Bitcoin derivatives in the driver’s seat for $ 100,000, data appears

The data shows that the volume of Bitcoin derivatives was higher than Spot One during the last BTC Rally exceeding $ 100,000.

The Bitcoin trading volume has decreased by a 1.0 mark recently

In new mail In X, the author of Cryptoquant Axel Adler JR talked about the trend in Bitcoin’s trading rate. The “trading volume” is an indicator that tracks the percentage between the amount of assets participating in trading in instant stocks and those on derivatives.

When the value of this scale is greater than 1, this means that the instant platforms are witnessing more trading volume of derivatives. On the other hand, its presence below the threshold indicates the dominance of derivative trading activity between investors.

Now, here is the graph that the analyst who shows the trend in the percentage of Bitcoin trading over the past two years:

As shown in the graph above, the Bitcoin trading volume was sitting under one sign recently, indicating that the size of derivatives may exceed this on that instant.

This has been preserved while the cryptocurrency has passed its latest leg from the recovery rally, which regained its price to the level of $ 100,000. From the graph, it is clear that the trend was different during the gathering of last month.

This previous station was accompanied by a rise in the percentage of trading volume higher than the first level, which indicates that topical deals were likely to be the main fuel behind it.

Historically, sustainable prices were generally of this type; The runs that are transferred from high speculation activity in the derivative market tend to be unstable.

Given that the derivative market has dominated this assembly so far, it is likely that it has a problem in entering it. Nevertheless, it remains only to see how things will develop for Bitcoin.

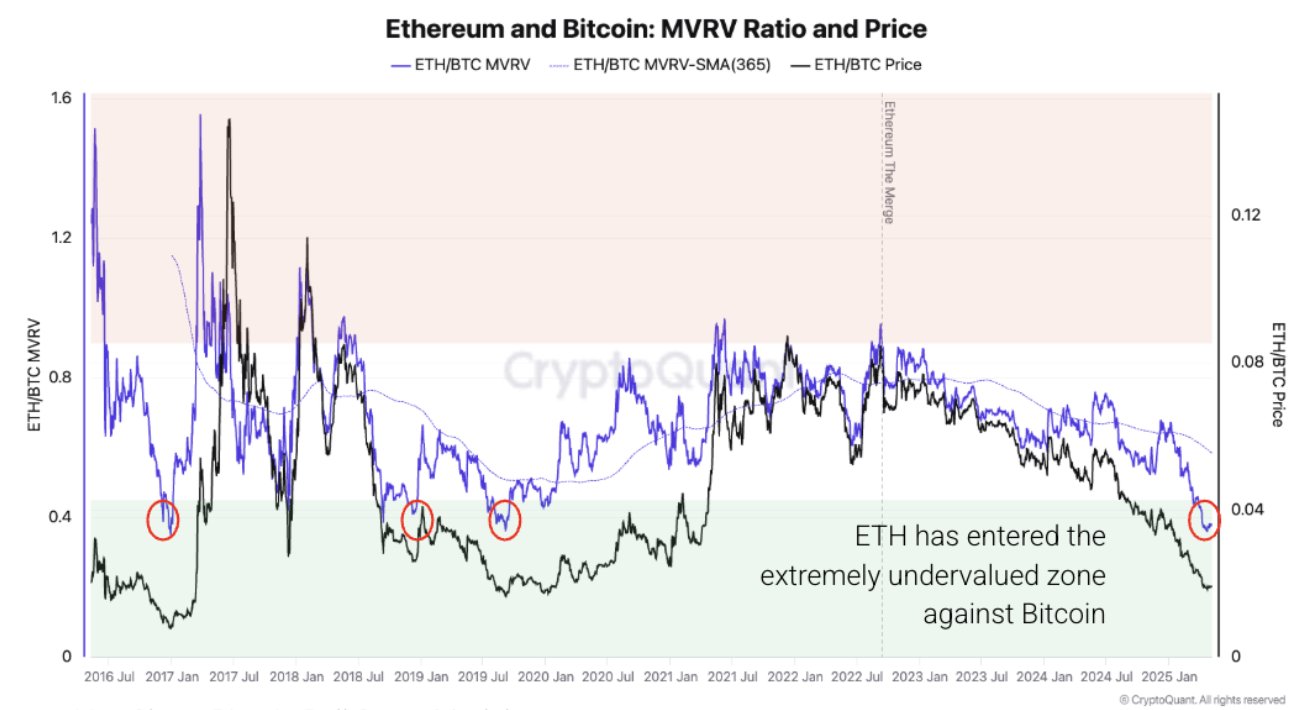

In some other news, ETHEREUM is less than its value compared to bitcoin, and the analytics company revealed the series Cryptoquant in X mail.

The indicator shared by the Analysis Company is the ratio between the market value Ethereum and Bitcoin to the value of the achieved value (MVRV). The percentage of MVRV is a common scale on the chain mainly that mainly follows the profit loss for investors as a whole.

As visible in the graph, the MVRV ratio of ETH is very low compared to the current BTC. “Historically, this led to the superiority of ethereum”, notes Cryptoquant. “However, the pressure pressure, the weak demand, and the flat activity can stop a recovery.”

BTC price

After an increase of 3 % in the past 24 hours, Bitcoin has managed to break the level of $ 101,000.