Bitcoin correction approaches the end? The main levels when supporting 83 thousand dollars and resisting 91 thousand dollars

With the current Bitcoin price at $ 88178, along with its historical flexibility and expert expectations, the optimistic view remains optimistic with caution.

In the short term, investors must monitor the support level of $ 83,000 and the $ 90,000 resistance threshold, as these levels are likely to form market morale.

Short -term expectations: correction or bear market?

On Easter Sunday 2025, Bitcoin reached $ 84,600, which represents his highest level in this holiday 17 years, according to Report by Documentbtc On X. From $ 0 in 2009-2010 to 84,600 dollars in 2025, Bitcoin showed flexibility and unparalleled adoption over the years.

Bitcoin (BTC.D) was the highest level in 4 years. Nevertheless, experts remain divided on whether the Altcoin season is on the horizon.

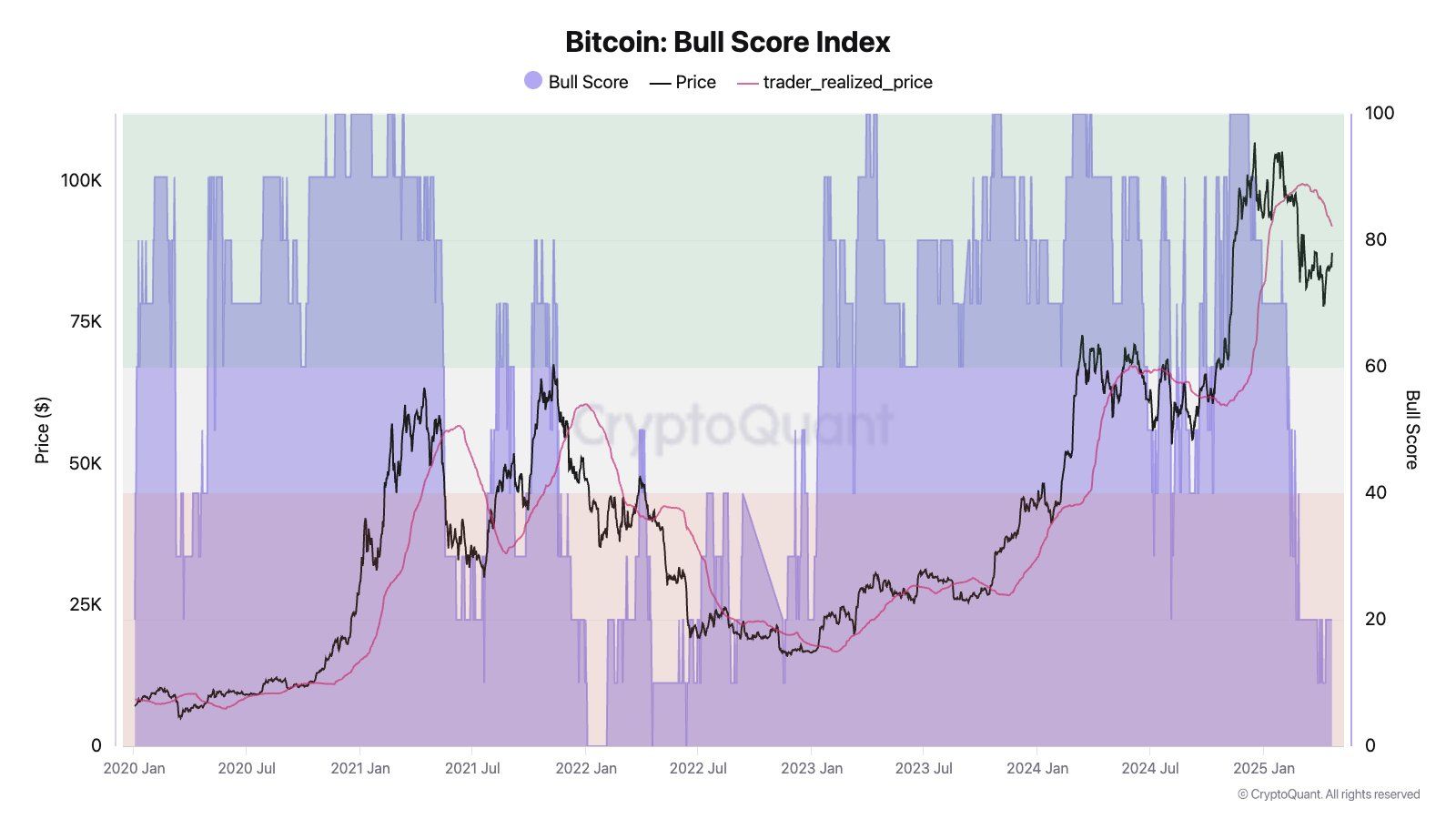

Cryptoquant Research Head, Julio Moreno, subscriber In X, the resistance of Bitcoin prices can range between 91,000 dollars and $ 92,000, as it is in line with the price achieved on the series for traders. According to the analysis, during the Taurus (Taurus Class ≥ 60), this achieved price often works as support; In the bear market (bull market degree ≤ 40), it is a resistance. It is still considered the current market in the last scenario.

In another analysis, Cryptoquant indicates that the market is likely to be subject to a typical correction instead of entering the full bear market cycle. This offer is in line with the current Bitcoin price of $ 88,178, which, although it is slightly less than the modern highlands, is still higher than the main support levels.

Analyst Mark Coleen expressed special doubts about the level of $ 83,000. If Bitcoin decreases below this threshold, the market may witness a stronger declining reaction.

“Bitcoin’s liquidity of $ 90,000 is still calling. But I think the level of $ 83,000 is not safe, its lowest levels will be operated from Sunday and Wednesday.” I mentioned.

The Beincrypto report recently stated that Bitcoin is looking forward to the outbreak of more than $ 90,000, driven by increasing momentum in the derivative market. The fracture of this level can indicate a new upward wave, which is likely to be fueled by buyers and derivatives.

Long -term capabilities: a future future?

Looking at long -term expectations, experts remain optimistic about the Bitcoin path.

“Seriously, this may be the last opportunity that you have to buy $ BTC <$ 100,000," Arthur Hayes, co -founder of Bitmex, subscriber.

Robert Keusaki, author of the book “Abi Abi Al -Faqr”, to publish On X, a firm belief believes that Bitcoin will reach $ 180,000 to $ 200,000 by the end of 2025.

The historical flexibility of Bitcoin after the corrections supports this upward view. For example, after dipping it to 27,931 dollars on Easter Sunday 2023, BTC has frequently turned away to $ 84,600 by 2025. This recovery pattern is in line with analysts’ opinions that health corrections for long -term growth.

Fear and greed index can play a role in forming an investor behavior. The value of the higher index (which indicates greed) often indicates upscale feelings, which may push Bitcoin near the mark of $ 90,000 and beyond.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.