Bitcoin price failed to launch it by 751 million dollars in external flows, are the institutions to spend?

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

The price of Bitcoin continues to face the opposite winds, as the last report on The digital asset fund flows Amazing $ 751 million appears in external flows of digital assets. The huge size of this withdrawal raises the alarm bells about whether it is The institutions may be pure From the leading cryptocurrency.

Bitcoin price faces pressure amid huge flows

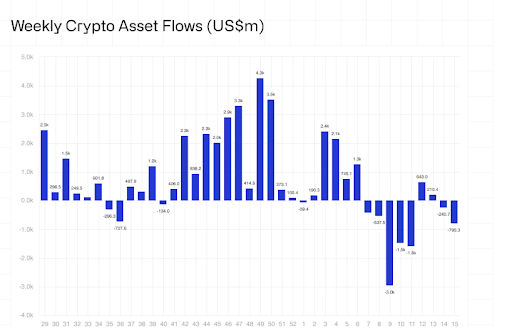

Coinshares’ weekly a report In digital assets funds, it revealed a huge presence 795 million dollars in external flows From the encryption market – wonderfully, 751 million dollars came from Bitcoin alone. This mass migration is one of the largest one -week flows per week, and comes at a time Bitcoin hit the wall.

Related reading

James Bouteville, head of research at Coinshares, revealed that since early February 2025, investment products in their digital assets have He suffered from cumulative flows From about 7.2 billion dollars, almost almost all flows throughout the year. It is worth noting that this week represents the third consecutive week of declines, with Bitcoin leads the recession And record the most important losses between the main digital assets.

As of this report, net flows of 2025 diminished to 165 million modest dollars, with a sharp decrease from the peak of billions of dollars just two months ago. This sharp decline confirms a Cooling feelings between institutional investors It highlights a growing sense of caution amid the continuous fluctuations of the market.

currently , Bitcoin price is struggling To restore its highest levels ever, with modern outfits as one of many barriers that hinder the encrypted currency Horization capabilities. Until these external flows and market stability are reflected, the Bitcoin Road remains to put new levels ever face a challenge.

Despite losing 751 million dollars in external flows, Bitcoin still maintains a moderate positive position with $ 545 million in net flows over the course of the date. However, the huge and speed range of the latest external flows raises anxiety. The fact that Bitcoin has suffered from such a huge withdrawal indicates a possible shift in feelings between institutions. Whether that is due to attracting profits or total economic uncertainty, this step indicates that the big players began to withdraw-at least in the short term.

In addition to Bitcoin, ethereum She witnessed $ 37 million in external flows, while Solana, AAVE and SUI also recorded losses of $ 5.1 million, 0.78 million dollars and $ 0.58 million, respectively. Surprisingly, even the short Bitcoin products, designed to benefit from the market decline, spared, as it recorded $ 4.6 million in external flows.

Political definitions and fluctuations pay external flows

One of the main engines behind the decline across digital assets is the high economic uncertainty raised by the tariff policies that negatively affected the morale of investors. wave Negative feelings He started in February after the President of the United States (the United States), Donald Trump, announced his plans Identification of definitions On all imports coming to the country from Canada, Mexico and China.

Related reading

However, a recovery was seen late in the week at encryption prices after Trump A temporary reflection of controversial definitionsProvide a short rest period for the market. This policy shift helped increase the total assets under management (AUM) through digital assets, from a decrease of $ 120 billion on April 8 to $ 130 billion, which represents an 8 % recovery.

Distinctive image from Adobe Stock, Chart from TradingView.com