Bitcoin Price Risplge explained: What is the following for BTC after it reached $ 111,980 ever?

Bitcoin was in a six -week ascending direction, which prompted the price beyond the decisive psychological barrier of $ 110,000.

Despite the increasing concerns that the assembly may face a saturation point or a potential decrease, the last Bitcoin performance and historical trends indicate that the King Crypto has not ended yet, with more gains on the horizon.

Bitcoin investors refer to more growth

Historically, one of the main indicators of the bull cycle in the cryptocurrency market is the decrease in the average age of bitcoin. Over the past five years, three main emerging markets have already been previously. Since April 16, the average age of bitcoin has decreased from 441 days to 429 days.

This trend is a strong indication of the continuation of an upward movement for Bitcoin. The younger currencies mean that new investments enter the market, which indicates a strong strong interest. If this trend continues, it justifies the expectations of additional bullish behavior, which may prolong the current assembly and push bitcoin towards the features of the new prices.

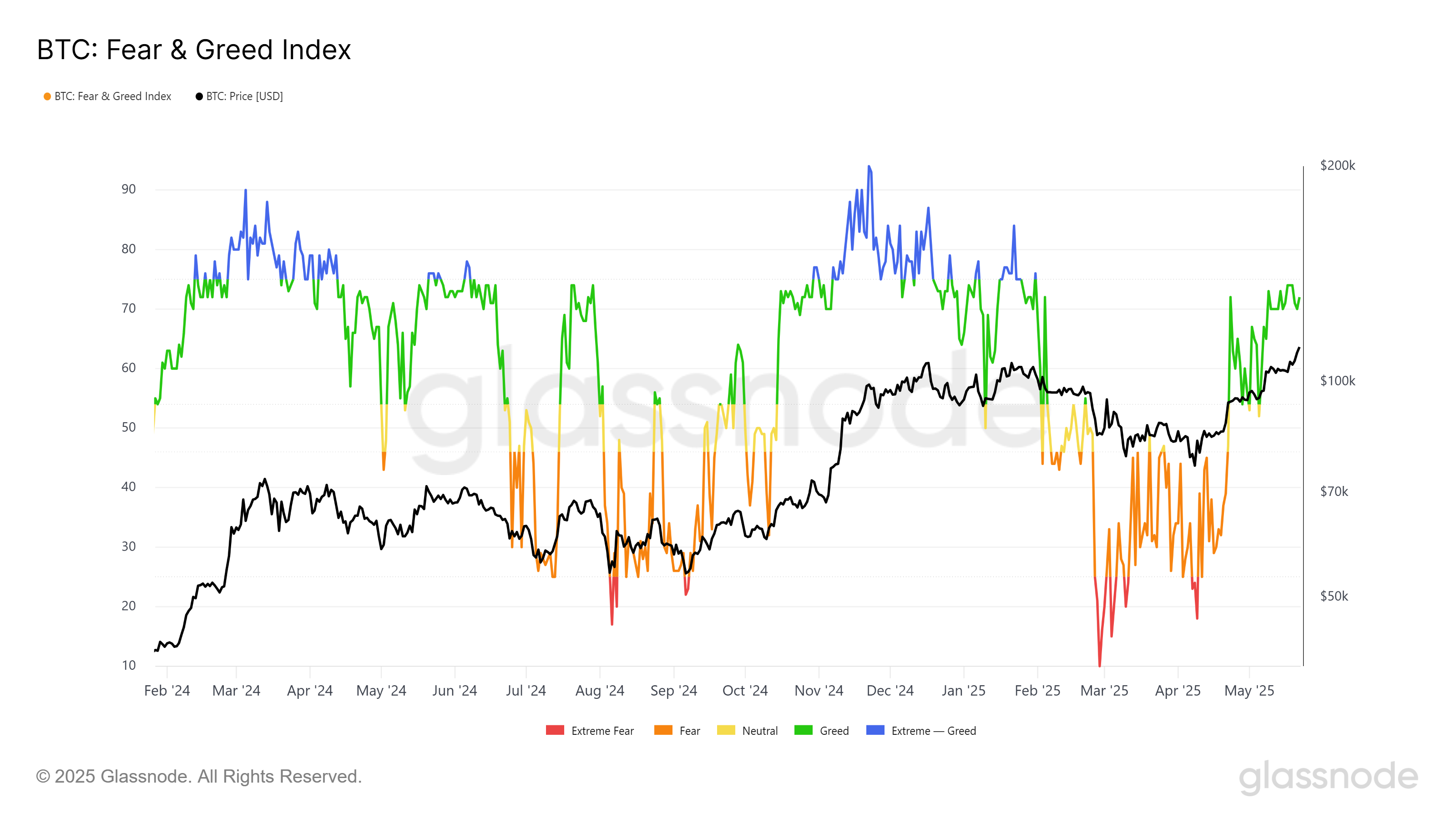

Fear and greed index also indicates that bitcoin momentum ascending is not yet satisfied. Historically, when the index violates the extreme greed area, it is followed by a sharp increase in the price of bitcoin.

However, Bitcoin has not yet reached this threshold, leaving a space for more prices. This indicates that the market has not yet been done in the peak area, and there are still great upward potential. The index position in the signals of the greedy area is that investors remain optimistic about the future prices of Bitcoin.

The BTC price aims to follow up the upward trend

The Bitcoin price has witnessed a fixed increase during the past six weeks, and its peak at the highest new level (ATH) of $ 111,980. Lennix Lai, Global CCO OF OKX, highlights the total economic factors, such as favorable market conditions and increasing institutional interests, which contributes to the last bitcoin gathering.

“Bitcoin through $ 111,000 to a new rise has ever shown how strong its technical preparation is. It was particularly affected by how it is dealing with the US credit reduction in the United States of Moody with hard hiccups before paying higher … This is not your model Crypto cycle That that that that that that that that that that that that that that that that that that that that that that that that that that that that that that that that that that Sen.

Looking forward, the Bitcoin price is ready to penetrate the current ATH and may reach $ 115,000. This continuous growth will attract more investors, which increases the assembly nutrition. If positive momentum continues, Bitcoin may enhance its position as a leading origin in the market.

However, if investors start selling their property to secure profits, Bitcoin may suffer from a short -term decline. The decrease of less than 106,265 dollars would indicate the weak morale of the investor, which may lead to a decrease of about 102,734 dollars. In the event of this, upcoming expectations may be null and void, causing a temporary monotony for the Bitcoin price.

Bitcoin’s high price explained: What is the following for BTC after it reached $ 111,980 ever? He first appeared on Beincrypto.