Bitcoin 100 thousand dollars explains a problem for investors in the short term-study

Este artículo también está disponible en estñol.

The last price fell in BitcoinCaused by a turbulent encrypted currency market, sending many investors to panic, forcing them to cancel the download of their BTC property at a confusion.

However, Glassnode Glassnode noticed that a group of Bitcoin investors are still flexible despite the fluctuations in the encryption market, saying that long -term virgin encryption holders do not decrease through the current stagnation in the market.

Related reading

Long -term holders “is not greatly affected by”

Glassnode said that Bitcoin, like other encrypted currencies, has seen a fragile week in which merchants witnessed the most digital assets in the world less than $ 100,000.

At one point, the price of Bitcoin was approximately 90,000 dollars, at $ 92,800, on February 3, which was the lowest since BTC recorded $ 90,890 on January 13.

On the brighter side, Blockchain Analysis has noticed that long -term BTC holders appear isolated from all The chaos surrounding cryptocurrencies Society, saying: “The owners of BTC still in the long term (LTHS) are not largely affected.”

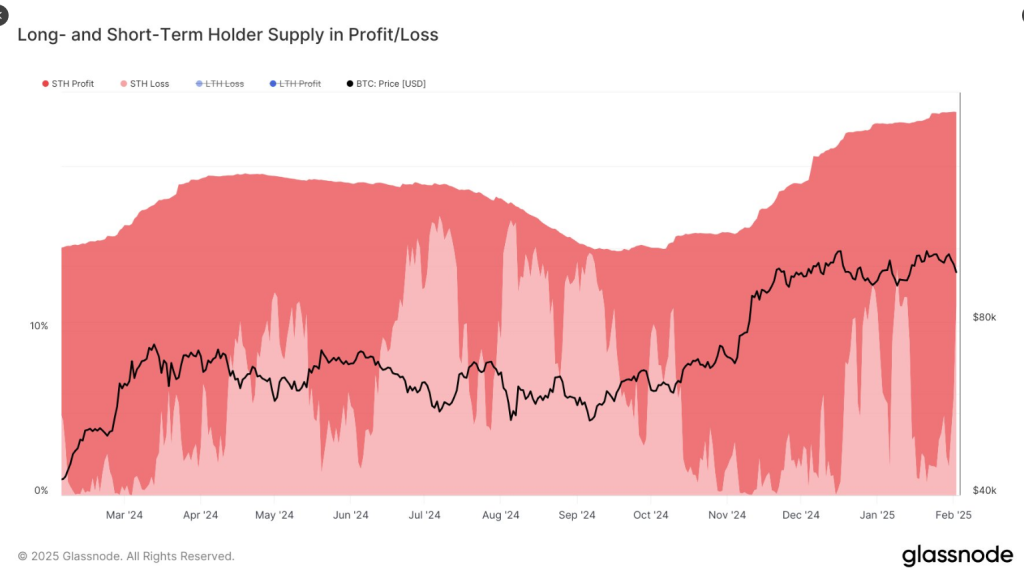

Glassnode revealed that the data showed approximately 0.01 % of BTC’s supplies in the loss, focusing on long -term investor flexibility in market turbulence times. However, the encryption company noted that these Bitcoin investors have witnessed unintended profit.

Glassnode said in a post: “However, the unreasonable profit share has decreased steadily since November, and now at its lowest levels since September – indicating that there is no accumulation of accumulation yet,” Glassnode said in a post.

The analyst pointed out that BTC holders do not buy strongly at current prices, and may wait for the better market signals before resuming accumulation.

Bitcoin holders in the short term bleeding

Meanwhile, the data showed that another segment of Bitcoin investors suffered more than the short-term market breakdowns.

According to Glassnode, the short -term BTC holders witnessed a significant loss after the encryption price dropped to less than $ 100,000, causing panic among these merchants.

#Bitcoin Less than $ 100,000 decreased during the weekend, which prompted a noticeable amount of short -term width (STH) in the loss. At a price of 97 thousand dollars, the offer was divided into the STHS equally by approximately 11 % – the largest loss to StHS since early January: https://t.co/drjy6Ahqmm pic.twitter.com/gypnij0BQX

– Glassnode (Glassnode) February 3, 2025

Glassnode said that when Bitcoin decreased to $ 100,000 during the weekend, it paid “a noticeable amount of short -term width (STH) in the loss.”

“At 97 thousand dollars, the offer was divided into the STHS, almost 11 %. The largest loss to Sths Since early January, Blockchain Analytics said at X.

The morale of the descending market

An analyst noticed that bitcoin decreased to a short period that it reached nearly 90,000 dollars per currency, as the dominant encryption suffered after the market collapsed.

“Bitcoin decreased to less than 91.2 thousand dollars, as all encryption decreased with global stock markets that start the week with severe bleeding. It seems that the media is due to the absolute sectors “Trump’s trade war”“The intelligence platform on the market Santint is in a publication.

😰 Bitcoin decreased to less than 91.2 thousand dollars, as all encryption decreased with global stock markets that start the week with severe bleeding. The media appears to play the falling sectors to the “Tramp War”.

Whether this is the main reason or if there is the other … pic.twitter.com/ij1bq6xfuu

– Santiment (Santimentfeed) February 3, 2025

Related reading

Santiment added that there were significantly negative reactions from investors in the cryptocurrency community as a result of low price, and it appears that BTC is about to enter the Habboudia.

The market intelligence platform noted that at the present time, Bitcoin managed to decline to $ 96,000.

“Was this flow to obtain the Saadine retail merchants for sale at a local bottom? Historically, markets always move the opposite direction of the crowd’s expectations,” he asked Santime in a post.

Distinctive photo of Pexels, tradingView graph