Bitcoin Binary CDD hints in healthy unification, not a summit

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

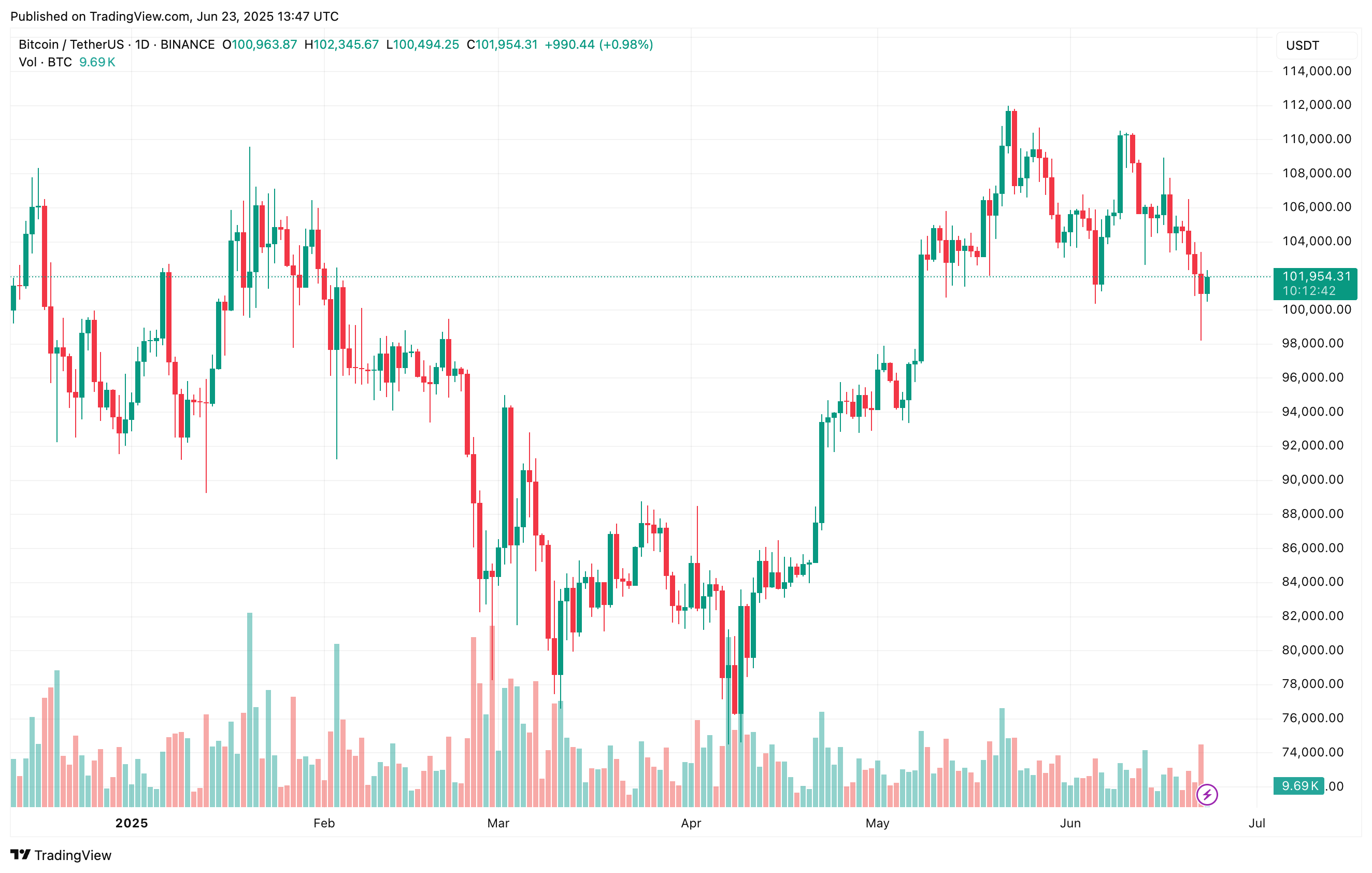

After a summary decrease to $ 98,000 during the weekend, Bitcoin (BTC) has now regained 101,000 dollars at the time of this report. While concerns about a potentially continuous double summit, data on the series has not yet shown any major warning signs.

Bitcoin is subject to healthy unification

According to the participation of QuickTake by the shareholder AvocadoAlthough the broader market morale in the market, BTC has not yet shown any important red flags. In fact, the cryptocurrency is still in the stage of unification.

Related reading

It is worth noting that the 30 -day moving average (MA) for the destroyed binary currency days (CDD) indicates that long -term holders continue to stick to BTC instead of selling. This indicates that investors remain optimistic about Bitcoin’s capabilities for more upward trend in the short term.

For beginners, the dual CDD for 30 days soften the daily fluctuations to show the frequency of bitcoin holders in the long term for their metal work over a month. The low value suggests strong behavior and strong accumulation, while the higher value may indicate the distribution or pressure of the sale of experienced holders.

The analyst noticed in a previous analysis that when the Bitcoin diode exceeded 0.8, it was usually followed by a sharp correction. However, this time, the index reached its climax about 0.6 and is now the decline – which indicates that the market is far from the high temperature. They added:

Although the data may not be completely consistent from cycle to cycle, this moderation is less than 0.8 still means that the market may enter a unification period, and it may follow more prices or time.

The analyst emphasized that this indicator does not indicate the end of the bull run. Instead-like the two previous market phases-Bitcoin can follow a “stairs similar”, as monotheism follows a strong upward leg.

They concluded that BTC historically tends to gather when the market attention fades and feelings remain calm. Therefore, the current period of low fluctuations can be the introduction to the next main Bitcoin step to the upward trend.

Is BTC Bears in trouble?

While the current landmarks have raised hopes for further decline in prices for the largest encrypted currency through the maximum reported market, both of them idiomatic And indications of the series indicate otherwise.

Related reading

For example, short positions were high in the range of 100,000 – 110,000 dollars, more The possibility of short pressure-which can push BTC to the highest new level ever (ATH).

However, there is a justification for some caution, as it was short -term holders sale During the recent declines, showing a lack of confidence in Bitcoin’s ability to maintain its upward path. At the time of the press, BTC is trading at $ 101,954, an increase of 1.1 % in the past 24 hours.

Distinctive image with UNSPLASH, Cryptoquant and TradingView.com plans