Bitcoin outperforms the stocks on the main risk scale – what does that mean?

Data shows that Bitcoin outperformed the main stock indicators over the Sortino ratio. Here is what this says about the performance of the cryptocurrency.

The 30 -day Sortino percentage of Bitcoin is currently at 1.23

In new mail In X, Defi Solutions Sentora (formerly IntothLock) talks about the Sortino percentage of Bitcoin. “Sortino” is an Sharpe -like indicator, which compares the returns of the original in exchange for its fluctuations.

The Sharpe “volatility” or the risks involved in the original as the standard deviation of revenues takes over a certain period. Note that the indicator does not differentiate between positive and negative returns. This is where the Sortino ratio varies.

Sortino only takes the standard deviation of negative returns, with the aim of picking up “harmful” fluctuations only. As a result, the value of the scale tells us how the asset returns accumulate in exchange for the risks of the negative side associated with it.

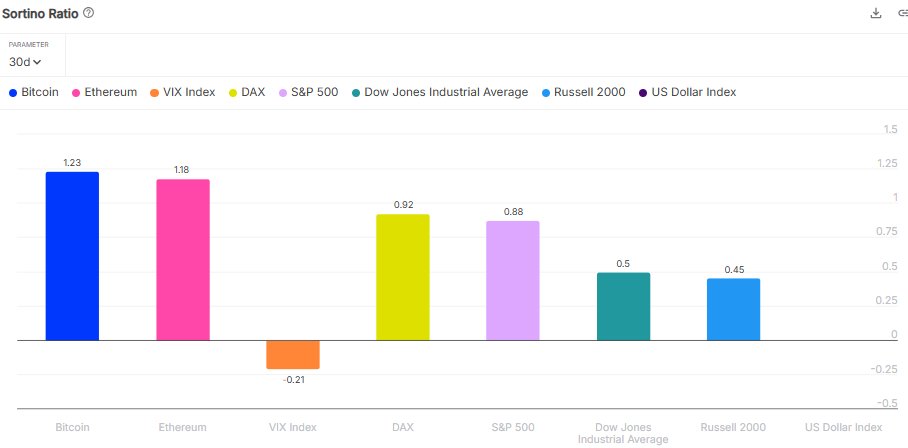

Now, here is the graph that the Analysis Company shares, shows how the 30 -day Sortino ratio is looking for Bitcoin as well as assets and other indicators:

The metric's value seems to be the highest for BTC at the moment | Source: Sentora on X

As visible in the graph above, the Sortino percentage of Bitcoin recently reached 1.23, which means that the asset revenues during the past month surpassed its negative fluctuations.

It is also clear that the same thing was true for Ethereum and the indicators listed in the graph as well, but it is clear that BTC was released in the foreground compared to all of them. The only person who is approaching is ETH, an encrypted curriculum, where he sits a scale at 1.18.

In some other news, the Pisces on the Bitcoin network resumed the growth network recently, as Glassnode participated in the Analysis Company on X in X mail.

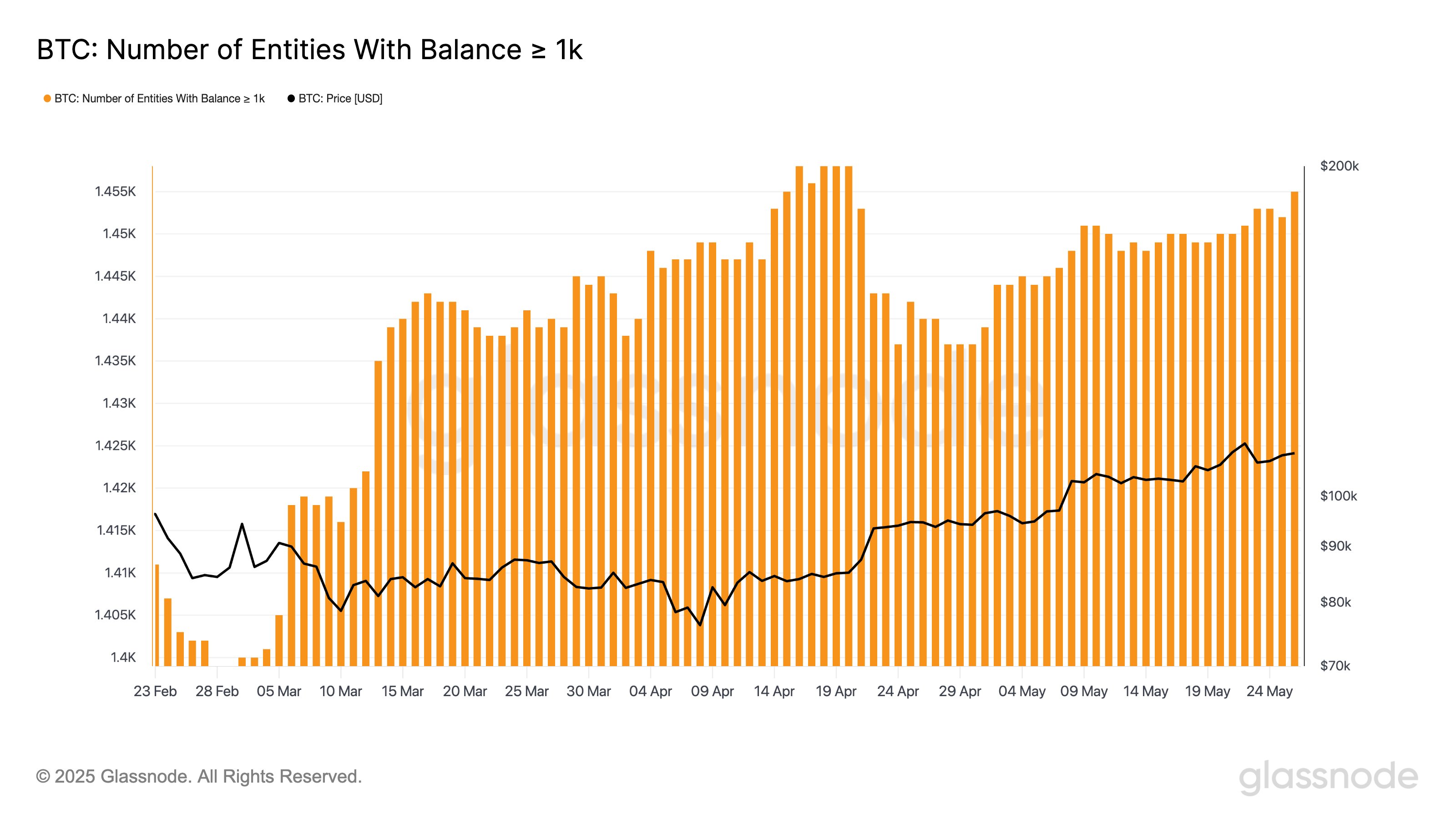

“Whales” in the context of BTC refer to entities that carry 1000 or more metal currencies. Below is the graph that shows the trend in the number of investors of this size who are on Blockchain:

Looks like the indicator took a hit last month | Source: Glassnode on X

As shown in the graph, the number of bitcoin investors the size of the whale witnessed a stage of decline in April, a sign that some investors from large money came out of the encrypted currency.

However, the scale this month resumed a bullish trend and continued to rise even with the rise in the price of the original at the highest new level (ATH). Nowadays, there are 1,455 whale entities on Blockchain.

Note that “entities” here simply do not indicate individual addresses carrying 1000 or more than BTC. Instead, the “entity” is a group of addresses that the Analysis Company decided to belong to the same investor through its analysis.

BTC price

At the time of writing this report, Bitcoin floats around $ 109,700, an increase of 3 % over the past seven days.

The trend in the BTC price during the past five days | Source: BTCUSDT on TradingView

Distinctive image from Dall-I, Glassnode.com, Intothblock.com, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.