, indicated that despite the recent withdrawal, long -term holders are still not affected, as data on the chain showed a decrease in a long -term SOPR SOPR, indicating that most of the selling pressure comes from traders in the short term.

Bitcoin Super. source: Sudlytic.

“This may be just a break before the next station, which deserves to be monitored,” the analyst added.

The broader preparation indicates a holding company in the market, but waiting for the direction.

Without a new incentive, the price procedure may remain in the range as traders measure whether modern support levels can afford to increase pressure in the short term.

At the time of writing this report, Bitcoin was trading at $ 103,993, or almost 4 % less than its highest level.

The break above this level can be a short -term bullish stimulus if buyers can pay the price to discover prices.

Altcoins see modest gains

Even with modest gains in all fields, Altcoins remains invalid.

The Altcoin season index decreased 8 points to 25, much lower than the threshold for the ALT season.

Senior artists this week, as of May 16, they were:

Dogwifhat

DogwFhat (WIF) increased by 53 % during the past week, and now trading about $ 1.11 with the maximum market up to $ 1.1 billion.

source: Coinmarketcap

It seems that one of the main reasons behind this mutation is the noise of society, especially after the news that Coinbase is added to the S&P 500.

This step was considered difficult in WiF because it is part of the Coinbase’s Coin50, a group of the 50 best digital assets listed on the platform.

There was also a clear rise in the activity of the futures market. According to Coinglass, WiF Futures increased to $ 450 million, up from $ 175 million at the beginning of April.

On the daily chart, WiF seems to form a rounded bottom since early December, a bullish preparation that usually indicates fixed gains forward, at least through technical analysis.

Moreover, the most likely financing rate has been positive over the past eight days, a sign of a strong bullish feeling in the market.

Bay

Last week, PI (PI) gained 24.5 %, trading at $ 0.91 at the time of writing this report.

Its ceiling on the market amounted to 5.92 billion dollars, while the daily trading volume was about 422 million dollars.

source: Coinmarketcap

This gathering was mainly driven by societal excitement after the PI disturbed a “major advertisement” on May 14.

This humor sparked a huge pump, as PI jumped more than 200 % to reach the highest level per day $ 1.60 on May 12, its highest price since March 2025.

But when the big disclosure occurred recently, the PI project fund was worth $ 100 million to support the projects of the ecosystems, the market was not admired.

PI quickly gave up most of its gains, as more than 50 % decreased after news appeared.

There are a few reasons for sharp decline. First, the Venture Box is more than a long -term play and does not bring any immediate benefits or price support for the distinctive symbol.

Second, the noise around the advertisement may have led to unrealistic expectations.

This type of price procedure is an example of a textbook for the pattern of “buying rumors and selling news”, where investors raise the price in anticipation of large news, only to empty it once the actual announcement is less than noise.

Kaspa

KASPA (KAS) has received 18 % over the past seven days, trading it at $ 0.1211 when writing. The maximum market is more than $ 3.17 billion.

source: Coinmarketcap

While no clear catalyst was determined at the time of the press, the gathering seemed to gain momentum after the bulls were successful with the success of the $ 0.12 resistance area to support.

Renewable attention may also be linked to the last “Crescendo” Mainnet Promotion from KASPA, which was broadcast on May 5.

The update improved expansion and efficiency by increasing the speed of the mass production ten times and turning the network into a rust -based structure.

The post Bitcoin stuck less than 105 thousand dollars amid macro shifts, WiF and Pi Altcoin appeared first on Invezz