Bitcoin price rises to the highest level for eight weeks to reduce the risk of the market

- summary:

- Bitcoin’s price has been optimistic, with 10 percent in the past seven days. Here is the reason to climb here for a while.

The price of Bitcoin rose to its highest levels in the 94,540 dollars amid improved market expectations on American commercial tariff negotiations. Bellweether Market Market increased by 10 % in the past week, on his way to registering his largest weekly gains since November 2024. In addition, the volume of BTC price trading increased by 60 % in the past 24 hours, indicating that the momentum is likely to remain on the future climbing path.

The investor’s confidence increases with the melting of the risk morale

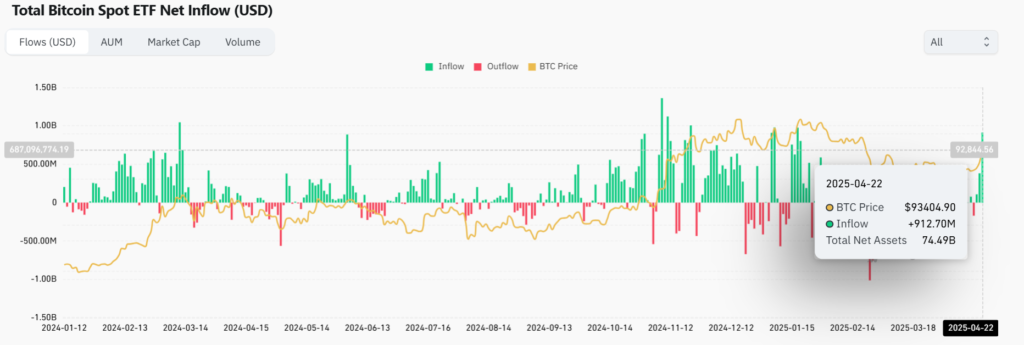

On Tuesday, the largest flow of the investment funds circulated in Bitcoin since mid -January, confirming a strong institutional appetite and adding credibility to the potential continuity of the gains by the BTC price. Nine out of 11 investment funds circulated for net positive flows against combined purchases of $ 912.7 million.

Bitcoin ETF spot. Source: Coinglass

US President Donald Trump injected the market confidence after stating that commercial tariffs against China could significantly decrease from the current 145 % in the coming days. This has reduced the aversion to the risks in the markets and the investors saw that they are exposed to very volatile assets such as cryptocurrencies.

Meanwhile, the Coinmarketcap Fear and Greed index moved from reading fear for the first time in 58 days, in line with the increasing investor confidence. The continuation of this feeling supports the continuous gains at the price of bitcoin.

Bitcoin prediction

The bitcoin price axis brand is $ 92,980 and buyers will be in the event of control if the price is higher than this level. The upper momentum is likely to meet the first barrier at 94,465 dollars. However, the strongest momentum will collapse above this level will indicate a stronger momentum that can test 95,945 dollars.

On the other hand, the transition to less than 92,960 dollars will turn the momentum into the negative side. In this case, the first support is likely to be 91,715 dollars. The bullish narration will be not valid below that mark. In addition, expanded control by sellers can send a less BTCUSD to test $ 90,120.