Bitcoin slides less than $ 84,000 – the main support levels for viewing

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Bitcoin price has been placed in one of its strongest offers recently over the past week, as it gathered to the top of $ 88,000 early. However, the first cryptocurrency witnessed a sharp correction on Friday, March 28, following the latest basic inflation data in February.

With the BTC price now under $ 84,000, panic it appears to be growing in the market as investors fear more correction of the largest encrypted currency in the world. Interestingly, the latest data on the chain shows critical support levels of Bitcoin price.

Is BTC at risk of decline to $ 71,000?

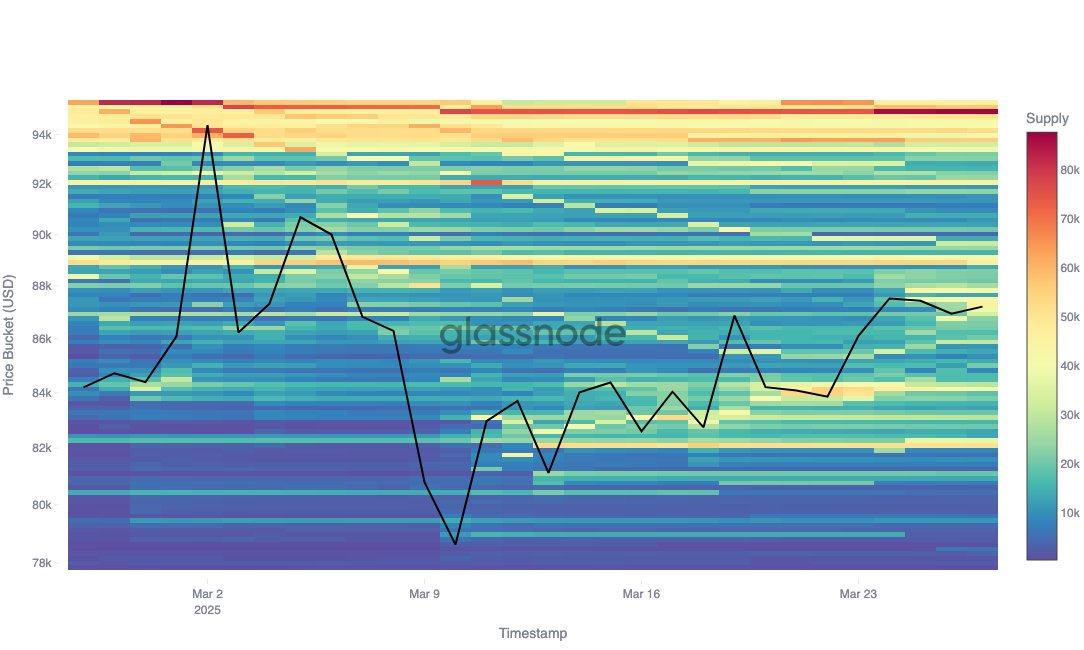

In a recent post on the X platform, Glassnode Blockchain Analytics Make up The last investor behavior and how it can affect the work of the bitcoin during the next few days. This evaluation depends on the cost basis distribution data for investors around the bitcoin price.

Related reading

According to Glassnode, cost basis distribution data reflects the total Bitcoin supplies that are kept addresses with average cost in specific prices. As observed in the graph below, the heat map (color intensity) represents the volume of BTC supply in the price area.

Source: Glassnode on XGlassnode data shows that a large percentage of merchants bought approximately 15,000 BTC at 78,000 dollars on March 10 before selling at the local summit of $ 87,000. After this last round of the redistribution, the BTC offer is now $ 78,000, weakening the support pillow.

However, it should be noted that the following decisive support levels are about $ 84100, 82,090 dollars, and 80,920 dollars, as investors bought 40,000 BTC, 50,000 BTC, and 20,000 BTC, respectively. However, bitcoin price can be at risk of deep correction if losing these levels.

In the event of a deeper correction, it may not provide 78,000 dollars a strong cushion enough for the leading cryptocurrency after the last sale by investors who have already been detained at the level. Glassnode data shows that bitcoin price may decrease to $ 74,000, which is the next important support level after $ 80,000.

The analysis platform on the chain highlighted $ 74,000 (where investors bought 49,000 BTC) and $ 71,000 (where investors bought 41000 BTC) as the following support levels in the event of a decrease in bitcoin drop below $ 80,000. “These levels reflect the accumulated accumulation areas that can absorb additional negative pressure,” Glassnode added.

Bitcoin price at a glance

As of the writing of these lines, the price of Bitcoin is about $ 83,800, which reflects a decrease of approximately 4 % over the past 24 hours.

Related reading

Distinctive image from Istock, tradingvief chart