Is 100 thousand dollars the next goal or a trap in the golden pocket?

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Biper Bitcoin Try to pay higher From less than $ 97,000, an attempt to confirm the latest outbreak over the scope of multiple monotheism. After nearly 95,000 dollars stopped for more than a week, Bitcoin erupted to $ 97,000 before the opposite and formation of a fair valuable gap.

Related reading

This has led to an increase in activity on Bitcoin Blockchain, and the following expectations are whether the current is The structure holds a continuation To $ 100,000 or if this momentum can stumble in the resistance area.

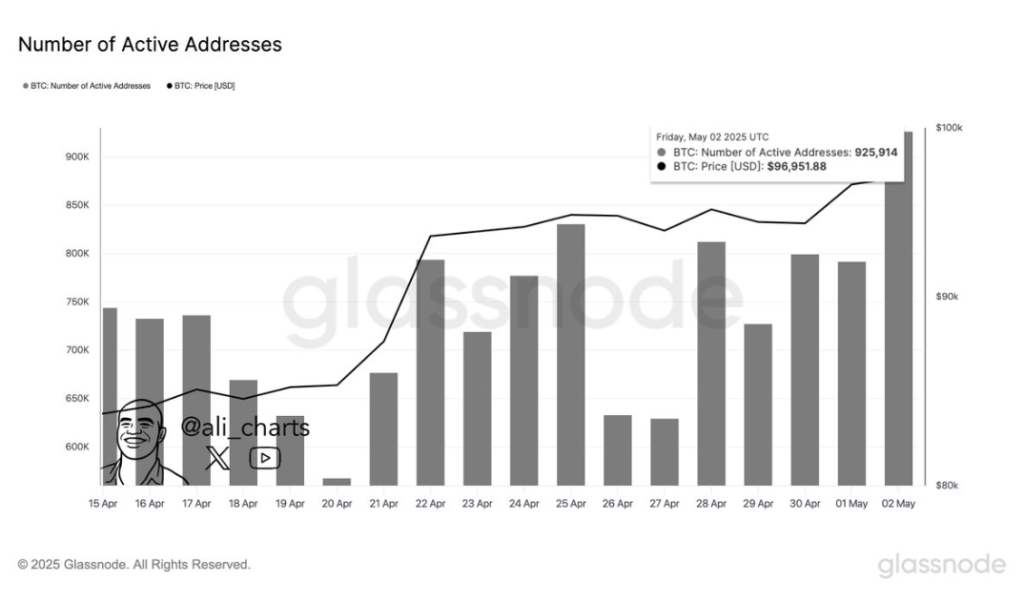

Bitcoin reaches its peak for 6 months in the network activity

One of the most prominent transformations in the market dynamics came from the side on the chain. According to the Ali Martinez, Bitcoin analyst, Bitcoin I just recorded its highest number One of the active headlines in the past six months. As it is subscribed to a post on the social media platform X, Martinez indicated that the 925,914 BTC addresses were active in one day, which is something Unusually high level of participation On Bitcoin Blockchain.

The accompanying Glassnode chart reveals the severity of this increase, as it is based on a gradual climb that started in the last week of April. Interestingly, the rise in Bitcoin’s activity coincides with its recent recovery from the price of $ 95,000.

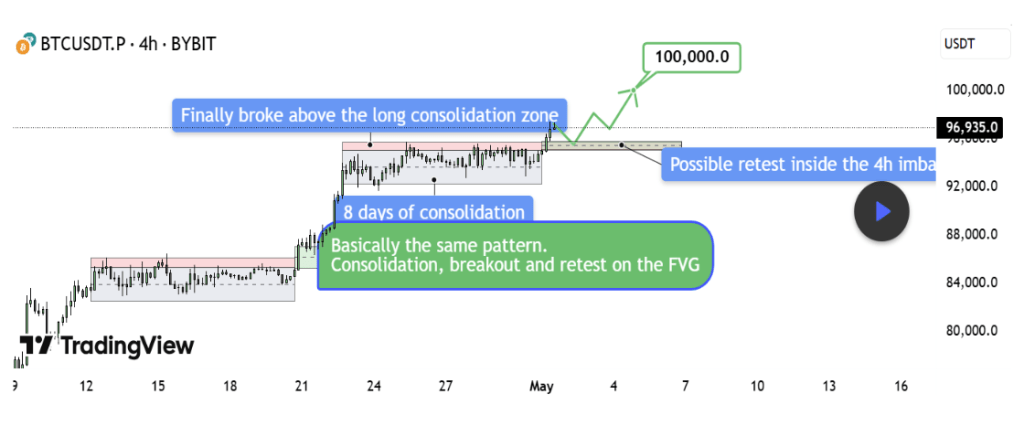

In addition to the upholstery, Tehthomas Crusion analyst Share convincing Technical analysis that indicated the outbreak About $ 100,000 continues. The interpretation of the time frame for 4 hours shows BTCUSDT is an identical structure of the structure seen in mid -April.

At that time, Bitcoin was united near $ 86,000, left behind a fair value gap (FVG), prepared the gap, and raised nearly $ 10,000. A mirror image of this style Currently. Bitcoin price was pressed less than $ 95,000, penetrated resistance, and created a new FVG between 94200 dollars and $ 95,000.

Tehthomas noted that the key is not chasing the penetration, but waiting for a clean re -test for the new FVG. If buyers are defending that area as they did earlier this month, the road to $ 100,000 is structurally sound. However, although the structure is currently preferring bulls, the situation may turn to landing if Bitcoin returns to the old domain to less than $ 94,000.

Chart from TradingView

The preparation of the dirt golden pocket highlights the upcoming risks

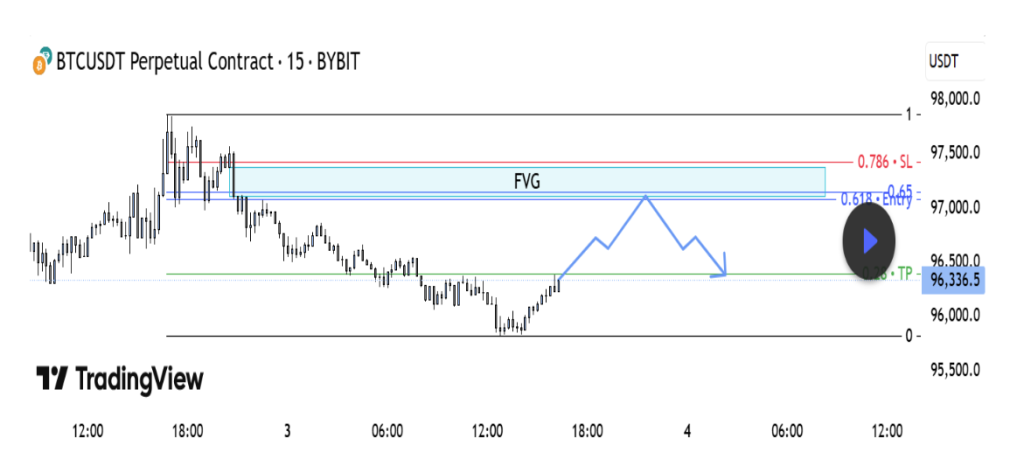

Not all analysts are convinced Bitcoin will reach $ 100,000 again without shake first. Anti -look on The TradingView platform highlights a short -term, potentially limited, based on the BTCUSDT scheme for 15 minutes.

According to the analyst, the current rising decline appears to be corrected rather than rush, which constitutes a classic short preparation in a powerful, fair gap area. Technical analysis shows that Bitcoin has regained an area that corresponds to the fully value gap and the golden pocket area specified at a level of 0.618 to 0.65 Vibonacci.

Related reading

As is the case, the fair value gap sits between $ 97,000 and 97,450 dollars. If the price fails to penetrate this supply area, it may reflect this And the arrest of the bulls for guarding.

Chart from TradingView

At the time of writing this report, Bitcoin was trading at $ 96,040.

Distinctive image from Unsplash, tradingvief chart