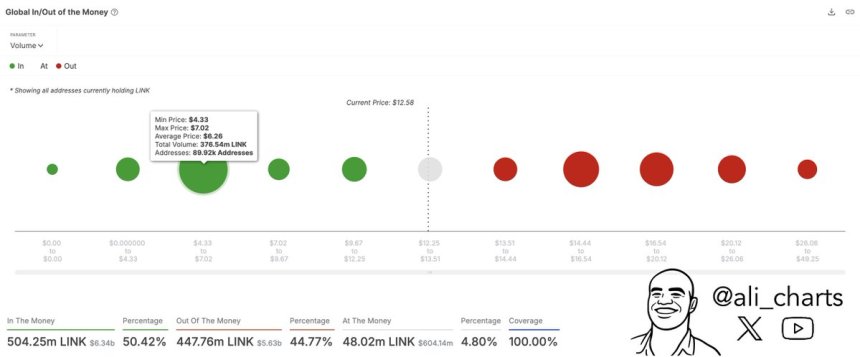

The huge demand wall serial chain at $ 6.26, where it buys 90 thousand investors, a link of 376 meters

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

ChainLink is currently trading at critical demand levels as the broader encryption market faces continuous pressure. With the growing global financial conditions increasingly growing, volatility continues to control risk assets. The geopolitical tensions and the overwhelming definitions imposed by world leaders – including recent moves by US President Donald Trump – have only added to the uncertainty, and the investor’s confidence and bullish momentum shaken.

Related reading

In the midst of this background, ChainLink struggled to restore a higher floor, instead uniformity around the main support area. According to the data on the series, the most important demand wall in Link sits at $ 6.26. This focus in purchase of interest represents a potential strong support area that the bulls must defend to avoid deeper correction.

Since the markets interact with changing macroeconomic signals, Chainlink’s ability to retain this demand area can determine its next step. If this level fails, the additional downside may follow. But if so, it may be a base for potential apostasy once feelings improve. At the present time, all eyes remain on the LINK price movement because it tests one of the most important areas of accumulation on its scheme.

ChainLink deals as the following demand level below lies

Despite the broader uncertainty in the market, Chainlink is still one of the most prominent players in narrating the distinctive symbol of the real world (RWA)-a sector that is expected to see significant growth in the coming years. As traditional funding continues to explore the Blockchain infrastructure, the Oracle technology and decentralized data extracts remain necessary to narrate the assets outside the chain with applications on the chain.

However, in the short term, the LINK price movement reflected the shrinkage of the broader encryption market. Chainlink has decreased by 17 % since March 26, with the current price procedure showing continued uncertainty. LINK is standardized higher than the main demand level, and although the bulls have struggled to restore momentum, some analysts believe that the worst may be behind them. Fears of continuous sale pressure continue, but the total market conditions indicate that the most severe withdrawals may end.

Support this opinion, Ali Martinez Common on the DAT seriesIt reveals that the most important demand for Chainlink sits at $ 6.26, as approximately 90,000 investors accumulated about 376 million links. The powerful accumulation area may provide this basis for price stabilization and a potential opposite, especially if the broader market morale begins to recover.

While analysts still warn against a possible deeper correction, the density of joy in selling and a strong support indicates increased flexibility. ChainLink’s basics, especially its leadership in the RWA space, continue to attract attention-even in times of market fatigue. If the level of $ 6.26 persists, the link may be in a good position for the bounce once the bullish momentum returns through the encryption scene.

Related reading

The link holds a solid ground as a confirmation to restore Bulls

ChainLink (Link) is traded at $ 12.8 after withstanding several days of heavy pressure. Despite the last negative side, Bulls managed to defend the level of decisive support of $ 12.3, which has so far worked as a strong demand zone. This reservation is a major victory in the short term, but the broader trend is still fragile as Link is struggling to restore upward momentum.

To confirm a potential increase in recovery, the bulls must pay a link higher than $ 14.6-a critical resistance area that corresponds to both the 4-hour moving average (MA) and the Si-moving average (EMA). The decisive collapse over this area would indicate a renewed force and may attract more buyers to the market.

Related reading

However, the risk of negative additions is still waving on the horizon. If LINK loses its grip on the demand area of $ 12.3, the next logical support may be near the 10 -dollar sign, the psychological level that has not been tested since the beginning of Q4 2023. With the broader encryption market is still under pressure and warns of feelings, Link remains at a crossroads. The coming days will be pivotal as the bulls try to restore momentum and avoid slipping deeper into the correction area.

Distinctive image from Dall-E, the tradingView graph