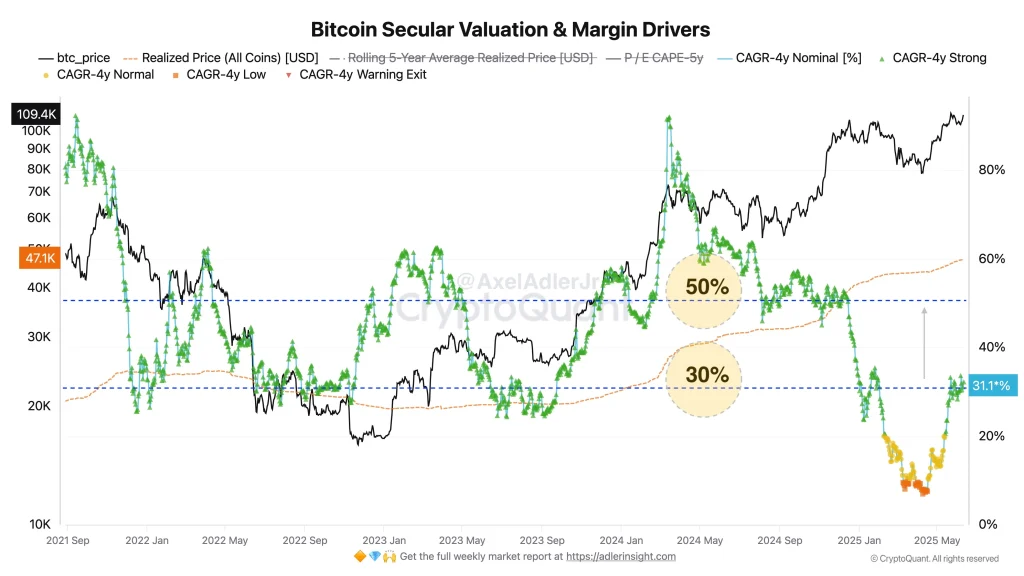

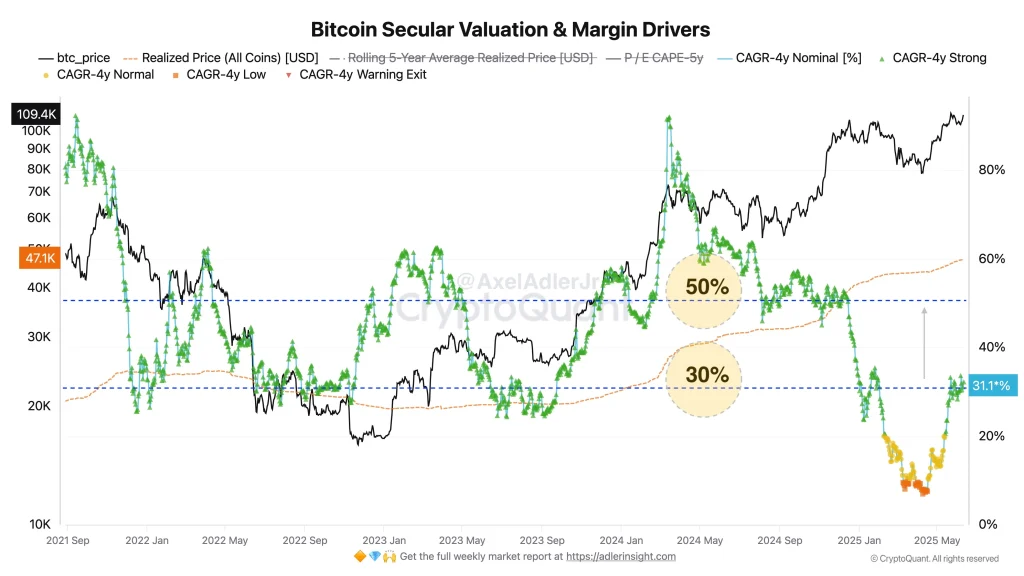

Bitcoin Bull Run, where you press BTC CAGR 31 %

The strong Bitcoin performance in April and May has made hopes for the main bullish collapse. From April 9 to May 22, Bitcoin price increased by 46.32 %, including a rally by 18.48 % between 5 and 22 May. The price recovery also prompted the annual growth rate (CAGR) – renewable optimism in the market.

BTC Cagr Nails with price recovery

Encryption Axel Adler Junior Recently highlighted a noticeable increase in the 4 -year annual growth rate in Bitcoin. In April 2025, he decreased to only 7 %It reflects the beginning of the volatile bitcoin for this year. In January, BTC grew by 9.54 %, but the following months have seen sharp declines –A 17.5 % decrease in February and 2.19 % in March. Even the price did not touch its lowest level 74,446.79 dollars In April.

However, the market is frequently recovered. by June 2025Adler mention that CAGR in Bitcoin rose to 31 %.

“This sharp recovery shows how quickly the long -term trend ships when the momentum of the strong buyer enters the market,” Adler stated.

However, he notes this 31 % CAGR is still less than the tops of the historical bull marketWhich means the most growing growth.

168 thousand dollars by October?

Axel Adler JR expects possible Bitcoin’s goal of $ 168,000 by October 2025Assuming momentum in Futures and leverage markets market Continues.

It is based on this projection to accelerate the growth and historical patterns that were observed during the previous bull runs.

Risk control: CAGR versus standard deviation

In the interconnection index, X User Manu suggested a more accurate way to interpret CAGR – by dividing it on the standard deviation to eliminate fluctuations and discrimination Risk modification returns.

Adler agreed to this approach, saying that it provides a cleaner offer for market performance, but he also confirmed another critical point:

“The real reflection point comes when investors begin to achieve profits based on the expected returns.”

According to him, the risk of the bear market grows once the BTC trading volume crosses a million coins, because achieving profits on a large scale can disrupt supply and demand balance.