Bitcoin is invisible between claims and CypherPunks

At the recent Bitcoin conference in Las Vegas, there were many of the government and tradfi to the extent that bitcoin owners began to worry that they were losing their digital monetary system from peers to “claims”.

One of the preliminary step of Blackrock to the Bitcoin Exchange Fund in the summer of 2023 to the embrace of US President Donald Trump for encryption, all signs indicate that the institutions are in the end here.

“The years of Bitcoin that have crashed” institutional investors “and follow -up of price estimation more proactive than privacy, second self, and other CypherPUNK, led to Bitcoin to quickly become just another Tadfi tool.”

However, Darius Mukhtarzad, a strategic expert on encryption research at Spot Bitcoin ETF, 21, notes that there are benefits and defects in the union.

He says: “Institutional adoption provides the range, credibility and maturity of the infrastructure, thus improving liquidity, and reduces fluctuations and clarity of compliance.” “But it also provides the risks of custody, potential control and ideological drifting.”

Perhaps the increasing effect of traditional institutions may have been inevitable as Bitcoin has grown to $ 2 trillion assets. But do institutions affect bitcoin, or are they on the contrary?

Problems with Bitcoin

Bitcoin has been created as an alternative digital financial system to remove the central energy in the old financial system, such as the strength of the central bank to amplify the money supply and the ability of banks to reach personal financial statements.

Bitcoin, Satoshi Nakamoto, Satoshi Nakamoto, Frankly wrote about many of these issues.

But with the increasing interest of Traffi in Bitcoin as a neutral non -political store, many of this central communication points started to crawl to the Bitcoin network.

Seth For Privacy says it is concerned about the lack of privacy on Bitcoin today, especially because it was the main CypherPunk philosophy that prompted Create bitcoin In the first place.

“The main problem is that the incentives of the network change,” Seth adds to privacy.

“If the majority of money and influence in Bitcoin have a harmful financial incentive to remove the individual’s privacy and keep power for themselves, we will likely see less funding and resources that are poured into improving bitcoin or self -monopoly technology.”

However, the co -founder of Citrea OKun Mahir Kilic takes a more balanced vision.

“Bitcoin itself is inherently resistance to external influence,” says Kelik magazine. He says the relationship is mutual and that Tradfi has begun to know the value of bitcoin.

“However, they rarely interact with Bitcoin in its purest forms (for example, good self -need). Instead, they often adopt solutions to limit, which in turn leads to the demand for central tools.

Bitcoin is cooked in the long run if you really turn from “not your keys, not your currencies” to this narration “adding a democratic character to reach” that Silor Wall Street Financial engineers paid. pic.twitter.com/pbeo01nwt4

– Beaniemaxi hat May 29, 2025

Kilic’s Citriea, which builds the Layer-2 network based on zero knowledge, at the head of Bitcoin, wants to help expand Bitcoin’s adoption in a way that allows holders to maintain their own keys, unlike ETFS and treasury companies, which do not offer the real Bitcoin reservation.

“If the majority of people depend on the trustee or the traded investment funds, the transactions will occur in that layer without touching ever to Bitcoin.”

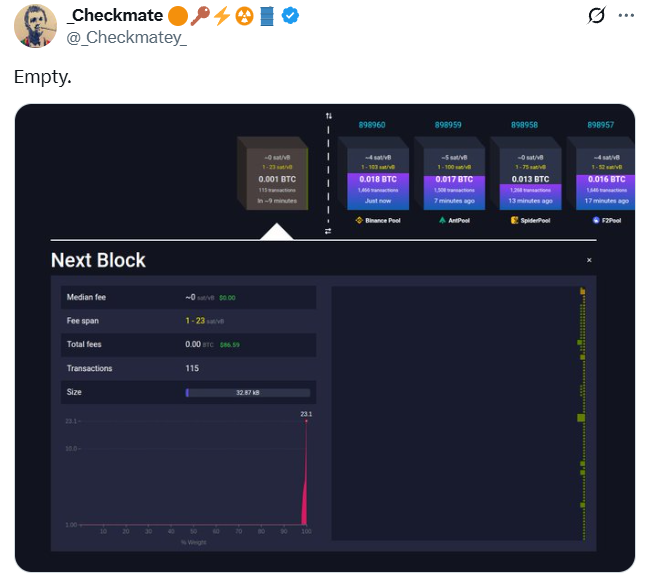

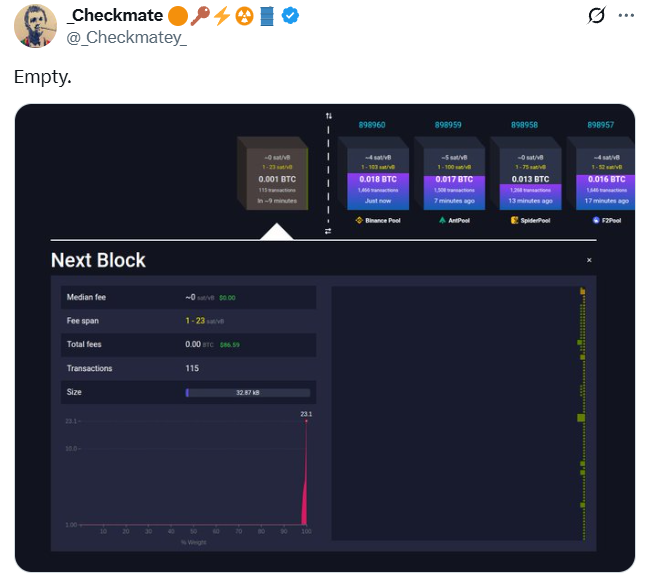

He says: “This deficiency in Onchain transactions means fewer transaction fees, which will become a critical issue with the continuation of the mass rewards in half,” he says.

Many observers have noted that the blocs have been somewhat empty in recent times, although bitcoin has reached new levels at all and cases of “random mail” such as inscriptions.

Kilic adds that there are also well -documented risks that come with a central nursery, as with FTX and BLOCKFI, which went bankrupt in 2022.

Bitcoin and Trafi develop together

Moukhtarzade of 21shares with Kilic agrees that the effect is going in both directions.

“It is a bi -directional dynamic,” says Mukhtarzad. “Bitcoin undoubtedly formed novels in Traffi and Politics Circles, starting from the transition from the legal tender for El Salvador to the global ETF race that drives institutions and events until it takes it serious

“We are witnessing rapprochement: Bitcoin forces Trafi to develop, while Trafi is the institutional character.

However, bitcoin owners do not like the idea of returning the same old trustee to the mix. However, Moukhtarzade argues that institutional products are widely need organized secretary to meet compliance and security standards and investor protection.

“Although this provides a degree of centralization of sensitiveness, these platforms are also subject to strict audits, use a better cold storage in their class, and are kept according to high credit standards, which is not guaranteed in the face of retail self -need.”

Read also

Features

Amnesty International has not killed the metaphor, and it will adopt – strange worlds, Bettenasor against Eric Wall: AI Eye

Features

Fights for encryption children on Facebook for the spirit

Moukhtarzade says the guardian like 21shares and the rest of the ecosystem bearing the responsibility for preserving the foundational values of Bitcoin, providing technical neutrality, and supporting the user’s choice.

“In the long run, we believe that the various nursery models of investment funds circulating to decentralized nursery protocols must coexist, enabling users through the spectrum of negative owners to active participants in the network,” he adds.

Not perfect, but a general system in general

So, what happens to go forward? Currently, there is a wide division between bitcoin and those open to the Trafi centralization.

The magazine also noticed earlier this year, there is an argument that the central Trafi will end in a lot of activity, which is currently decentralized financing (Defi).

Some say that the worst scenario will be equivalent to Bitcoin for Francin de Roosevelt Executive Order 6102, Which prevents citizens from storing gold.

Read also

Features

VCS risks and benefits for encryption societies

Features

Satoshi may need a pseudonym, but can we say the same thing?

Subscribe

The most attractive readings in Blockchain. It was delivered once a week.

But the traditional financial institutions and governments organized also have good reasons to support decentralized Bitcoin, whether to protect the basic value of the asset from greed or just get votes from local components.

The positive aspects of the Tradfi sharing in Bitcoin also cannot be ignored. Despite the centralized investment funds and other custody options, it also allows the effectiveness of millions of people to obtain bitcoin prices without the need to pay the onchain fees or the recognition of the governor and the seed phrases.

“[Things] It can change rapidly with mining becomes more industrial and organized, and governments follow judicial prosecution against open resource developers, and much more, “warn SETH for privacy.” Fortunately, there are “malignant programmers” who will continue to build strong tools regardless, but there is something to watch it.

Kyle Torbi

Kyle Torpey has been covering Bitcoin and Crypto since 2014. In particular, he covered the Bitcoin War in Bitcoin and Forbes. Over the years, his work has also been published in Fortune, Vice, Investopedia and many other media outlets