Bitcoin random signals

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Bitcoin (BTC) has increased by 14.6 % in the past two weeks, increasing from about $ 84,500 on April 18 to a range of $ 90,000 at the time of this report. With this upward momentum, the leading cryptocurrency appears to put its scenes at the highest new level (ATH), as many technical indicators and momentum indicate an increasing trend.

Bitcoin monthly RSI turns up

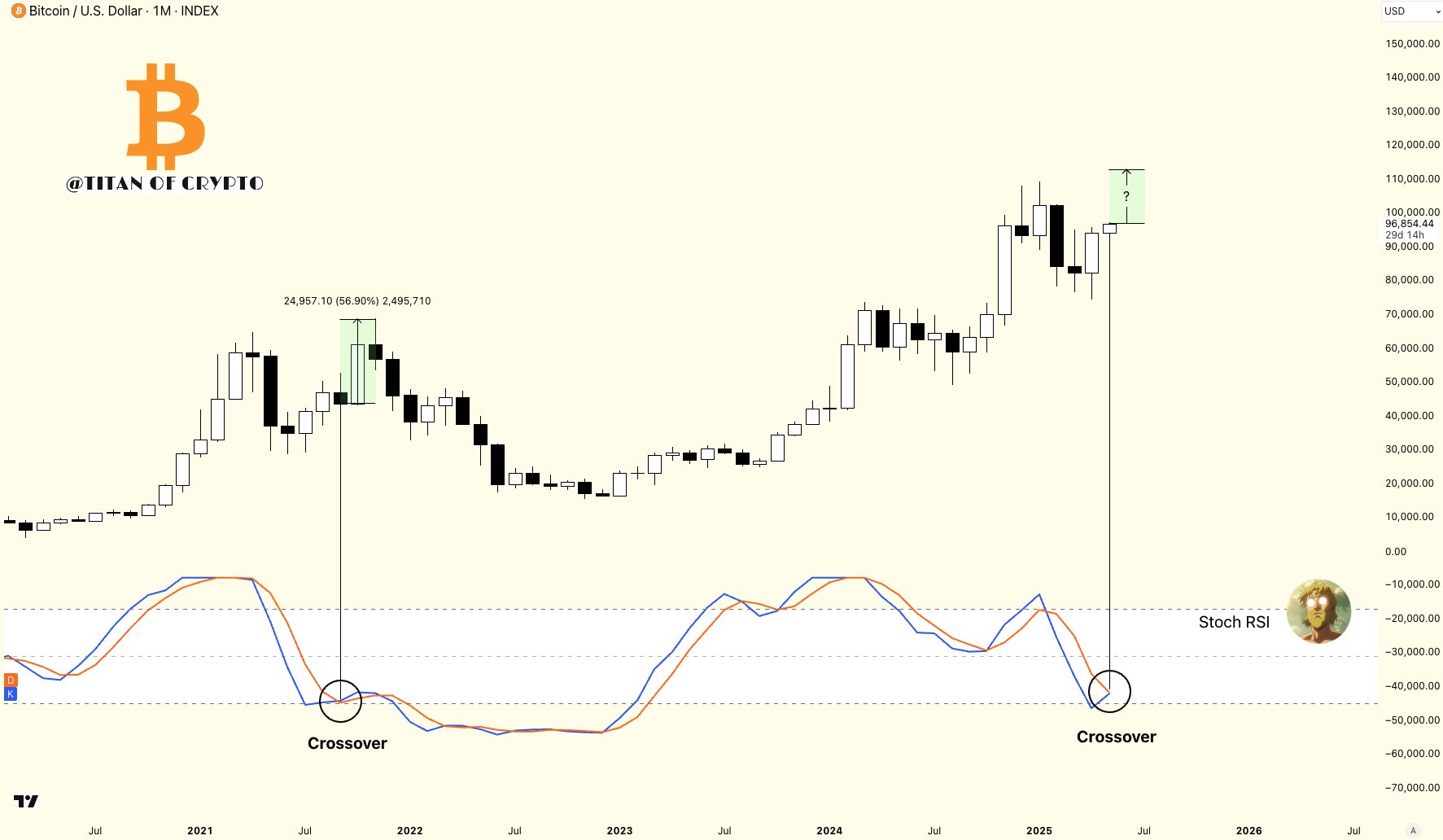

In a modern post on X, Titan of Crypto shared a monthly BTC diagram indicating that the RAM (RSI) is about to bullish intersection.

For beginners, RSI random references indicate a high momentum and are often interpreted as a potential purchase signal or a possible startup. Titan of Crypto added that if it is confirmed, the bullish intersection may start in the next BTC match.

Related reading

For example, the analyst pointed to the BTC prices on the monthly graph from the back in the Q3 2021. At that time, a similar bullish intersection in RSI random random at 56.9 % at the Bitcoin price.

However, Bitcoin should carry decisive support levels to maintain this bullish structure. In a separate X publication, the famous analyst Ali Martinez indicated that BTC can re -test the 95700 dollar support area before applying to a $ 100,000 teacher.

On the side of the resistance, Martinez confirmed that $ 97,530 is still a “major viewing level”. A A successful outbreak Behind this threshold you can pave the way for BTC to reconsider or overcome the previous ATH. As, Bitcoin is trading approximately 10 %.

Analysts expect the next step for BTC

Rekt Capital also weighted on BTC’s possible path. In x mail It was published yesterday, suggested that once BTC was decisively cut in the region 97,000 to 99,000 dollars, you may face rejection near 104,500 dollars. After that, keeping a set of 97,000 to 99,000 dollars will support it is very important for BTC to launch the highest new levels.

Related reading

Likewise, analyst Ted indicated that BTC is currently circulating in the Wyckff accumulation phase. The analyst added that the BTC slice is less than $ 76,000 in early April was likely to be at the bottom of this market cycle. He added:

Looking at the WyckFF, it appears that the level of 96 thousand dollars to 99 thousand dollars can be resistance. I think BTC can merge here for a few days, before separation in the end to the upward trend.

Despite the difficult momentum, some fears remain. Analysts to caution Bitcoin is unlikely to have a practical shock in the real supply in the near future, which may reduce the potential of the upward trend. At the time of the press, BTC is trading at $ 97142, an increase of 0.9 % over the past 24 hours.

A distinctive image created with Unsplash, X and TradingView.com plans