Bitcoin Rallly lacks support on the series-The analyst warns of the activity of the fading network

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Bitcoin has regained a $ 90,000 brand, prompting renewed optimism in the encryption market. With feelings and returning to upward calls, many investors are looking forward to moving about six numbers. However, not everything as it seems below the surface. Although impressive prices increase, there are still risks, especially as global tensions between the United States and China are escalating. The ongoing trade war and geopolitical friction pump fluctuations into the markets, creating a fragile background of risk assets such as bitcoin.

Related reading

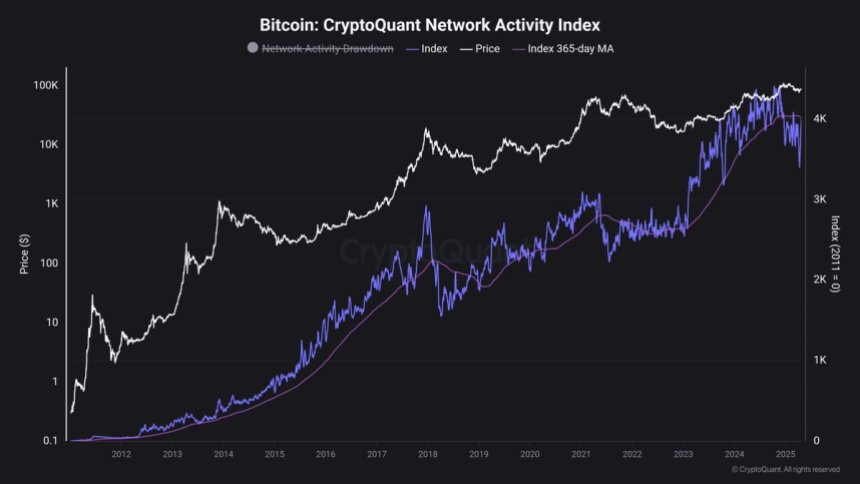

The best Maartunn analysts participated in a blatant show in the current situation of Bitcoin, which reveals standards on the series that draws a different image. According to his analysis, the last upper step is mainly driven by leverage and derivatives instead of strong organic demand. He pointed out that the Bitcoin network is, in his words, “ghost town”, with a little new activity or visual flows from real users.

This separation between prices and the basics indicates that the current gathering may lack sustainability. As such, investors must deal with the next stage of bitcoin price with caution, especially if the macroeconomic conditions begin to exacerbate the positions derived from relaxation.

Bitcoin faces resistance: the activity is lagging behind the chain

Bitcoin is now facing critical resistance as Bulls tries to restore 95,000 dollars, a region that can determine the momentum in the short term. The last penetration over the resistance of $ 88,600 is a major transformation in the market morale, with bull control and paying price procedures to a new domain. However, to keep this momentum, the continuous demand will be necessary. Analysts warn that a health decline may occur before the next stage, especially given the current market conditions.

The fluctuation and uncertainty continues to control the scene, with fear still exists despite the last gathering. A large part of this caution stems from the ongoing global tensions and the unstable total environment that has been revealed since the re -election of US President Donald Trump in November 2024. With the rise in winding and trade negotiations with the increasing strained China, investors are still fully committed to risks.

The chief analyst Maartunn participated in realism Series analysis On x, highlighting the separation between the work of Bitcoin and the network activity. According to its results, the last mutation is largely driven by ETF flows and the open interest in the derivative market rises – the factors that precede it are often opposite rather than a sustainable gathering. Maartunn describes the current situation of Bitcoin as “the ghost of the city”, noting that there is no new visual request on the series.

This difference between prices and network basics raises questions about the sustainability of the current step. In order to convincing Bitcoin to pay 95 thousand dollars and prepare the tour about 100 thousand dollars, it is possible that the demand for a stronger spot and raising in the real user activity is necessary. Until then, traders should remain careful and watch the main support levels closely.

Related reading

Details of the procedure prices: 95 thousand dollars on the horizon

Bitcoin is trading at $ 93,600 after several days of the ups in the prices that have witnessed the restoration of the main resistance levels. The price is now in a standardization stage around the level of 93 thousand dollars, as Bulls prepares for a possible penetration of about 95 thousand dollars. The ongoing step above Mark will open the door to get a batch towards a teacher of $ 100,000, which indicates a renewed force in the encryption market.

However, the path is still uncertain. Although short -term feelings look optimistic, Bitcoin must stick to the support level of $ 90,000 to maintain the upholsterer. Failure to do this can lead to a decrease in the moving average for 200 days near 88 thousand dollars-a level that was the main axis of the market structure during the past months.

Related reading

This region is seen closely by both merchants and their long -term holders, as it is possible to undermine the collapse of less than 90 thousand dollars in the current recovery momentum. As unification continues, the following few sessions will be crucial in determining whether BTC has enough power to break up or if a short -term correction is present in the store. Currently, all eyes are at 95 thousand dollars as the next obstacle was in the Bitcoin batch to restore the dominance of the market.

Distinctive image from Dall-E, the tradingView graph