Bitcoin near ATH, but their long -term holders do not sell

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

The new data on the series indicates that although Bitcoin (BTC) is near its highest level (ATH), LTHS holders (LTHS) do not unload their property. Instead, these investors continue to collect the largest encrypted currency in the world through the market value, indicating their confidence in more price gains in the coming weeks.

Bitcoin holders do not sell in the long run yet

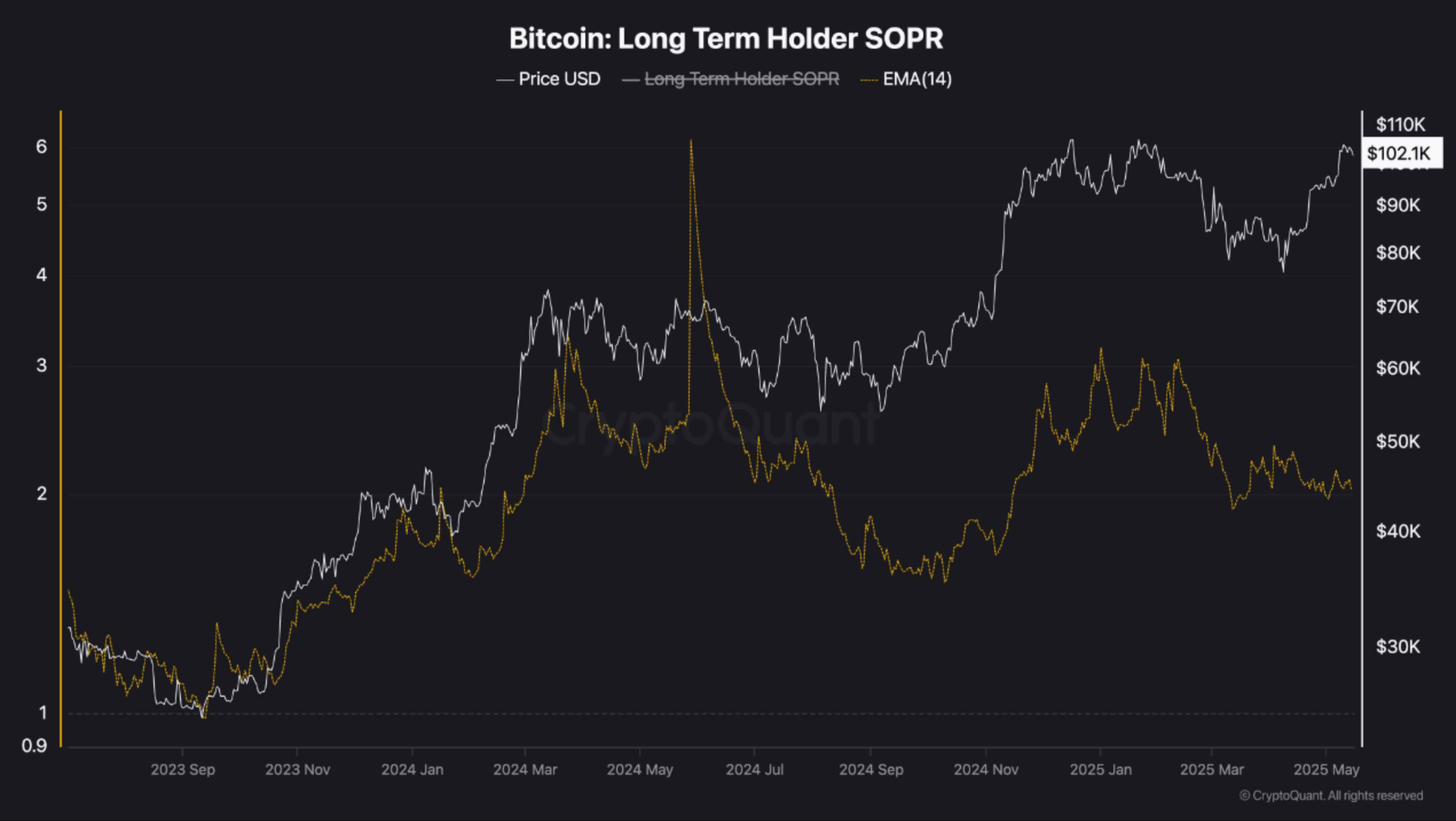

According to Cryptoquant Quicktake Post recently by ShayanMarkets, the profit between long -term holders is still relatively low, even with BTC trading near ATH. Historically, the profit achievement activity tends to increase significantly when Bitcoin is close to its highest level, as many investors are looking to imprison the gains. However, this was not the case in the current market round.

Related reading

The analyst highlights that Bitcoin uniformity near ATH levels usually achieve a great profit by market participants. However, current data reveals that LTH- those who held BTC for more than 150 days-they did not start achieving wide profits.

Specifically, the SOPR (SOPR) is directed at the bottom even when BTC continues to rise steadily towards a new ATH approximately $ 109,000. The analyst explains:

This decline indicates that long -term holders have not yet participated in achieving profits. Instead, it appears to accumulate, indicating confidence in the high price goals and expecting new higher levels ever.

In essence, it seems that the ongoing BTC unification stage is more driven by short -term holders and retailers. Historically, these investor sectors are more interacting with price fluctuations, and they quickly respond to both upward and bottom movements.

The analyst also stated that Bitcoin is likely to resume its upward direction after this period of monotheism. If the date repeats itself, the next Upward movement BTC can push new standard levels in the middle of the time.

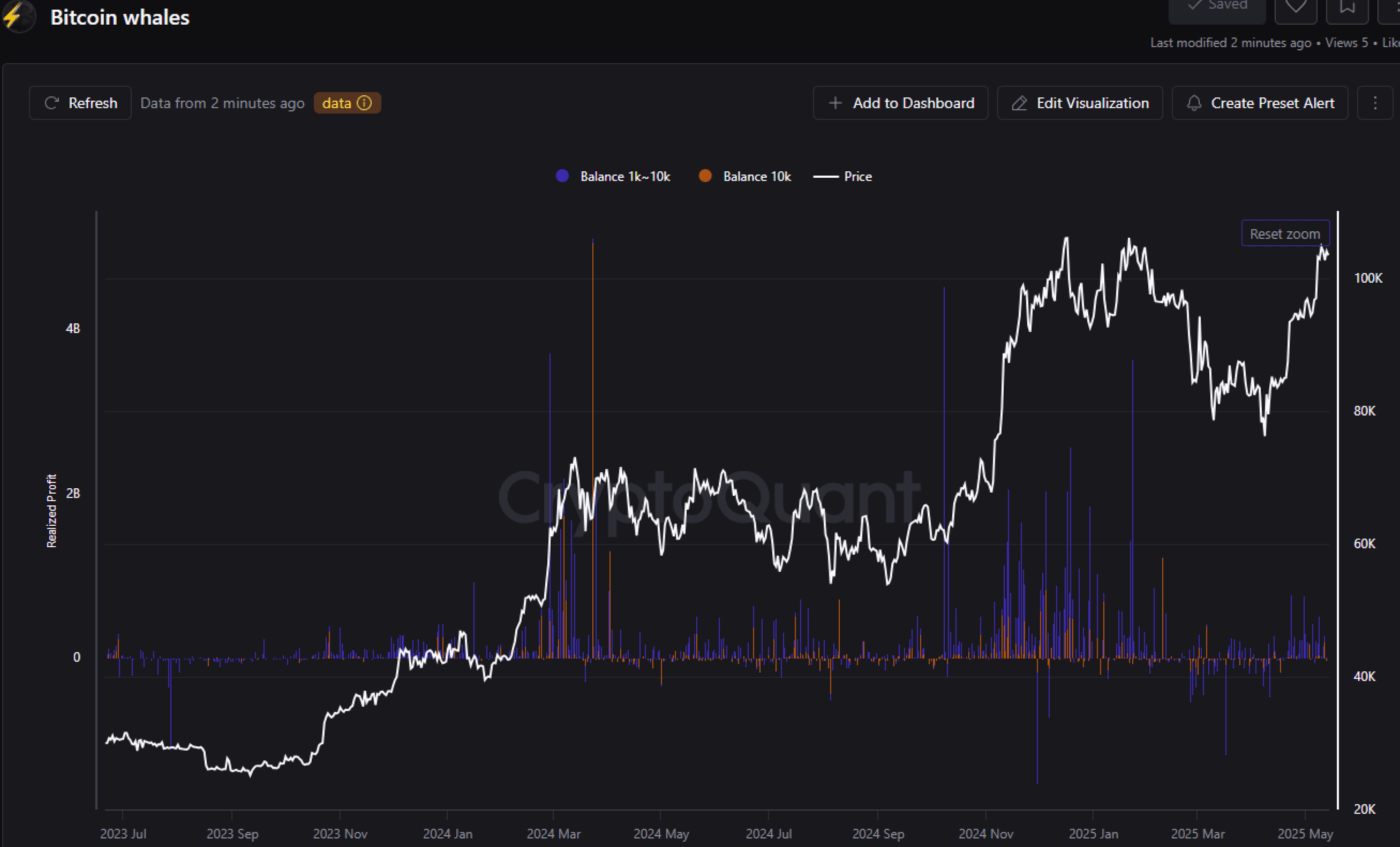

Analysis of his encrypted colleague, Blitzztrading, support these expectations. Blitzztrading noticed that the BTC whales – wallets that carry large Bitcoin’s possessions – got a much less profit compared to the previous floods.

This behavior indicates a long -term investment mentality between whales, and closely align them with LTHS more than retail or short -term speculators. It is fair to say that BTC whales are usually long -term investors, and often hold their positions through market courses, unlike the owners of the youngest who tend to trade frequently.

BTC may follow the historical work of Gold

Interestingly, comparisons between bitcoin and gold are now drawn. Gold has seen great gains over the past two years, to rise From about 1800 dollars an ounce in mid-2013 to about $ 3,200 an ounce today-an increase of approximately 75 %.

Related reading

Cryptollica recently noticed that BTC is likely to follow Gold and experience similar unusual gains in 2025. The analyst. Expected BTC may rise to $ 155,000 this year.

Likewise, the Bitcoin Bull-Bear Market Index Index Indicate Towards the bullish momentum of Cryptocurrency Apex. At the time of the press, BTC is trading at 101,852 dollars, a decrease of 1.5 % in the past 24 hours.

A distinctive image of Unsplash, plans from Cryptoquant and TradingView.com