Binance, XRP, Jack Dormy, and more

This week in Crypto has been filled with major developments, starting with the launch of Mainnet and legal drama to attempts to break down long -term puzzles.

Below is a set of decisive developments that took place this week, but will continue to form the sector.

The PI network acquires momentum with a main teacher

Pi Network has done this week as the original, Pi Coin, its lists were secured on multiple exchanges, indicating the interest of the strong market before its main launch. The main exchanges such as HTX and Bitmart, among other things, are listed in PI, effectively enhanced their clarity and accessibility.

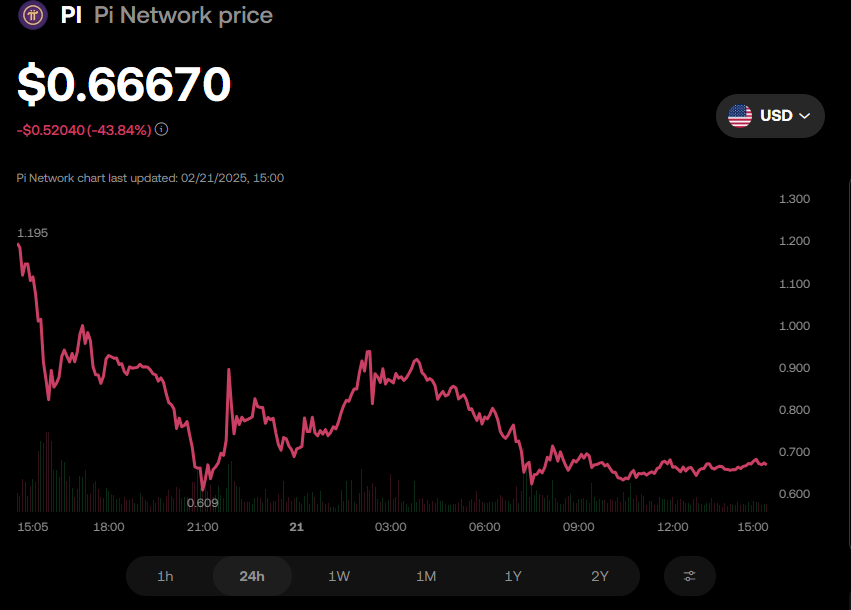

Despite this momentum, the price of the PI Coin decreased after it was included on OKX, a common trend where the assets face corrections after the list due to early profit. PI governance code has been traded at $ 0.66 in Exchande to this writing. A 43 % decrease since Friday’s session, which some analysts opened disappointed.

Nevertheless, the PI Airdrop is now the most valuable on the date of encryption after the disposal of the UISWAP. With millions of participants receiving PI symbols, the project has set a new standard for symbolic distributions on a large scale.

As the network advances forward, its adoption and benefit in the real world will be major factors in determining the long -term value.

Binance to delete 4 altcoins

Another title this week in Crypto was the Binance Exchang advertisement, and revealed plans to delete four altcoins. The revelation that the stock exchange will delete and stop trading on all topical trading pairs of AB, Clv, STMX and VITE rocked the market, causing low prices.

However, this step, which will bear the valid on February 24 at 03:00 UTC, is part of the continuous efforts of Binance to maintain market quality and security standards.

“When a currency or symbol is no longer a symbol that does not meet these standards or change the industrial scene, we are doing a deeper review and put it in it,” Binance. ” He said.

Historically, abnormal ads lead to declines in sharp prices as traders have rushed to sell affected assets before trading stopping.

For Binance users who hold these symbols, it is important to the place of money withdrawing before the deletion date or converting them to other assets. Distinctive shattered symbols often witness low liquidity and trading options, making it difficult to sell after payment.

SEC’s XRP SuPUIT Kiosk: tactical delay?

One of the news that was widely discussed this week was the potential tactical delay by the Securities and Stock Exchange Committee) in a lawsuit against Ripple. As Beincrypto mentioned, there are speculation that the organizer may disrupt its decision to reject the case.

Legal experts suggest that SEC may drop the lawsuit by April, although there is no official confirmation.

Meanwhile, the Supreme Education Council is facing a 240 -day deadline to make a decision on XRP keys. If approved, XRP ETF can bring institutional capital to the market and enhance the credibility of XRP.

However, continuous legal uncertainty overwhelms its short -term price procedure. XRP investors must remain in constant knowledge of the court procedures.

Any decision, whether separation or settlement, can have significant effects on the future of origin. To this writing, XRP has been traded for $ 2.66, a decrease of approximately 2 % since the opening of the Friday session.

Microstrategy of $ 2 billion

Microstrategy, the strategy now, has topped the headlines between the best encryption news. The company doubles to Bitcoin again, announcing a huge offer of $ 2 billion to finance BTC acquisitions.

The company, led by Michael Sailor, was one of the largest companies in Bitcoin. He enhances his shares to collect more digital assets.

This aggressive strategy inspired the companies that are fighting to deleted. As Beincrypto mentioned, many companies are studying strategies similar to the shares version to gain exposure to Bitcoin.

“Gamestop, a company that does not have a viable action plan, has cast another Hill Mary by announcing that it may use its money to buy bitcoin. The paradox is that bitcoin is more exaggerated than GME. It does not matter; speculators buy stocks anyway, Hoping to become MST books.

While this approach carries risks, it highlights the increasing belief that bitcoin is a long -term hedge against inflation and traditional financial instability.

Is Jack Dorsi Satoshi Nakamoto?

Meanwhile, a new theory that makes waves in the encryption space indicates that Twitter and Block (previously square) Jack Dorsy can be Satoshi Nakamoto, a long -standing creator for Bitcoin. Speculation stems from the deep belief in decentralization, his early call to Bitcoin, and his focus on digital payments from analogy to counterpart (P2P).

Although there is no concrete evidence that supports the claim, it adds another layer of ambiguity to the continuous search for the Bitcoin facility. Dorshi did not confirm or deny speculation, but his continuous participation in the bitcoin ecosystem makes him a convincing candidate, with a famous industry Executive managers Finding convincing theory.

“Jack Marches himself in the Satoshi shirt,” male Sean Murray, the creator of this theory.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.