Bitcoin faces a brutal correction, but there is still hope for the bull

Bitcoin It is clearly struggling. Pioneer encryption price It decreased by about 26 % From its highest levels ever, it was wiped 400 billion dollars In the market value and the destruction of market morale.

Investors are now afraid Donald Trump’s tariff policies This prefers to rise the US dollar index, while depleting interest in speculative assets. The pump, which was previously launched by the American presidential elections, was completely canceled.

However, there is still a glimmer of hope for my holders: historically, such clouds precede a strong recovery, which can be fulfilled in a The new market gathered. Meanwhile, the data on the chain and whale behavior provide valuable evidence about the procedure in the future prices of Bitcoin.

Why do bitcoin decrease? A comprehensive overview

In a sensitive moment like this, everyone asks Why bitcoin falls What sparked such a noticeable bear. The answers will be found outside the context of encryption, within the most complex macroeconomic field. In fact, along with Bitcoin, the S& P500 also gives unpleasant surprises, lost more than 4 % in the last 5 days.

Donald Trump It represents one of the main actors in emptying the financial markets, like it Foreign policies It does not seem to have received investors well. Recently, the new president of the United States announced that from the fourth of March, it will impose a trade tariff on Canada and Mexico, which also doubles a 10 % global tariff applied to imports from China. Import taxes on the European Union, which will face since April 2025, have affected an increase in US exports.

All of this negatively affects American inflation, while increasing prices that may make it difficult for the federal reserve to build a wide monetary policy. Thus, it can be there Less discounts in interest rates Just a few months ago, it affects the direction of speculative markets such as the appearance of bitcoin in the direction of the bear.

The only person who benefited from this scenario is US dollar index (DXY), which rose on Thursday, February 27, by 0.77 %. The DXY direction is usually opposite to the growth of bitcoin and arrows. It is not a coincidence that during the 2022 bear market, this indicator reached its highest local levels at 114 points. Since the US dollar is the global reserve currency, price changes can affect the purchasing power of individuals and institutions and influence the demand for the most dangerous assets.

The worst trading week since June 2022 for BTC

With the latest decrease in prices, Bitcoin recorded The worst weekly performance since June 2022, When its value decreased by about a third. On that occasion, SEC COINBASE was accused of SEC without a license and unregistered securities. This time, however, we have PipeThe second stock exchange in the encryption market for stain sizes, which was hacked for $ 1.5 billion from $ ETH by the North Koreans of the Lazarus Group.

Time to write this article, Bitcoin represents a catastrophic week of -18 %, Less than 80,000 dollars decreased dangerously. With this sale, the currency was filled CME gap Formed in mid -November. Some analysts suggest that from here he can test low price levels, while others believe that the bull’s motivation will start from here. Let’s remember that there is another small gap in CME at $ 93,000 waiting for filling.

According to data on the series, in the last three days Realized losses By Bitcoin merchants exceed 3 billion dollars sign. This is one of the most drops since August 2024, when the pregnancy trade ended in the yen and the cryptocurrency reached $ 49,000.

Also keep in mind that the last weekly candle of the BTC-Usdt chart is the worst ever in terms of price trip, with a total capacity of about $ 18,000.

In total, according to data from Tradingvief, The market value of the cryptocurrency lost $ 1.1 trillion, thus a total of $ 2.59 trillion. Many of this exit through retail who bought last month and panic with the collapse of the market. According to InTothheblock, currently There is still 6.34 million titles “Of money“On BitcoinThat was bought at a price ranging from $ 86,000 and 106,000 dollars.

Margin traders at Bitfinex benefit from discounts and go long on Bitcoin

While the price of bitcoin faces a significant decline, Some users benefit from shopping in the market And their average positions. In particular, it appears that merchants on Purvinix, known as the presence of whale investors An imminent recovery from the encrypted currency. The BTC number has increased on BitFinex with already borrowed funds to more than 60,000 BTC from 50773 this month.

Investors usually tend to accurately predict the peaks and market of the cryptocurrency market. These merchants, holders of large quantities of bitcoin, It accumulates during the decline Or in the stages of Rangebound, and sell it within moments of increased noise. This style was clear during the highest market levels in 2021 and 2024. For example, in the middle of last year, its participation was very active, given the great speculation opportunities that arose with the low summer prices.

These days, a Petinix whale It seems that shopping has gone by buying as much as 4000 BTCThat is, the equivalent of 323 million dollars. The same user accumulated 70,000 BTC between $ 40,000 and $ 16,000 during the Luna and FTX accident in 2022, only to sell it between 40,000 dollars and $ 70,000 in 2024. His new new purchase indicates that despite the future look,, Bitcoin can recover well In the coming months.

the Fear and greed index Coinglass It indicates The value of extreme fear, It can be seen on the market. Last year, the market did not witness only four days of extreme fear. Bitfinex dealer is likely to be the ancient Baron Rothschild guide, who recited at the beginning of the nineteenth century the wise phrase “R.It is time to buy when blood runs in the streets“

Are we in the middle of a giant decline or at the dawn of the new bear market?

At the present time, the prediction of the future direction of Bitcoin is especially difficult, especially because of Many total economy variables in play. According to different expectations, ASSET CRYPTO still has a space for the last bullish payment, which can be crowned at the highest new level ever and the end of Bull Run. However, technical analysis indicates an increase in control by bears, which increases the risk of consumption. If this trend is monotheism, this may lead to a long bear market.

HTML

Bitcoin needs a catalyst It can justify a strong recovery of the price, restore the typical balances of the bull market. One of these things could be the inclusion of the currency as a backup asset of the US Treasury, as Donald Trump promised it. Another factor that can return vitality to the market is the end of the war between Russia and Ukraine, which reduces geopolitical uncertainty and prefers a more stable climate for investments.

“

Bitcoin’s largest support in a $ 73,000 regionA break from this level, which was confirmed by a lower closure with a weekly candle, which would give more strength to the bears. recovery Resistance at $ 89,000 Instead, it will create more confidence in looking at the current style as a large bottom. The most valuable, most cruel cryptocurrency, as well as the most severe, is the inability to predict.

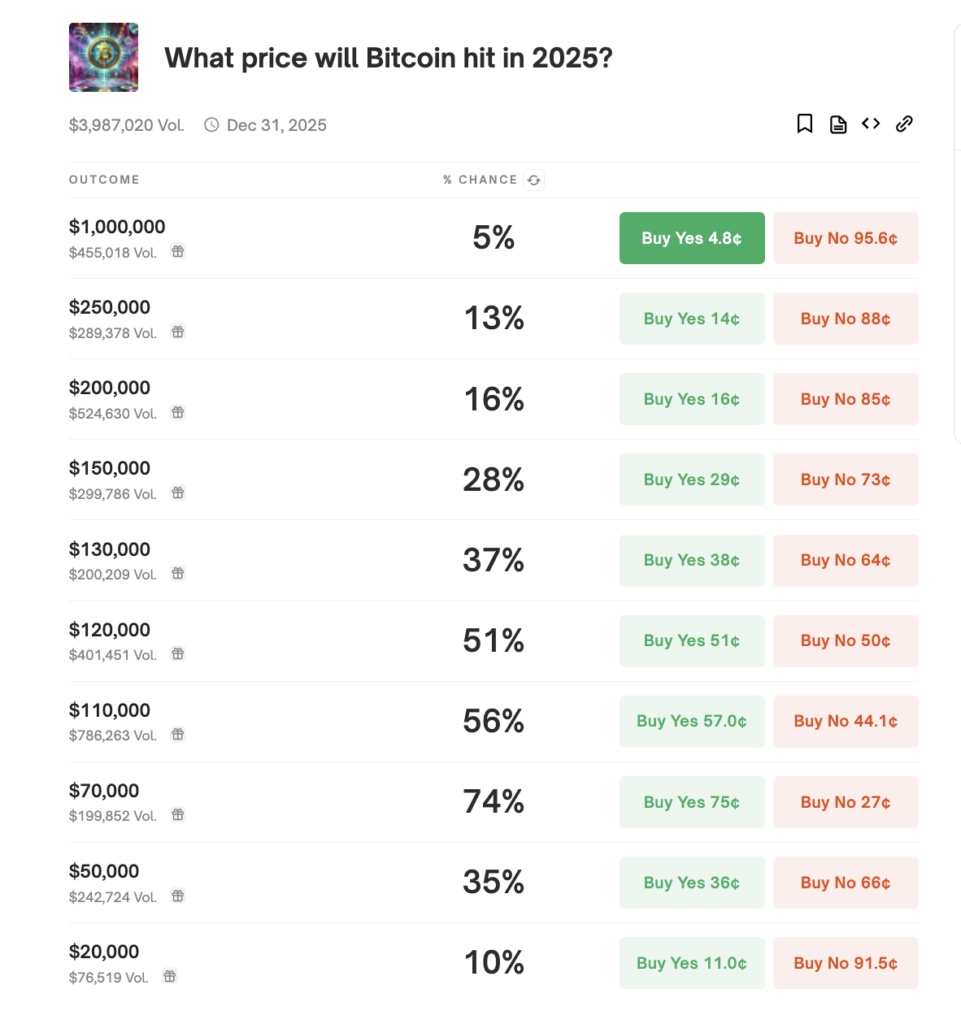

Polymarket expectations indicate that anything that can happen in 2025, where Bitcoin is likely to reach $ 200,000 or reconsider the 2017 bull market summit at $ 20,000. Everyone plays their own game.