Bitcoin Long -term holders, can BTC reach $ 85,000?

The leading bitcoin coin has had the past few weeks, as prices have pushed many investors in the short term-which are referred to as “paper hands”-to get out of the market.

However, amid the fluctuation of prices, the long -term currency holders (LTHS) remain firm and no signs of retreat appear when trying to push BTC to above 85,000 dollars. When can they realize this?

Bitcoin bearers in the long run from selling turns into stacking

In a conversation a reportBURAK KESMECI Cracks evaluated the long -term BTC changing (SUM) and found that since April 6, the scale has become positive, and showed a clear upward momentum. As a result, Kesmeci wrote, BTC increased by approximately 12 %.

The long -term BTC network changes to the center on the purchase and sale behavior of LTHS (those who kept their assets for at least 155 days) to measure the transformation in the number of coins that these investors keep over a specified period.

When its value is positive, it indicates that LTHS does not sell, and remains optimistic about the performance of the future prices of BTC. On the contrary, when it becomes negative, it indicates that these bearers sell or distribute their coins, often in response to market pressure, which is a declining sign.

According to Kesmeci, the pure BTC change in the SUM 30D is positive. This scale remained less than zero since last October, indicating that LTHS has been constantly selling BTCS.

Selofs operations reached its lowest point on December 5, which led to a 32 % decrease in the BTC price and the peak of the distribution period for 6 months by LTHS.

However, this trend has changed since April 6. The scale now sits over zero and is in a bullish direction. He talks about what this means, Kimsky added:

“While it is very early to say categorically, the growing positive momentum in this scale can be a sign that long -term condemnation belongs to the market.”

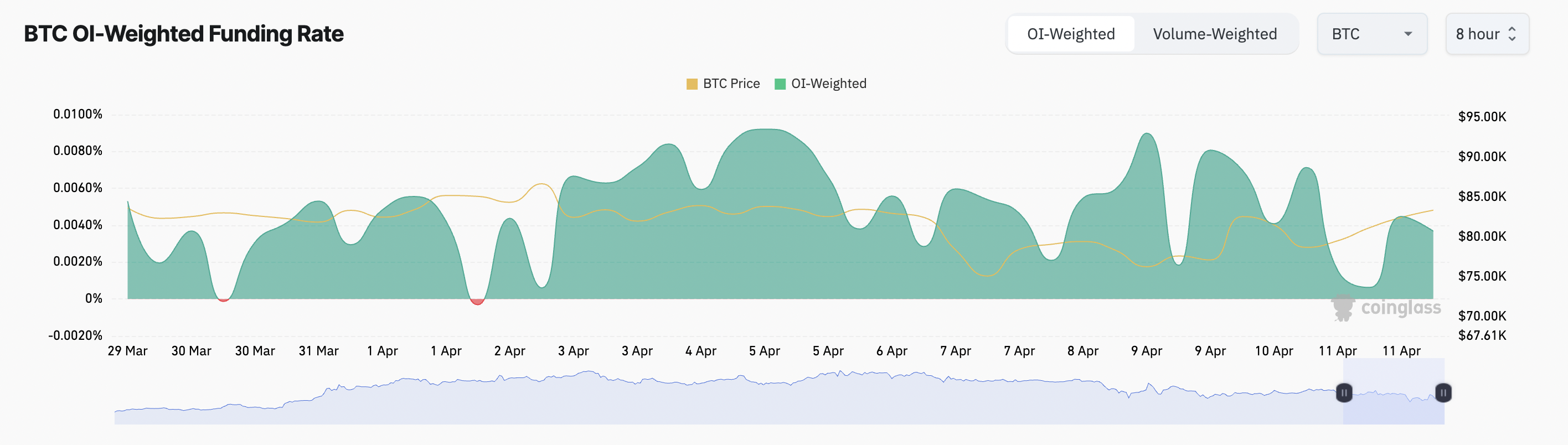

Moreover, the BTC financing rate remained positive amid price problems, confirming the ups off above. At the time of the press, this is at 0.0037 %.

The financing rate is the periodic payment that is exchanged between long and short traders in the permanent futures markets. It is designed to maintain futures for futures from the immediate price of the basic asset.

When this is positive like this, traders have long pushed short traders. This indicates the presence of the ups of the upscale market, as more traders are betting on the BTC climbing price.

Long -term holders prepared the road for $ 87,000

The accumulation of accumulation of BTC LTHS has paid the currency price higher than the main resistance at $ 81,863. At the time of the press, King Coin is trading $ 83,665.

While the market responds to these ongoing joint pressures from LTHS, the price of the modified currency may be ready for a large crowd in the near future.

If the retail traders follow it and increase the demand for the coin, BTC may break more than $ 85,000 to $ 87,730.

However, if the direction of accumulation ends and this LTHS begins selling to achieve gains, BTC can resume its decrease, less than $ 81,863 decreased, and about $ 74,389 decreased.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.