Bitcoin spoils the news of a fake tariff bomb

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Speculation about the alleged White House plan to stop the customs tariffs for a period of ninety days on all countries except China, the markets were sent to madness earlier today, which led to sudden price repercussions across stocks, bitcoin and encrypted currencies. In a quick series of conflicting updates, the rumors initially float at about 10:10 am, east, which sparked momentum in the origins of danger, and the White House considered “fake news” in the end.

Kobeissi (Kobeissileter) Message Described The timeline on X, noting: “What has happened just at 10:10 am EST, rumors that the White House was thinking about stopping the tariff.” At 10:15 am, CNBC reported that Trump is considering a 90 -day stoppage on definitions for all countries except China.

Related reading

However, just seven minutes later, at 10:25 am EST, it appeared that the White House was not “aware” of Trump given a 90 -day stop. “At 10:26 am EST, CNBC stated that the temporary suspension addresses for 90 days were incorrect. At 10:34 am East time, the White House officially called it the temporary suspension headlines to stop fake addresses“ fake news ”. By 10:40 am ET, S&P 500 -2.5 trillion dollars from the maximum market of the market was wiped before, before, 22 minutes.

Just a temporary removal of the definitions managed to quickly transform feelings in both stock markets and encryption. BTC, which traded about $ 75,805 at the time, increased by approximately 7.2 % to exceed 81200 dollars within half an hour. Once the confirmation reached that no cessation was planned, the gains evaporated at the speed that it arrived, and withdrew Bitcoin to approximately $ 77,560.

The sudden role of events launched a wave of comment between encryption monitors. Pentoshi (@Pentosh1) noted that “the fake news tweet showed that there is a lot of dilapidated capital at least for relief and risk in the budget direction on at least any positive news.”

Will Clemente III warned: “Bear Take: Bad liquidity and this volatility may break something. The Bull Take: This title was the title Cointelegraph Internet BTC ETF but for stocks.”

Related reading

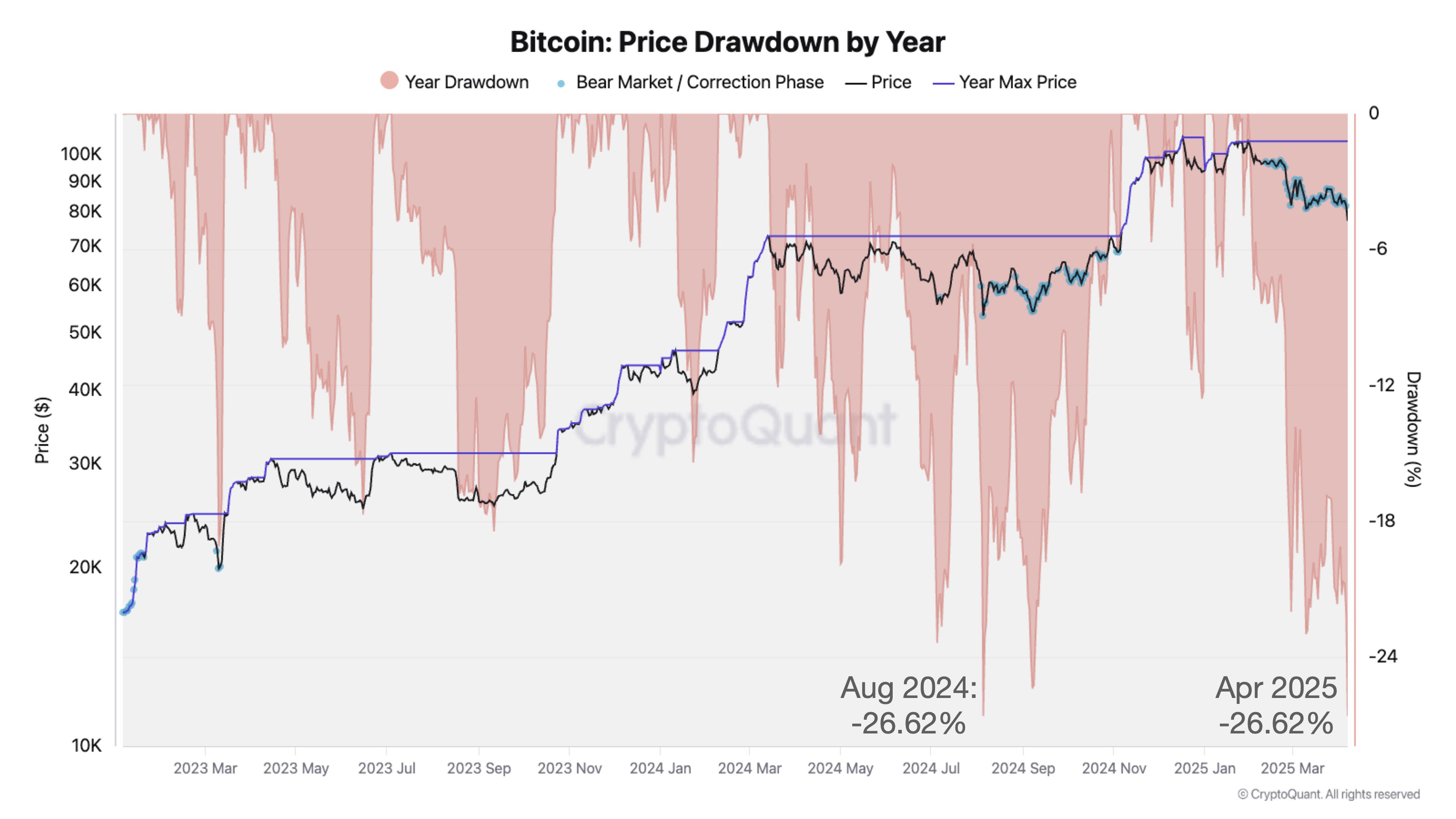

Julio Moreno, head of research at Cryptoquant, commented that “the current price of Bitcoin is about to become the largest in the current cycle,” explaining his point of view with a scheme that showed BTC correction up to -26.62 %, which corresponds to the August 2024 correction scale.

Macro Alex Kruger (@krugermacro) Call Blackrock CEO Larry Fink says that the market decrease by 20 % is not possible, saying: “This is the thing. Under normal circumstances, the possibility of such scenarios or things like the recession is very low, you can only clean them with brush. Open the left tail => everything is possible.

“What is very crazy about this incident versus the other is completely self -will and can be reversed in a moment in one tweet. Was there anything like that?” Says PodCast Felix Jauvin (Fejau_INC).

In the midst of the turmoil, European Union Commissioner Ursula von der Lynn has again prepared to search for solutions, saying: “Europe is ready to negotiate with the United States,” including the possibility of a yellow tariff on industrial goods.

At the time of the press, BTC was traded at $ 78,824.

Distinctive image created with Dall.e, Chart from TradingView.com