Bitcoin and ethereum options are the expiration

Today, Bitcoin (BTC and ETHEREUM (ETH) options (ETH) (ETH) (ETH) (ETH) (ETH)) ends with about $ 8.05 billion, prompting participants in the encryption market to facilitate volatility.

Traders and investors should be particularly aware of today’s options due to their size and virtual value, which increases the possibilities of potential impact on short -term trends. However, the ratio of calling calls and maximum pain points provides an insight into what can be expected and possible market trends.

Visions about Bitcoin and Ethereum options that end the authority today

The virtual value of Bitcoin’s validity options today is $ 7.24 billion. According to Deribit data, Bitcoin options that expire 77,642 contains a summons of 0.73. This percentage indicates the spread of purchase options (PUTS).

Data also reveals that the maximum pain point of these expired options is $ 86,000. In the trading of encryption options, the maximum pain point is the price in which the original will cause the largest number of financial losses for my holders.

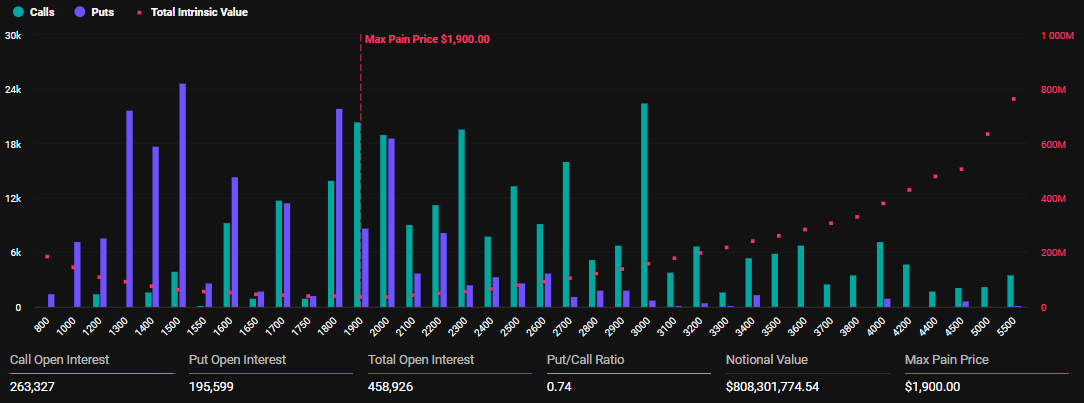

In addition to Bitcoin options, 458,926 ETHEREUM options contracts have been set until their validity ends today. The value of these expiration options is $ 808.3 million, a rate of up to 0.74, and a maximum pain point of $ 1900.

The number of ETHEREUM options today was much higher than last week. Beincrypto reported that the ETH options that expired last week were 177,130 contracts, with a virtual value of $ 279.789 million.

As of the writing of these lines, Bitcoin was much higher than the level of pain of $ 86,000 at 93,471 dollars. Meanwhile, Ethereum was trading less than the $ 1900 strike at $ 1764.

“BTC is trading over Max Pain, ETH below. Apply at expa Note.

With the maximum level of pain (which is also called the strike price) often serve as a price of the price due to smart money procedures, both bitcoin and ethereum can be pulled towards the levels of each.

BTC and ETH’s open mode indicate a high circulating activity near Max Pain. This heavy collection of their graphs shows about $ 80,000 to $ 90,000 for Bitcoin and about 1800 dollars to $ 2000 for ETAREUM.

This location determination indicates the possibility of unifying prices in the short or volatile.

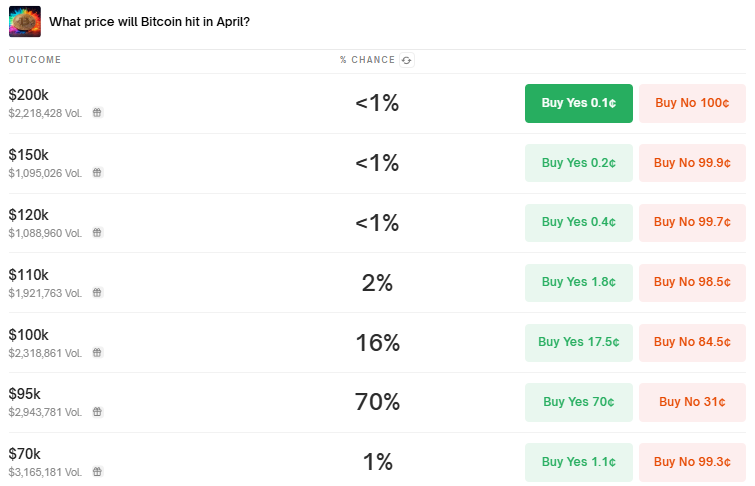

Polymarket: only 16 % chance of Bitcoin price reaches $ 100,000 in April

According to Deribit, traders sell PUT options for the Bitcoin. Moreover, they use Stablecoins to collect installments while locating to buy BTC at lower prices. This reflects a long -term thunderbolt look.

“BTC merchants on Deribit express the long -term upscale feelings, and they sell cash guaranteed using Stablecoins to buy and assemble the return”, Deribit books.

Deribit analysts also notice the highest open benefit for BTC options about the $ 100,000 strike price. This indicates the strong market expectations for Bitcoin to reach this level.

However, the data related to the Polymarket platform shows for merchants who appreciate only 16 % BTC chance of $ 100,000 in April.

Another interesting note is that the cumulative Delta (CD) via BTC and ETF options (the traded box on the stock exchange) in Deribit reached $ 9 billion. While this indicates a high sensitivity to bitcoin changes, it also indicates potential fluctuations where market makers destroyed their locations.

This is in line with notes from the Kyle Chassé that the hedge funds are never betting on the long -term prices of Bitcoin. Instead, they grow a risk -free return using pleading. Once the trade dies, it pulls liquidity and intensifies the sale of bitcoin.

Nevertheless, Deribit analysts also reveal an increase in the purchase of the Bitcoin call option for April to June 2025. It is said that investors are targeting between $ 90,000 and $ 110,000, which is an inspired feeling by Bitcoin Breaking prices above 89000.

This indicates that the ups of the upscale market is likely to be driven by FOMO, as the BTC price extended to more than $ 90,000. Analysts also highlight the impact of market stabilization of the Trump tariff policy on April 9. This step has reduced the fluctuations of the global market, which may encourage the rotation of investments from gold to encryption, which contributes to the recovery of the bitcoin price.

However, all the activity leading to Bitcoin’s recovery was not a new money or a new capital flow. According to analysis By Tony Stewart of Deribit, half of which includes the distribution of current positions, indicating strategic adjustments by merchants.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.