Bitcoin sees the largest ETF flows since January, becoming the fifth largest asset in the world

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Bitcoin has spent the past 24 hours On a prominent rally That saw this peak price at the highest level per day 94,320 dollars. This gathering represents an interesting change from the narrow monotheism range between $ 80,000 and $ 85,000, which set the Bitcoin path during most of April.

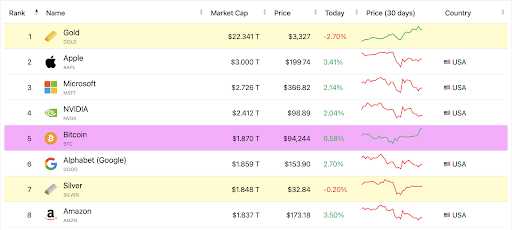

Behind this penetration It lies a significant increase in institutional activity through the instant investment funds in Bitcoin, which recorded its highest daily flows since January. Interestingly, this flow helped push Bitcoin to the five largest assets in the world, bypassing the alphabet, silver and Amazon in the market value.

Spot Bitcoin Etfs sees the largest flows since January

according to Data from SosovalueThe US -based investment funds in Bitcoin have achieved a seat of $ 936.43 million in net flows on Tuesday, April 22nd, which represents the best performance for one day since January 17 when it recorded $ 1.08 billion. Wednesday, April 23, witnessed a similar performance, as it recorded flows of 916.91 million dollars.

Related reading

IShaares Bitcoin Trust (IBIT) of Blackrock led the road with an amazing amount of $ 643.16 million, followed by ARK & 21 Shares Arkb for $ 129.5 million. Moreover, the Bitcoin Spot investment funds are now four days of consecutive flows of $ 100 million or more. The last time it happened in the last week of January.

These flows follow to the investment funds circulating in Bitcoin the point dry talisman for a week in the ETF activity, which witnessed many traders questioning the sustainability of institutional interests. However, the timing of these flows cannot be more effective. The price of Bitcoin has risen along with the last ETF activity, indicating the strong influence that these traded investment funds have become on the immediate price of bitcoin.

BTC outperforms Amazon and Google to become the fifth largest asset around the world

EtF spark flows and pushing the market reaction caused by the height of Bitcoin in the world rankings. According to the data from Companymarketcap, the total market value of Bitcoin rose to more than 1.87 trillion dollars, exceeding $ 94,000 For the first time in eight weeks.

Related reading

This interesting step allowed the Google (Alphabet) and Amazon in the maximum market classification, especially given that these stock prices were a noticeable decrease in a 30 -day time frame.

This development is placed in BTC not only as a leading encrypted currency but also as a large -level economic origin, Competition for the global theater With traditional technology and giants goods. As Bitcoin is now outperforming Nasdaq 100, analysts refer to signs A chapter of traditional indicators.

Now that Bitcoin has been trading over $ 90,000 again, the following focus is Where do you go from here. The bullish track will be at the price level of $ 100,000, and whether BTC can break this level before the end of April. However, the 94,000 dollar area is now formed to serve as an early resistance scope, and the short -term profit can lead to a decline in purchase orders.

Distinctive photo of Pixabay, Chart from TradingView.com