Bitcoin shorts are eliminated – for the highest assembly or sign?

The data shows that the short bitcoin operations have surpassed the long length recently. Here is whether this is something that warns of danger or not.

Bitcoin liquidation oscillator in a negative area now

In new mail On X, the author Cryptoquant Axel Adler JR presented a general overview of the futures market from the perspective of the dominance of the reference. The “liquidation” refers to the strong closure that any open contract is subject to after collecting losses to a certain degree (as specified on its platform).

Of course, this happens after the low price of the long contracts (bills), while after an increase in the state of short palaces (hippos). The risk of liquidating these contracts liquidated increases to more influence chosen by the investor.

The oscillator compares the dominance of the long and short references that occur throughout the sector and represent their balance as the oscillator around the sign of 0 %.

Below is the graph of the joint oscillation by the analyst who shows the trend in the medium -moving value for 30 days over the past two years.

The value of the metric appears to have been negative in recent weeks | Source: @AxelAdlerJr on X

As visible in the graph, the volatile of the bitcoin dominance for 30 days had a negative value recently, indicating that the short pants were monitoring more liquidation from the phase.

This hegemony came on short liquidation, as the price of cryptocurrency rose to the highest new level (ATH). From the graph, it is clear that there is a similar trend also witnessed during previous gatherings.

In general, the comprehensive liquidation events that involve short pants help support the upward trend. As the analyst in the graph has highlighted, the short level of dominance resulting from short liquidation involves the feverish conditions of Bitcoin, with its price besides.

Nowadays, although the indicator sits in “JUST” -11.5 %. At the end of 2024, the assembly witnessed that the scale reached a peak of negative value of -16.5 %. Likewise, it reached -19 % in April 2024 and -24 % in January 2023.

“Thus, despite the recent decline, the momentum remains intact – without the” high temperature “type that may lead to sharp local repercussions,” the analyst notes.

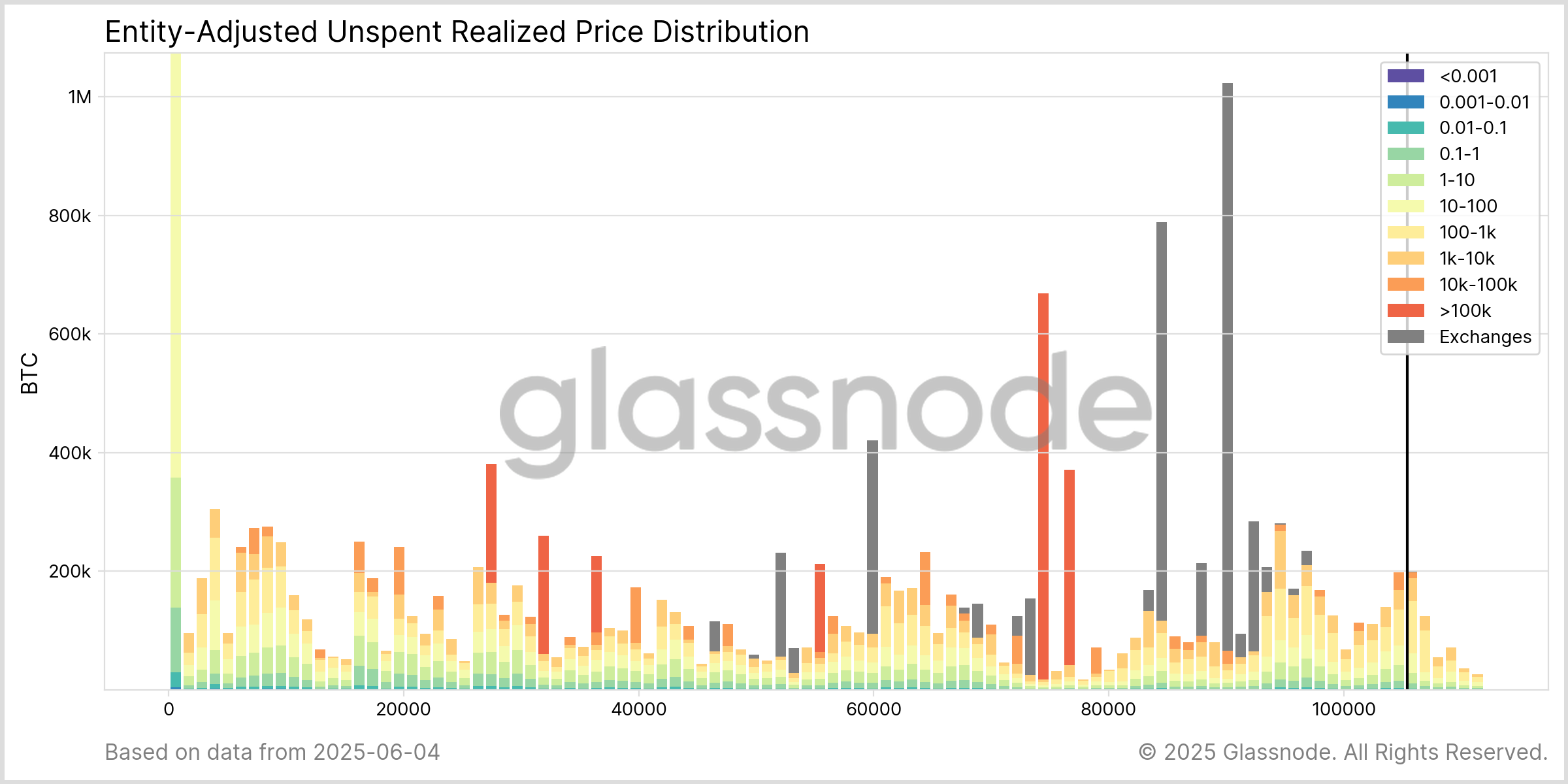

In some other news, Glassnode revealed its company on X in X mail How to give Bitcoin the involvement of institutional participation over the past six months.

The indicator shared by the Glassnode is the distribution of the uninterrupted achieved prices (URPD), which tells us about the amount of supplies that was purchased from the coded currency width at price levels.

The current entity-adjusted URPD of the asset | Source: Glassnode on X

The Analysis Company also shows,

Above 90 thousand dollars, the activity is led by 100-10K $ BTC Holder. The portfolios are concentrated> $ 100K BTC at 74 thousand dollars to 76 thousand dollars, and the large whales (10K – 100K) at 78 thousand dollars, 79 thousand dollars, and 85 thousand dollars – 90 thousand, and near the current levels.

BTC price

Bitcoin has been cut in the past few days as its price is still trading on a brand of $ 10,800.

The trend in the BTC price during the last month | Source: BTCUSDT on TradingView

Distinctive image from Dall-e, Glassnode.com, Cryptoquant.com, Chart from Tradingview.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.