Bitcoin has been set for a challenge with two main regions of the resistance

The Bitcoin (BTC) market has proven somewhat troubled last week after the price dropped to less than 75,000 dollars, followed a recovery to more than $ 83,000. With the clarification of the first cryptocurrency indicators on the continuous upward trend, Cryptoquant has identified Blockchain analyzes of possible major resistance areas waiting.

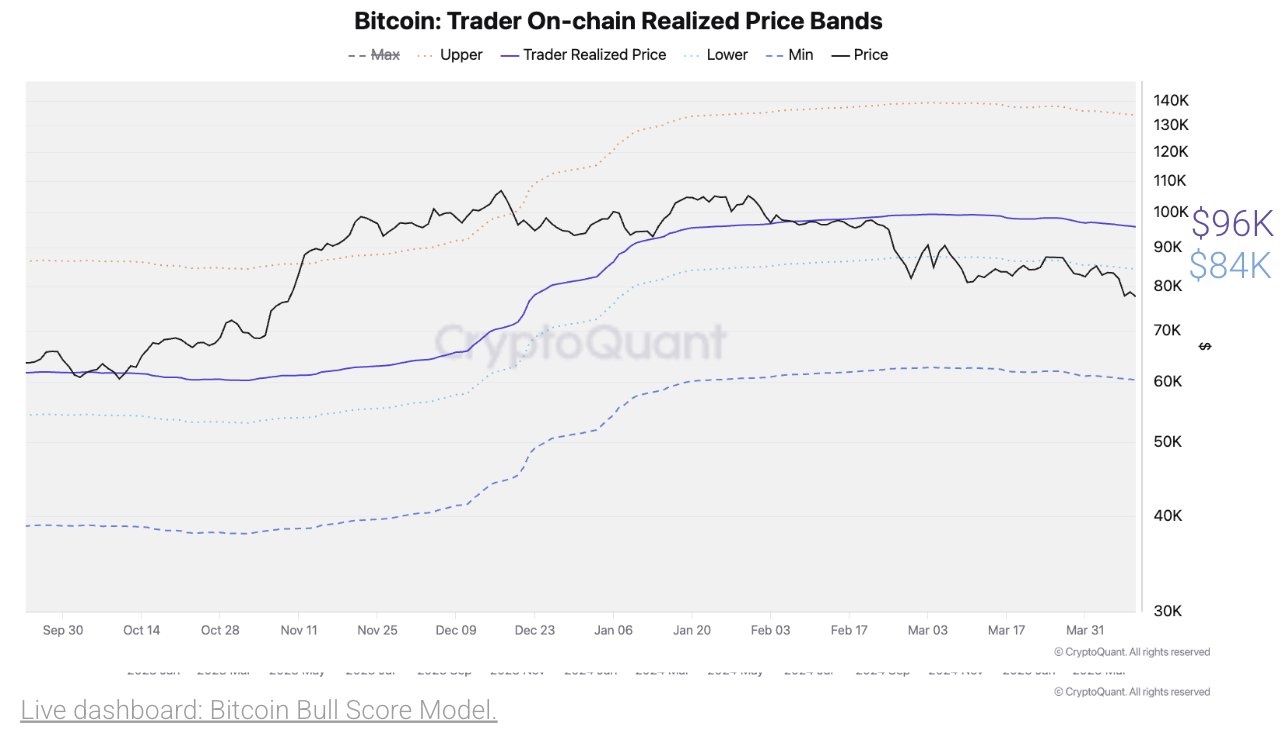

Bitcoin achieved price reveals strong barriers at $ 84,000 and $ 96,000

in X post On April 11, Cryptoquant participated in the series on the BTC market indicating a potential meeting with two main resistance at $ 84,000 and $ 96,000 if Bitcoin maintains its current upward path. These price barriers are detected by the price barrier, which reflects the average price in which the current BTC supply was transferred on the basis of the market at the market level.

When Bitcoin trades higher than this level, it indicates a healthy climbing momentum with the majority of profit holders. On the contrary, when BTC is lower than the threshold, it indicates underwater feeling because most investors suffer from a loss. Therefore, the achieved price often acts as a decisive market axis that works as strong support through the bull markets and the harsh resistance in the bear stages. according to Julio MorenoCryptoquant head of research, the current BTC price is 96,000 dollars with an immediate price range of $ 84,000.

Interestingly, these two levels of prices were major support areas in the upcoming upscarfing phase of the current market cycle. However, there is a possibility that both regions will be resistance amid the continuous correction of the market. However, if Bitcoin is able to exceed $ 84,000 and 96,000 dollars, it may indicate the resumption of the emerging market with the possibility that the first cryptocurrency trading up to $ 130,000. This expected profit will be an increase of 55 % in current market prices.

BTC price overview

At the time of the press, Bitcoin continues to trade at $ 83,180, which reflects an increase of 3.65 % last day. Meanwhile, the daily trading volume decreased by 11.99 % with a value of $ 39.19 billion.

In the midst of the continuous macroeconomic developments driven by the US government tariff changes, the encryption market still shows a strong level of uncertainty and the failure of assets to create a clear momentum. However, Blockchain Analytics Glassnode Reports Bitcoin investors have formed a strong support area at $ 79,000 and 82,080 dollars, over 40,000 BTC and 51000 BTC were collected, respectively.

In the appearance of any landing trend, both levels of prices must provide short -term subsidies and prevent a decrease in another price. With the rise of the market of $ 1.66 trillion, Bitcoin remains the largest digital asset representing more than 60 % of the maximum Crypto market.

Distinctive image from CNN, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.