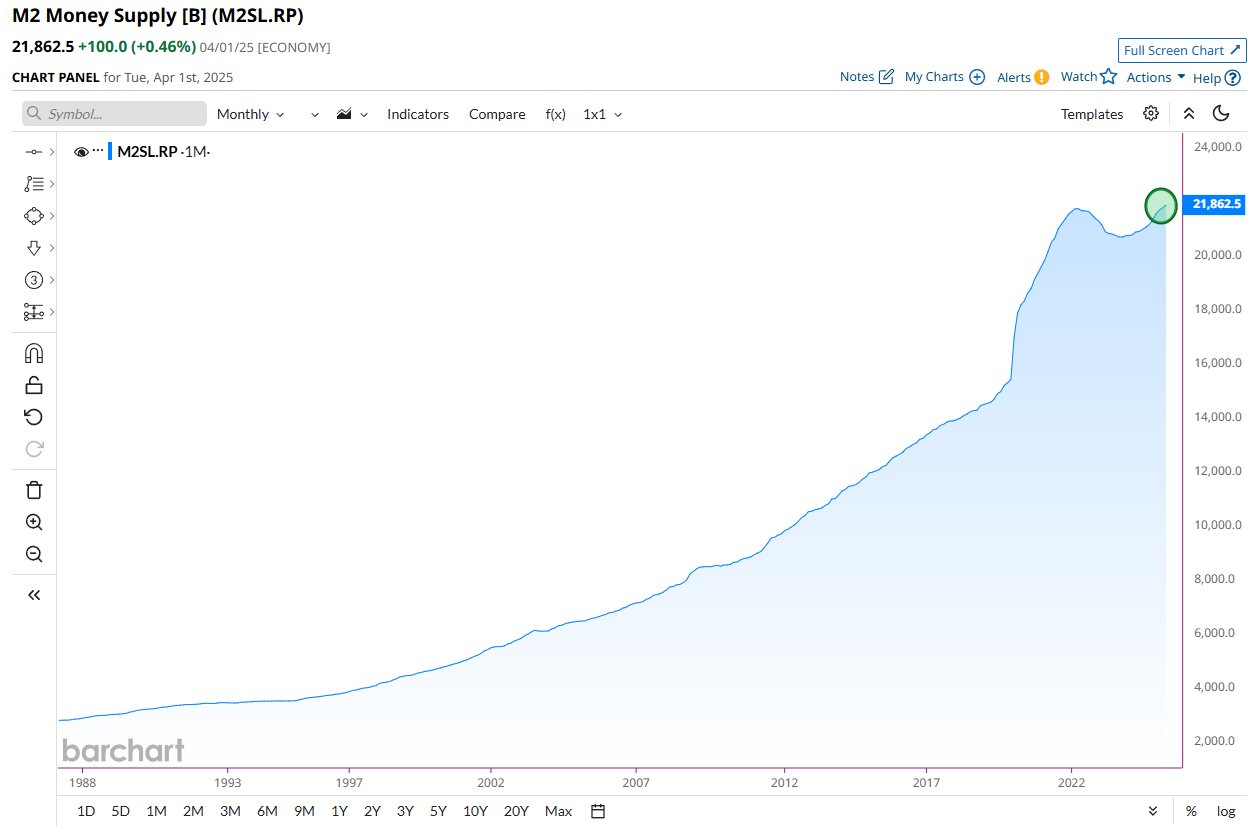

M2 Money Supply Thaits Recor is higher of 21.86 trillion dollars: Will Bitcoin follow the increase?

M2 Money Supply has reached a record worth 21.86 trillion dollars, which raised optimism among investors that Bitcoin (BTC) can soon reflect this upward trend.

This increase comes at a time when the economy faces increasing pressure, with the escalation of national debt, high government spending, and high inflationary fears that threaten financial stability.

How the record can affect 21.86 trillion square meters on bitcoin

For context, M2 cash supply measures the total amount of money traded within the economy. M1 includes (criticism and deposit examination), savings accounts, time deposits, and joint investment funds.

According to the latest data from Barchart, it peaked at the highest level ever at 21.86 trillion dollars.

The last boom is in line with the broader economic challenges in the United States. A taine -called TECH LEAD recently visited his X (Twitter). He highlighted that the debt ratio to the US gross domestic product has reached high levels historically.

The net benefits payments are now 20 % of federal revenues, which puts great pressure on the budget. In addition, the analyst indicated that government spending continues to overcome revenues.

“M2 Money shows the highest level ever. The money printer is running,” Add.

However, experts are increasingly optimistic about Bitcoin prospects in light of these data. Their point of view is supported by historical trends that show a strong relationship between M2 growth and Bitcoin price.

“On average, M2 Global Money Supply tends to lead the BTC price by about 12 weeks. Recently, the M2 has reached the highest new level ever reached 21.86 trillion dollars. This strongly suggests that BTC may follow in the coming months.” I mentioned.

Technical analyst confirmed the leadership of feelings.

“There are a lot of mixed signals, but the only brings that really concerns is liquidity. Follow money,” is He said.

But why does Bitcoin rise with M2? Well, with the expansion of M2, the value of the Fiat currency can eat, pushing investors towards Bitcoin as a value store. More liquidity in the market also encourages speculation.

Moreover, low interest rates makes traditional investments less attractive, increasing the demand for bitcoin and paying its price up.

“When you follow the supply of global money M2, you realize that everything else is just noise,” investor James Wayne to publish.

Besides these factors, the world of mathematics and analyst Farid Kruger highlighted the BTC capabilities amid these conditions in the market. He pointed out that since 2000, the offer of global money and US debt has been growing at a fixed rate of 8 %.

However, the analyst emphasized that bitcoin emerges as a origin that does not only keep its value but also grows at a much higher rate, making it an attractive alternative.

Basically, we have a “leakage bucket” losing 8 % of its value per year. The shares are compensated for almost. to publish.

These factors draw an emerging image of the largest encrypted currency, which faced correction after peak at a level higher than $ 111,917 on May 22.

Beincrypto data showed that BTC has decreased by 2.9 % during the past week. At the time of the press, it was circulated at 104,529 dollars, which represents a 0.8 % decrease during the past day.

Record post M2 Money Supply up to 21.86 trillion dollars: Will Bitcoin follow the increase? He first appeared on Beincrypto.