Bitcoin all time? The analyst believes it is possible

Willie Wu, a prominent series analyst in the series, stated that BTC (BTC) can recover their levels at all times if current capital flows continue.

He added that investors should look at low prices as health corrections and buy opportunities instead of market collapse signals.

Will Bitcoin come back high again?

Wu shared his vision on a detailed topic on X (previously Twitter). He believes that strong basics support the bullish trend of Bitcoin.

This includes a high capital flow in Bitcoin, with total and speculative capital flows. The alignment of these flows creates a solid environment and an environment for the original.

“The basics of BTC have turned up, not a bad preparation for breaking the high levels at all.” I mentioned.

In addition, WOO highlighted that Bitcoin liquidity deepens, as shown in the risk of the risk of a declining orientation. This declining trend indicates that the market liquidity has returned. Therefore, future prices are likely to be smaller and less severe, which reduces the risk of acute sales.

“All declines for purchase under the current system. In the short term, there are good opportunities for declines,” Wu.

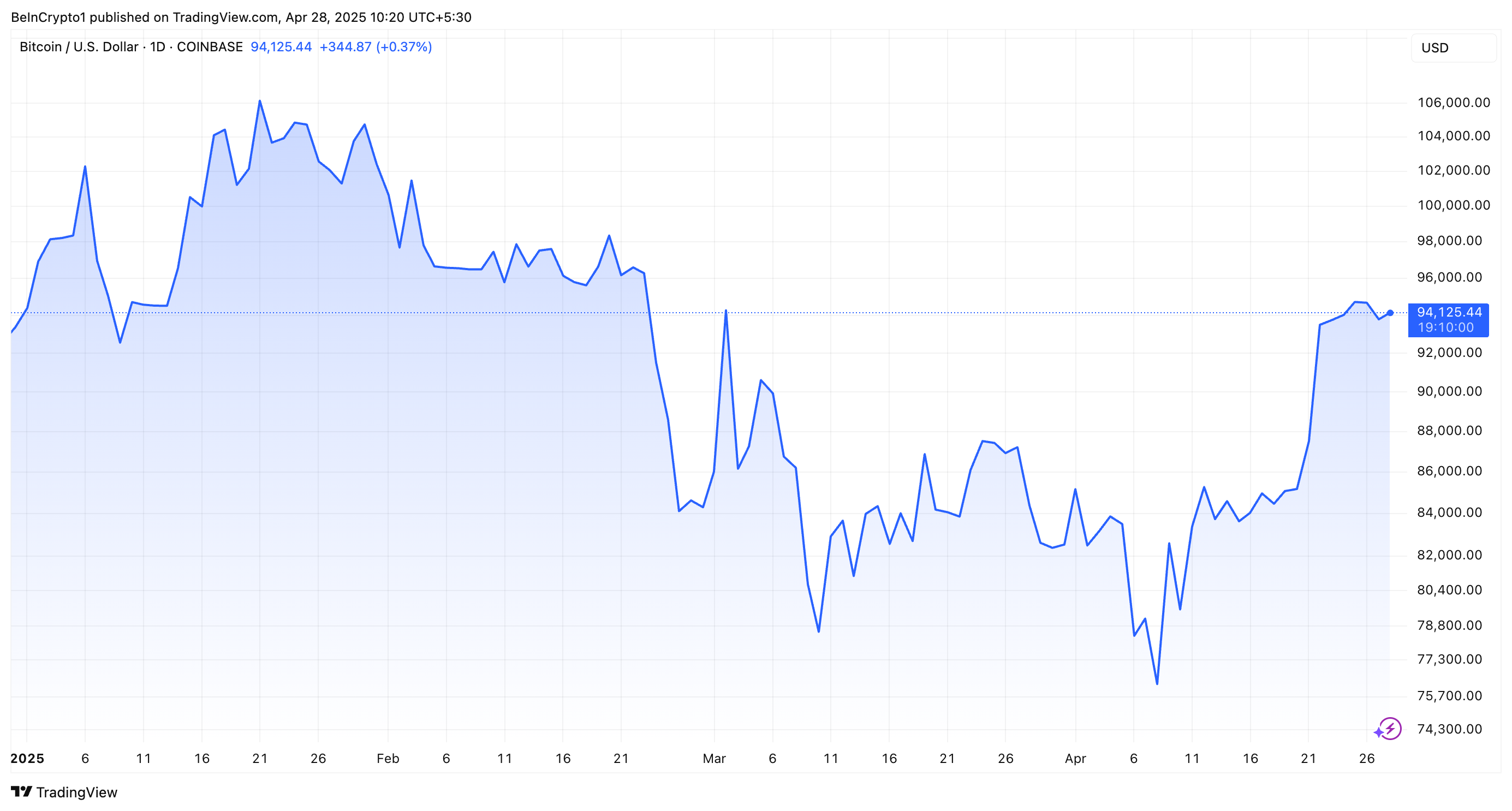

The analyst also indicated that Bitcoin has already regained medium -term price targets of $ 90,000 and $ 93,000. In addition, a new temporary goal of $ 103,000 has been formed, indicating that Bitcoin is likely to reach this level before paying towards the highest level at 108,000 dollars ever.

He explained that these goals are supported by sustainable capital flows instead of just circulating speculation, which enhances the issue of a solid escalating path.

Despite long -term optimistic expectations, Wu warned that short -term challenges may arise. The average price of Bitcoin size on the series (VWAP) is currently standard deviations +3.

This means that the current currency price is much higher than its typical range. When the original moves to this limit much higher than the average, it is considered excessive.

“It will be difficult to move up with a decent momentum due to excessive progress,” he explained.

According to Woo, this scale indicates that upward momentum may be limited in the short term. Instead, the most vulnerable results move sideways or slow and sacrifice instead of rapid assembly.

Previously, Beincrypto selects three main signals that promote Bitcoin’s recovery. In April, Bitcoin re -established its reverse relationship with the DXY dollar index (DXY) and its disintegration from the Nasdak Stock Exchange.

Meanwhile, investors gather in the long term with metal currencies. Together, these three differences indicate an increase in the market confidence and its hints in the possible main career of Bitcoin. In fact, the performance of the last market of BTC enhances this view.

Beincrypto data showed that the value of the currency has regained 7.7 % during the past week. At the time of this report, Bitcoin was traded at $ 94125, which represents a simple bottom of 0.07 % over the past day.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.