Bitcoin is struggling with less than $ 100,000, will Trump plan to treat inflation to the BTC?

- Bitcoin slides to the lowest level of $ 97777 on Monday, as Crypto Digest traders direct Trump’s orders and directions to inflation.

- Inflation can increase in inflation and support for risk assets such as bitcoin, and founding investors remain up.

- BTC’s eyes return to the highest level ever at 109,588 dollars, trading near 10 % below on Monday.

Bitcoin (BTC) corrects less than $ 100,000 on Monday, as it slipped about 10 % of its highest level ever at $ 109558 reached on January 20. The largest encrypted currency has decreased by market value to less than 97777 dollars, even with institutional investors remaining thanks to Bitcoin.

The encryption dealers keep their eyes peeled for the influence of President Donald Trump’s actions in the United States (the United States) to reduce inflation.

Trump brands note and multiple orders to cut prices

President Trump has signed notes and orders to reduce energy and inflation, dealing with a major concern among the market participants. A Washington Post The report says that many Americans voted in favor of Donald Trump because he promised to “defeat inflation.”

Trump’s first week in the office included directives focusing on bringing “relief in emergency prices” to Americans for housing, food, gas and other basics. The US President ordered government officials to decline in climate -related policies to reduce costs and reduce inflation.

Bitcoin and encryption symbols can benefit from increased liquidity and low inflation. However, many remain skeptical of President Trump’s actions and its effect on inflation.

Bitcoin decreased to less than $ 100,000 teachers

Bitcoin has wiped nearly 10 % of its highest level at all at 109,588 dollars. The distinctive symbol continues to decline and corrects less than $ 100,000 on Monday. Coinglass data shows that 248.21 million dollars have been filtered in the long centers of Bitcoin over the past 24 hours.

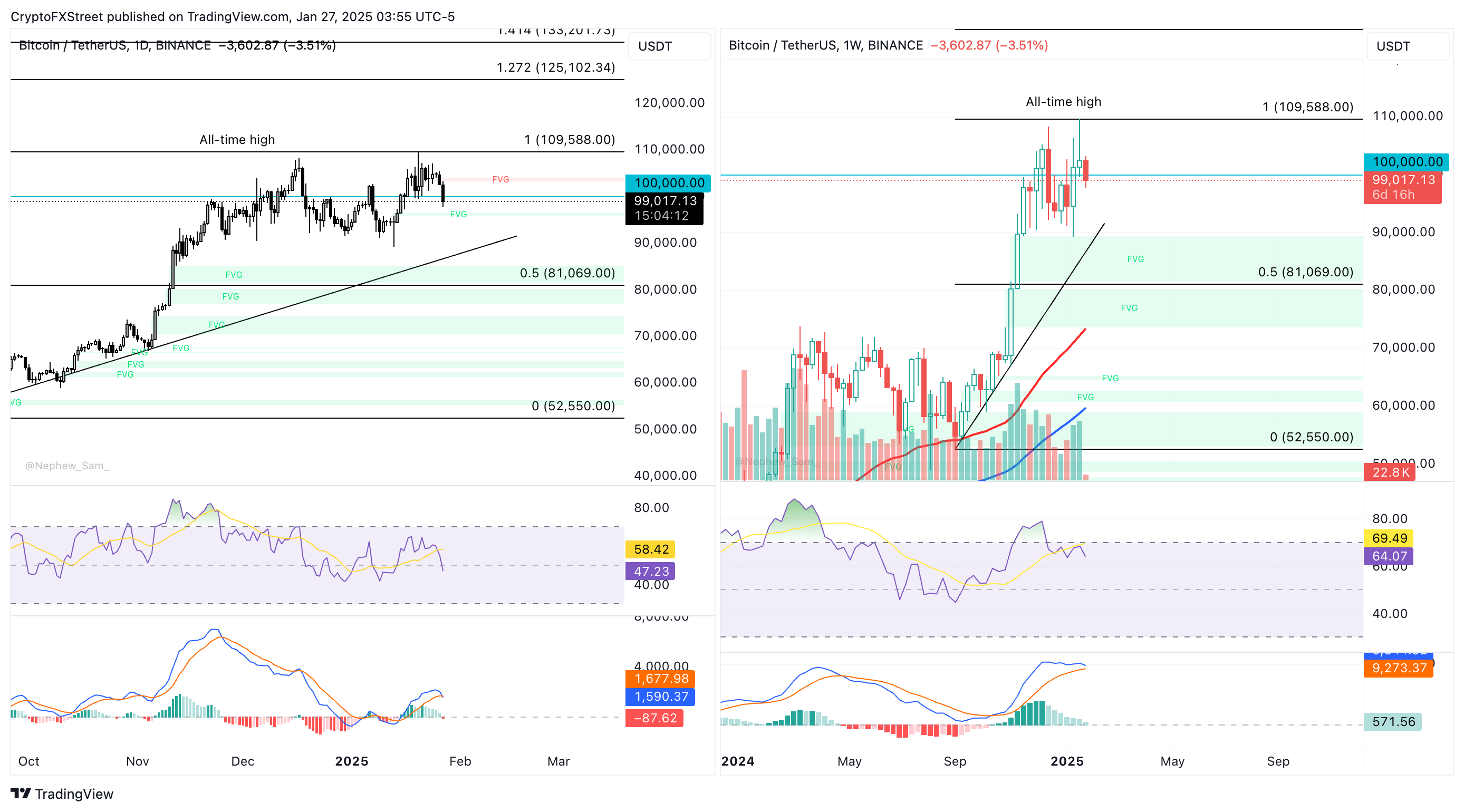

In the daily time frame, the RSI indicator and indicators of the contrast of moving average rapprochement (MACD) indicate a possibility of more correction in the BTC price.

RSI falls down and reads 47, while MACD ribbons red graph under the neutral line, indicating the negative basic momentum towards Bitcoin price.

In the weekly graph, BTC has the ability to recover from its last decline. The RSI 64 momentum is read and remains outside the conditions “above purchase”, while MACD flashes green graph tapes.

Bitcoin can try to recover over a $ 100,000 teacher and equipment to return to the highest level at 109,588 dollars.

BTC/USDT price scheme daily and weekly

Moreover, the length to the palaces is an important measure of morale among derivative derivatives. With a value above 1 on Binance and OKX, options merchants remain optimistic.

Bitcoin derivatives analysis Source: Coinglass

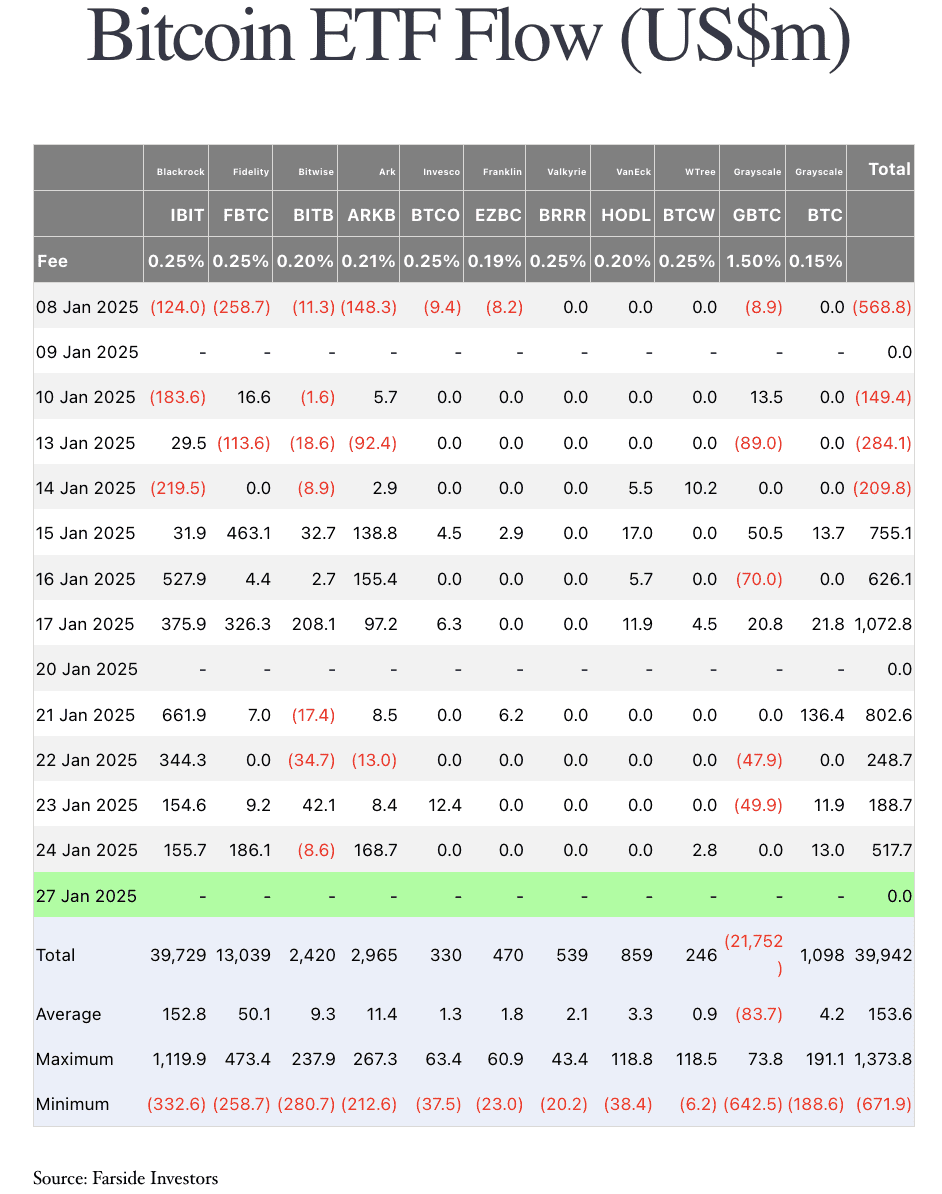

It is important to note that institutional investors maintain optimism, as the US -based Bitcoin Bedcoin Stock Exchange (ETFS) recorded a series of positive net flows for more than seven working days, according to Farside data for investors.

Farside Investors Data flow

Bitcoin trades about $ 99,000 at the time of this report on Monday.