Bitcoin is likely to fluctuate between $ 100,000 and $ 110,000 until the Federal Open Market Committee meeting, the analyst says

This material is also available in Spanish.

After rapid collapse to 89,256 dollars earlier this month, Bitcoin (BTC) achieved a rapid recovery, reaching the highest new level (ATH) at $ 108,786 on January 20. However, according to encrypted currency analyst, more height may be limited until it is announced. The Federal Open Market Committee (FOMC) is scheduled to meet later this month.

Bitcoin will remain within a specific scope until the Federal Open Market Committee meeting

The largest encrypted currency in the world has been going on a bullish path since November, driven by Donald Trump’s victory in the American presidential elections. Over the past three months, Bitcoin has increased from about $ 67,000 to $ 104536 at the time of writing this report, registering gains more than 50 %.

Related reading

However, Creen Currency Analyst expects that Bitcoin will continue to “decline” within a range of $ 100,000 to $ 110,000 until the Federal Open Market Committee meeting. The analyst notes that unless the Bank of Japan takes exceptional political measures, it is unlikely that Bitcoin is unlikely to come out of this range before the end of the month.

Nowadays, the CME Fedwatch tool Indicate The possibility of 99.5% is that the US Federal Reserve will not reduce interest rates at the next meeting. Krillin expects the decline in the market to follow the expected hardline meeting, which may be partially compensated through a pharying press conference hint In the context of future quantity (QE).

For beginners, quantitative facilitation is a monetary policy where central banks pump money into the economy by buying government bonds and other financial assets to reduce interest rates and stimulate economic activity. This increased monetary supply can weaken paper currencies, which may push investors towards assets such as bitcoin, which enhances their price as hedging against inflation and low value of the currency.

Creen’s expectations are compatible with the modern market note Which states that Bitcoin’s profits have decreased by 93 % from their peak in December, and that long -term stock holders have returned to accumulation, in preparation for the next step up. However, no one can guess the period in which the current integration stage may continue.

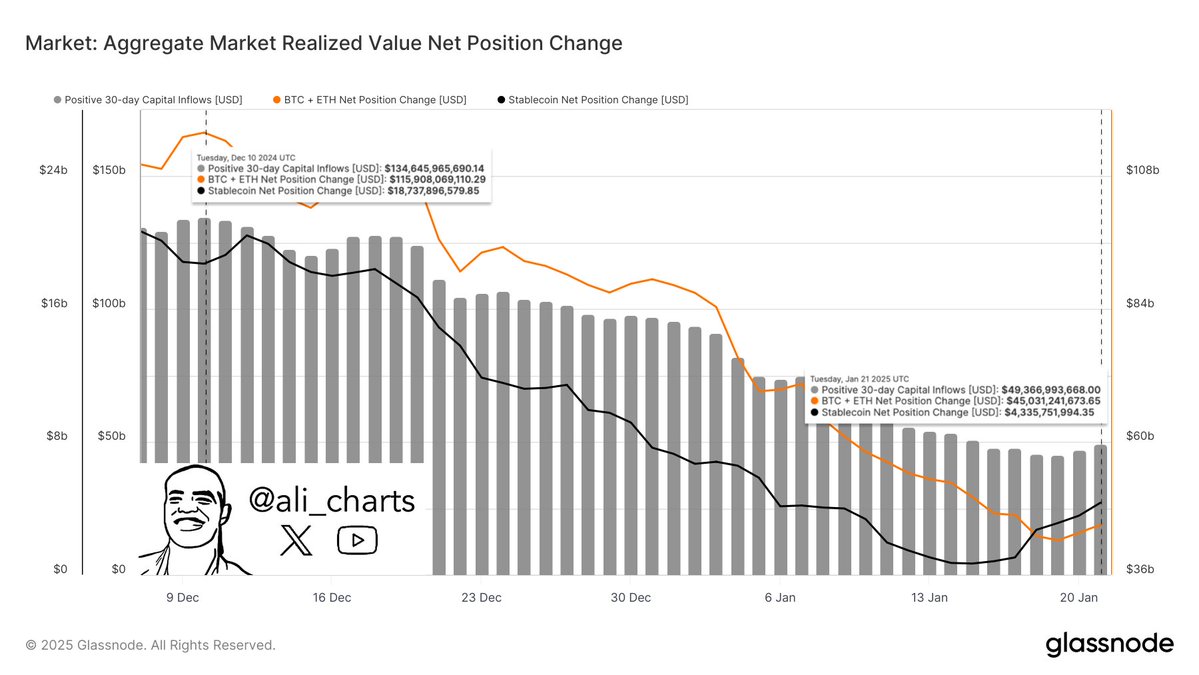

Meanwhile, the cryptocurrency analyst Ali Martinez Notes A sharp decrease in capital flows to the digital asset market, from $ 134 billion on December 10 to $ 43.37 billion. This low liquidity may lead to sharp fluctuations in prices, which increases the risk of liquidation for the leverage traders.

Will BTC reach its peak in the second quarter of 2025?

While BTC is awaiting the Federal Open Market Committee meeting to determine the next price direction, some analysts are optimistic that the cryptocurrency can reach the peak of the market cycle in the second quarter of 2025 with more institutions embrace the original under favorable regulations.

Related reading

For example, Dave the Wave Currency analyst recently anticipation Bitcoin is likely to reach its climax in the summer of 2025. BITFINEX report supports these expectations, Prediction Bitcoin can rise to $ 200,000 by mid -2025, albeit with slight corrections along the way.

However, Bitcoin must defend the price of $ 100,000, because failure to do so may lead to this Sees The original decreased to a low level of up to 97,500 dollars. At the time of publication, Bitcoin is trading at 104536 dollars, an increase of 1.4 % over the past 24 hours.

Distinctive image from Unsplash, graphic fees from X and TradingView.com