Bitcoin holds $ 103,000 while Altcoins awaits penetration signals, RAY leads daily gains

Bitcoin hovers near the support level of $ 103,000 throughout the day, trading in a narrow range with $ 104,000 with immediate resistance.

The broader encryption market increased in short to the highest level per day 3.52 trillion dollars before declining to stabilize about $ 3.46 trillion in the late Asian trading hours.

Market morale, as measured by the Crypto Fear and Greed Cynsmark index, improved after inflation data in cooling.

At the time of the press, the index reached 73, firmly in the lands of greed.

However, Altcoins spent a slow day, as most of the symbols dropped some weekend gains, while a handful of the best altcoins managed to stay in green.

Why is Bitcoin pending?

Bitcoin climbing came to the highest daily level of $ 104,836 against the backdrop of fresh macroeconomic optimism, led by cooling inflation that raised market morale.

The Consumer Prices Index (CPI) in April (CPI) showed an inflation to be reduced to 2.3 % on an annual basis, and comes in a softer than expected and giving traders a cause for breathing.

With a well reading reading in the Federal Reserve Rest Zone, the expectations of more prices have decreased, leading to the supply of demand for risk assets such as bitcoin.

The addition of fuel to the fire was a penetration in the trade relations between the United States of China.

During the weekend, Treasury Secretary Scott Beesen and Chinese Vice President, Leving, signed the deal to reduce the customs tariff in Geneva, reducing the rates of mutual tariffs to 10 % of the 145 % and 125 % heights.

The agreement actually enters today, May 14, and a 90 -day initial window began with low definitions.

It represents a turning point after a long period of economic tension, which raises renewed confidence among investors.

However, despite these rear winds, Bitcoin remained stuck under the 104,000 brand.

The gathering lost steam with the appearance of the scabies of profits at the main resistance levels. Santiment’s profit/loss scale rose on Tuesday, indicating that many holders are making gains, increasing the short -term sale pressure, and forming bullish momentum.

Will Bitcoin rise?

Some market trends indicate that Bitcoin still can explode if macro and material dynamics on the chain are aligned.

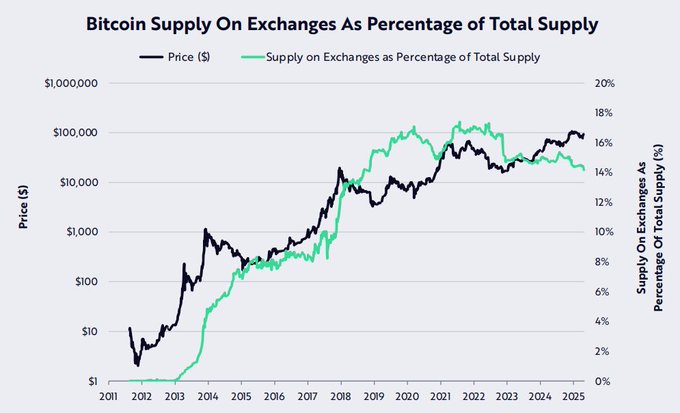

The data on the chain indicates the background of the display. According to the Miles Dotcher analyst, bitcoin supplies on the stock exchanges decreased to only 14 %, i.e. the lowest level in seven years.

$ BTC The display on the stock exchanges increased to the lowest level in 7 years by 14 %. What happens when you combine the very required original while constantly reducing the offer?

While leaving a fewer coins on trading platforms, data indicates an increase in investor confidence and sales volumes, both of which can reduce the declining pressure.

One major momentum is now upward, adding weight to the penetration state.

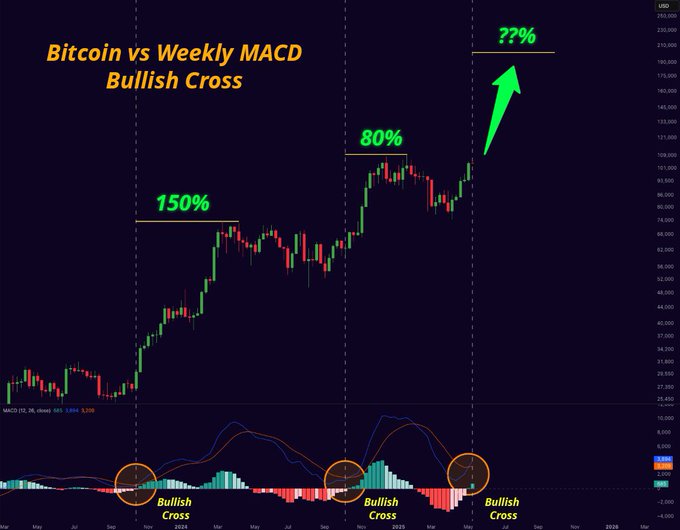

By drawing the weekly Bitcoin from MACD than scratch, indicating a shift from drop to upward momentum.

This is the first time that this has happened since late October, before BTC starts directly to its highest levels ever.

As it turns out of the graph below, the last five oud fluctuations led to a significant height, with only one wrong signal in March 2022.

Another intersection also follows the BTC bouquet of the moving average for 50 weeks, another preparation that was previously strong movements above.

Based on this setting alone, the TRADER SENSEI speculation with a long -term price target of $ 250,000.

$ BTC Give up to $ 250,000

However, not all analysts are aligned with an immediate look.

Roman, a trader for coding known for his total calls, believes that the current procedure related to the domain can represent a continuation of the direction, provided that the Bitcoin is unified more than $ 103,000.

In his opinion, a break can open more than $ 108,000 the door to $ 120,000 in the short term.

Meanwhile, analyst Hardy’s colleague is looking forward to a possible re -test of the 98,000 dollar area as a more attractive entry point.

He pointed out that this level corresponds to the retreat zone 0.618 Fibonacci from the last leg, and is often seen as a major field of support during the upward trends.

BTC/USD daily chart. Source: Hardy

Others look beyond the short -term levels and the similarities in the previous market sessions.

Sharp, the encryption analyst, referred to a frequent antagonist historically previously previously bitcoin gatherings.

In his opinion, BTC is currently re -testing multi -trend line, just as happened in 2017 and 2020 before he went vertically.

He suggested that in the event of a repeated date, an equivalent curve can follow, as Bitcoin enters a highly slope speeding phase similar to the summits of the previous session.

However, the general Byzantine wigs did not do Exclusion The possibility of moving bitcoin in the short term.

“If BTC remains calm, Alts can do what their own is a little,” the analyst indicated, indicating that stability in Bitcoin can allow capital to rotate in the broader market.

Currently, Bitcoin Bulls needs to exceed $ 104,000 resistance for the current gathering to continue in the absence of any instant stimuli.

At the time of the press, Bitcoin was trading at 103,465 dollars, a decrease of 0.6 % a day.

A slow day for altcoins

Over the past 24 hours, the Altcoin market cover has seen a small stumbling block of 1.78 %, which led to nearly $ 1.43 trillion.

Despite the gains, the Altcoin season index is still sitting in 30, which means that Bitcoin still leads the market and goes largely as Altcoins goes from here.

ETHEREUM (ETH), the largest altcoin depending on the maximum market, touched for a short period of $ 2700 but later settled at about $ 2578, by approximately 1 % from the previous day.

Simple gains between 0.5 % and 3 % altcoins such as XRP, Solana (SOL), Dogoin (DOGE), Cardano (ADA) and TON (TRX) are simple gains between 0.5 % and 3 %.

Raydium (RAY) has emerged with the largest gains per day, 12.6 % height. This was followed by Walrus (wal), which rose 9.7 %, and PI (PI), which rose 7.4 %.

source: Coinmarketcap

According to the well -followed analyst, Gordon, we are now in The second stage From Altseason course.

Ultimately, the real Altseass begins when the money begins to flow into medium and low metal coins, even those with weak basics, as the large symbols that surpass both BTC and ETH.

Michaël Van de Poppe also subscriber The maximum Altcoin market, with the exception of BTC and ETH, rose to about $ 925 billion.

He believes that the market may go through a short standard before the start of a new season.

Interestingly, one market observer He thinks The next big altseason may start tomorrow, May 15.

It is based on this in previous sessions, noting that the major altcoin gatherings occurred on this same date in 2017 and 2021, both four years.

According to his plan, Altcoin traders can witness a similar gathering this time, as the maximum of the maximum Altcoin market can climb up to 225 % of the current levels.

Post Bitcoin holds $ 103,000 while ALTCOINS awaits hacking signals, Ray Gains appeared daily on Invezz