Bitcoin near

Data shows that bitcoin feelings on social media may begin to rise a temperature, a sign that may be a threat to price equipment.

The feelings of social media are currently positive

In new mail In X, Santiment Analysis discussed how feelings about Bitcoin changed on the main social media platforms after the last recovery gathering.

The importance indicator here is “positive/negative emotions”, which compares the level of positive feelings to negative morale around a specific encrypted currency on social media.

The scale works by filtering publications/messages/interconnected indicators that contain originals and placing them through the machine learning model separating positive and negative comments. The index calculates the number of both types of publications and takes their percentage to provide a clear representation of social media.

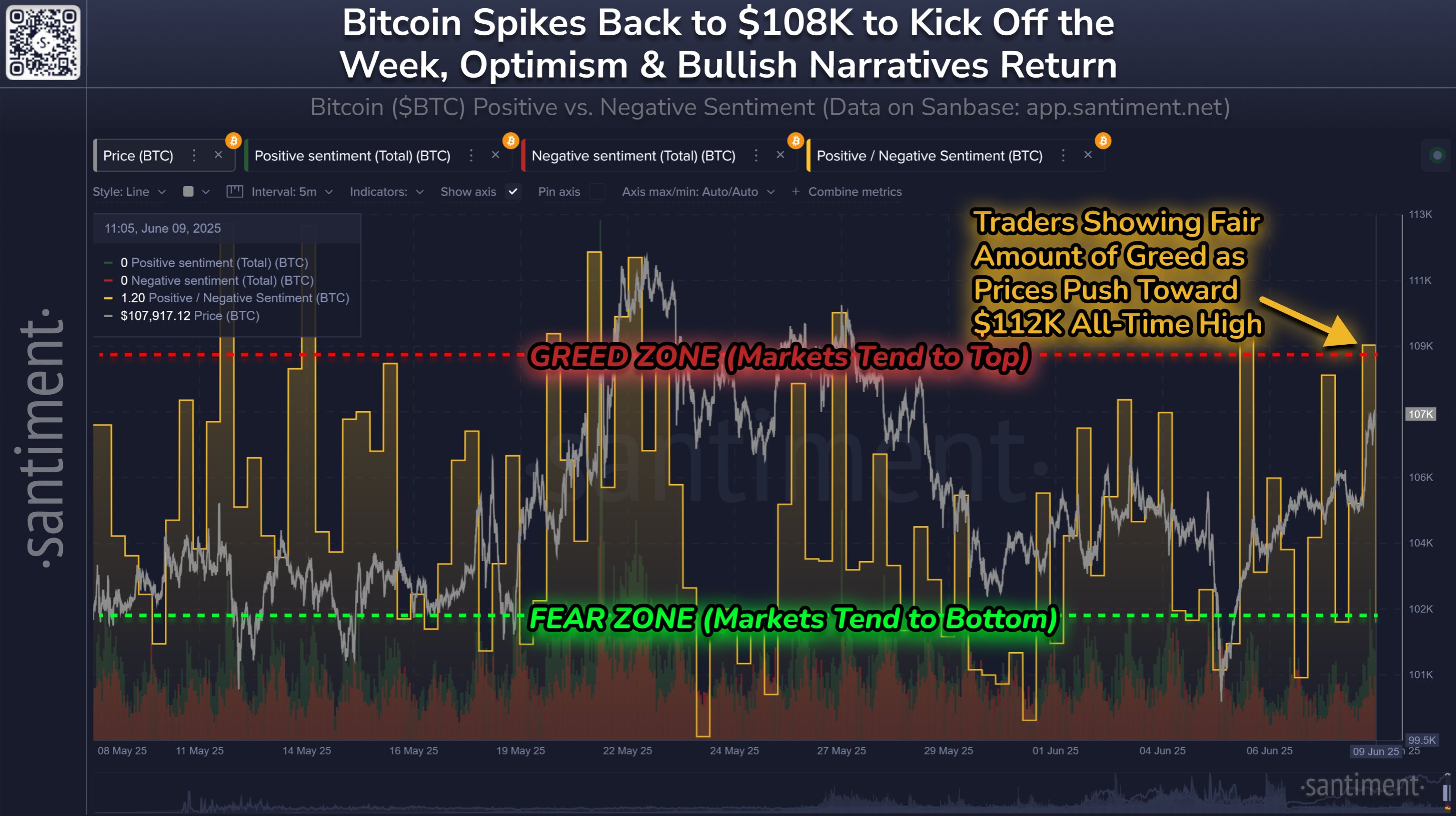

Now, here is the chart that Santemi shares, which shows the direction in the positive/negative feelings of Bitcoin during the past month:

The value of the metric appears to have spiked in recent days | Source: Santiment on X

As shown in the above graph, positive/negative feelings of Bitcoin have witnessed a rise in the region over the 1.0 mark, indicating that a flood of positive assets leaflets have struck social media platforms. This role towards a great positive feeling came with the passage of the price of the cryptocurrency to increase the recovery.

This is not a particularly unusual trend, as the excitement tends to height between merchants whenever the ups of the upward price occurs. In the context of the last mutation, in particular, raising the level of feelings is not surprising, because it made the price close to the highest level (ATH).

While some noise is expected, excess of it can be something to pay attention to. The reason behind this is the fact that Bitcoin and other encrypted currencies historically tend to move in the direction that contradicts the crowd’s opinion.

This means that increased greed in the market is something that can lead to the top of the original price. Likewise, the slowdown in feelings can indicate a bullish reflection instead.

From the graph, it is clear that positive/negative feelings decreased to a relatively low level a few days ago when Bitcoin witnessed a decrease of about $ 100,000. This fear among social media users has helped the currency reach the bottom.

After the last rise in the index, the situation is now the opposite, with the fear of the loss of FOMO that is likely to develop among investors. It remains now to see whether this excessive excitement will provide resistance to the price collection or not.

BTC price

Bitcoin briefly collapsed over $ 110,000 over the past day, but the assets have since witnessed a slight decline as it has now returned to $ 109,500.

The trend in the BTC price over the last five days | Source: BTCUSDT on TradingView

Distinctive image from Istock.com, Santiment.net, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.