Bitcoin accumulation resumes after 3 months of distribution – analyst

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Bitcoin (BTC) continues to trade below $ 85,000, providing fears from the additional passive side as the declining trend remains intact. The bulls lose momentum, and fail to restore the main resistance levels and obtain low demand areas, raising concerns about a possible continuation of the correction.

Related reading

Economic uncertainty and fluctuations in the macroeconomic economy remain major engines to work, with the addition of wrong policy decisions from US President Donald Trump to turmoil in both encrypted and traditional markets. The global narration of the trade war and the tightening of monetary conditions continues to consider greatly to the origins of the risk, which contributes to the bitcoin deficit in maintaining a meaningful recovery.

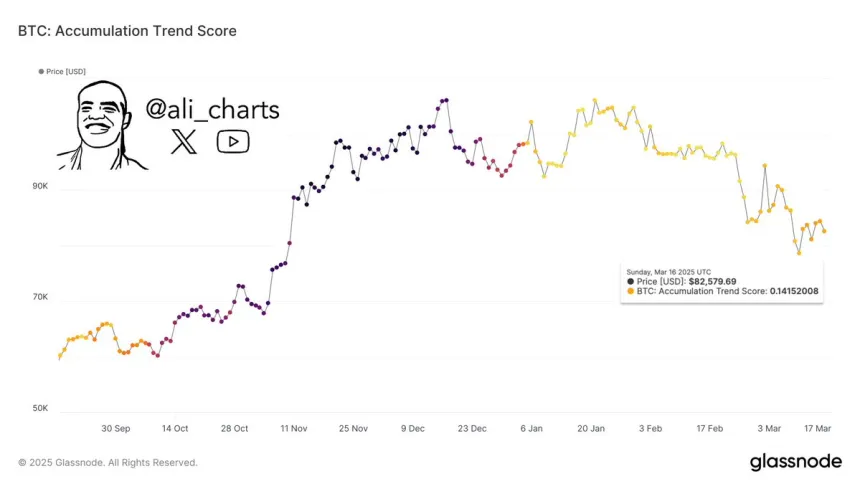

However, there is a shift in market behavior that can indicate a turning point. The main scales of Glassnode reveal that after three months of distribution, the accumulation trends are alluded to early signs of BTC accumulation. Historically, the transition from distribution to accumulation is often preceded by the recovery stage, indicating that investors may return to these low levels.

The next few weeks will be very important, as Bitcoin will determine the support of support and attract the new demand whether the market is preparing for a deeper correction or correction.

Bitcoin In Patch mode – accumulation trends hint in a possible seizure

Bitcoin has officially entered into a correction area after losing a $ 100,000 mark, and the declining trend was completely confirmed when BTC failed to keep $ 90,000. Since it reached its highest level (ATH) of $ 109,000 in January, Bitcoin has decreased more than 29 %, and this trend may continue with the universal macroeconomic conditions remained favorable.

Related reading

Trade war tensions between the United States and major global economies such as Europe, China and Canada continue to pressure the financial markets, which leads to uncertainty and a feeling of risks. With the intensification of these geopolitical issues, both encrypted markets and traditional markets are still very volatile, struggling to find stability.

However, not all indicators are downward. Ali Martinez Common visions on xAnd revealed that the tide is turning into bitcoin. After three months of distribution, the trend model for accumulation is alluded to early signs of BTC accumulation. Historically, these stages indicate that large investors are returning to the market and putting themselves before a possible recovery.

This stage of accumulation is a decisive turning point that determines whether Bitcoin sees a rapid recovery higher than the key supply levels or a long unification period before the next main step. The next few weeks will be decisive for BTC’s short -term expectations.

80 thousand dollars re -test on the horizon?

Bitcoin is currently trading $ 83,000, discovered in tight unification because it is struggling to break more than 85 thousand dollars while maintaining support at 82 thousand dollars. This limited measure of the group has left the investors inaccurate, as the bulls try to restore the higher levels and the bears pressure for more negative.

If the bulls want to restore control, the BTC must pay above 89 thousand dollars, which is a major resistance level in line with the moving average for 4 hours (MA). A successful collapse can confirm above 90 thousand dollars towards recovery and open the door to achieve other gains about 95 thousand dollars and beyond.

Related reading

However, if Bitcoin fails to break 90,000 dollars in the next sessions, the risk of deeper correction increases. Loss of $ 82,000 may be a BTC sending to a downward spiral, which is likely to re -test 80 thousand dollars or even lower levels. As the morale of the fragile market continues, the next main step is likely to determine the short -term track to make bitcoin price.

Distinctive image from Dall-E, the tradingView graph