Bitcoin on the brink of extreme greed – is it coming from ecstasy?

Data shows that the feelings of the Bitcoin merchant were swinging on the edge of extreme greed during the past few days, a sign that the break may come.

The Bitcoin Fear & Greed Index sits on the boundaries of extreme greed

“Fear and Fear Index” indicates an indicator created by substitute This tells us about the average feelings between investors in Bitcoin and the broader encrypted currency markets.

The index uses a numerical scale that extends from scratch to a hundred to represent market morale. All values above 53 are compatible with greed among investors, while those less than 47 indicate fear. The decisive levels are consistent naturally with a pure neutral mentality.

Now, here is how the current market morale looks, according to the fear and greed index:

The value of the metric appears to be 74 at the moment | Source: Alternative

As visible above, the index currently has a value of 74, which means that investors as a whole of greed and strength in this, given the high value.

In fact, this value is so high that it is located directly on the gate to a special area called extreme greed. This area, which is located outside the level of 75, is compatible with euphoria among the Bitcoin merchants. There is a similar area on the other end of the scale as well, known as extreme fear (under 25). When the indicator is in this region, it naturally indicates that investors are in the deepest state of despair.

Historically, each of these two regions was of great importance for Bitcoin and other digital assets, as great repercussions occurred when investors kept these mentalities. Thus, extreme greed can lead to a height and severe fear to the bottom.

Recently, Bitcoin has risen to price levels near the highest level ever, so it is not surprising that the feeling of height. However, at the present time, the index has not been divided into the intense greed area yet, so operation can have more space for operation before the excessive pattern is a problem.

It remains only to see how long it will continue to do so, taking into account that the Fear & Greed Index was sitting on this border level for three consecutive days so far.

The trend in the Fear & Greed Index over the past twelve months | Source: Alternative

Any continuation of the assembly can take the market morale beyond the threshold of extreme greed, and at this point the reflection may become more likely, the more index in the region.

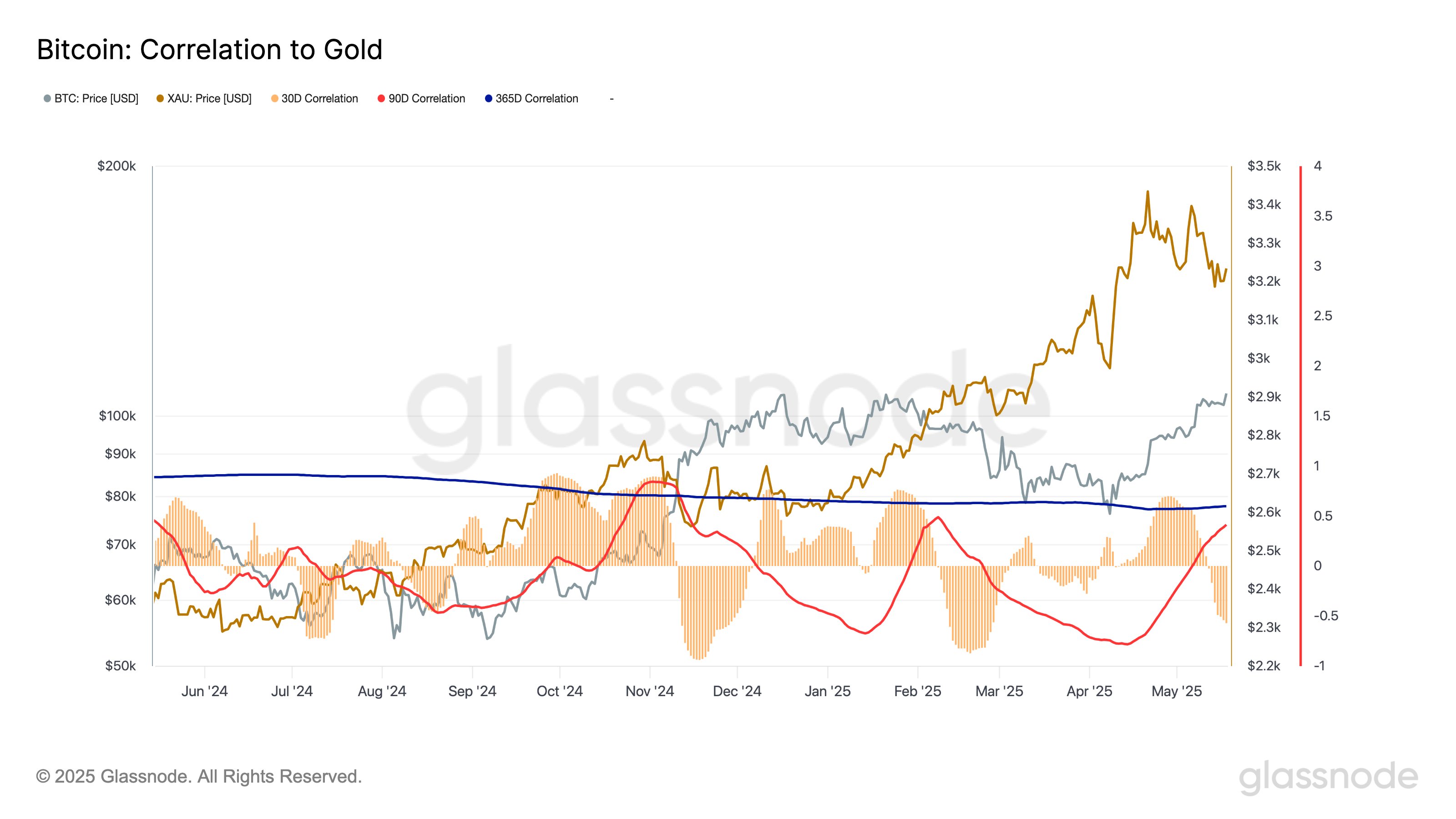

In some other news, Bitcoin’s connection for 30 days with gold has recently decreased to its lowest level since February, as Glassnode indicated at the Analysis Company at X mail.

Looks like BTC's correlation to Gold is negative on the monthly timeframe | Source: Glassnode on X

Nowadays, the 30 -day link between Bitcoin and gold sit at a value of -0.54, which means that during the past month, the two traveled to some extent to some extent.

BTC price

Bitcoin has witnessed a sharp explosion to a level of $ 107,000 yesterday, but the currency has since decreased by the same amount, as its price is now about 102,300 dollars.

The price of the coin has been moving sideways in the last few days | Source: BTCUSDT on TradingView

Distinctive image from Dall-E, Glassnode.com, Alternative.me, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.