Bitcoin specified for 50 %+ move within 6 months: Head Fund Head

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Bitcoin currently changes hands above $ 108,000, and unifies after the highest new level ever. Charles Edwards, founder of the Caprioly Investments Digital-ASET Hedge Investments, believes that the price may be at least 50 % higher by November. In his last market Note“Sadde Up”, which was released on May 27, the director argues that the rare meeting of total and technical factors and factors on the series has created “the most difficult technical preparation that we can ask for Bitcoin in the highlands at all.”

Bitcoin 50 % Rally is “Governor”

Edwards first took the call in late April, when Bitcoin was trading near $ 93,000. “We have noticed the preparation of the bullish bitcoin and expected to be” paying new levels at all […] He recalls, “After one month, the market rose by 16 %, and after one month, the market rose by 16 %, which led to the validity of this opinion, and in Edwards’s narration, cleanse the floors to the upper leg.

Essential in the thesis is what Edwards describes the “era of difficult origins”. The outbreak of gold to the S&P 500 is higher than its 200 -week moving signals, which investors again prefer rare value stores.

Historically, such systems are “sticky”, as he writes, adding that the performance of gold over arrows ranged between 150 % to 650 % in previous sessions. Edwards said: “If you think gold has already risen, think again,” Edwards said. On this analog, Bitcoin – which tends to delay gold for several months – can prepare for more severe gains.

Related reading

The changes in the last policy have pushed the rotation. The third Basel bases raised gold to the level of the level -1 in 2022, forcing the banks to return to the paper parking lots with material minerals, while the approvals last year on the trading boxes in the instant bits opened the institutions of institutional floods to the encrypted currency.

Washington Created Bitcoin Strategic Reserves in early 2025 feet an additional layer of legitimacy at the state level. At the same background, persistent inflation, identification frictions, and the precedent of freezing Russian foreign exchange reserves may feel the demand for political neutral assets politically.

Bitcoin and basic techniques

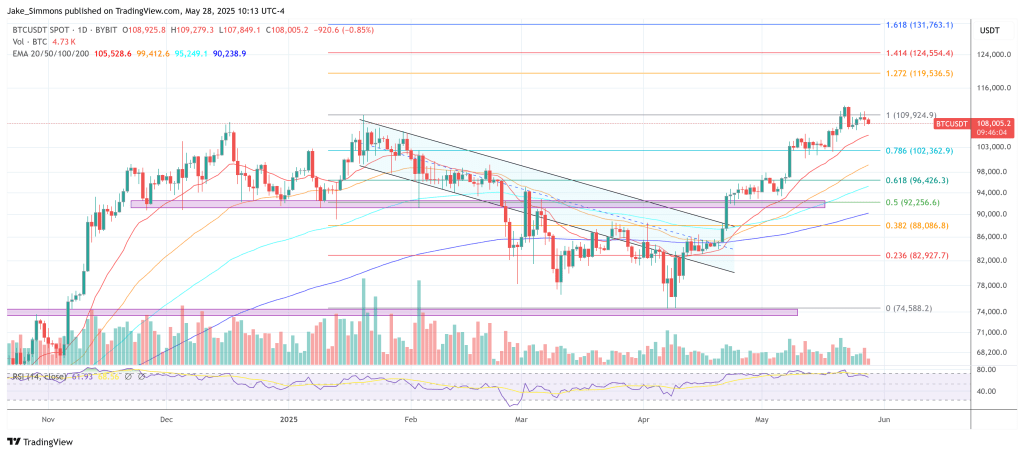

From the point of view of the market structure, the Bitcoin Slide is described in April to $ 75,000 and the sharp recovery of more than $ 90,000 as a “fake” text book-a failed collapse that precedes strong upward trends. Edwards claims that the weekly closure retrieves over $ 90,000 “has been marked with a new direction”, making the first defense level of $ 104,000. “As long as the price exceeds 104 thousand dollars, this is the most difficult technical preparation that we can order,” he wrote, which reduces risk management in the short term to number one.

Related reading

The Bitcoin Macro Index by the machine in Capriole, which mixes more than 100 variables on the chain, kidneys and stocks, continues to register in “upward growth”. The apparent demand (production incomplete supply) has turned into positive, American liquidity remains supportive, and the new “summer summer” scale of Capriole shows the expansion of the direction of the trading activity. Along with the historical delay from three to five months between gold and bitcoin gatherings, the company argues that “a 50 % increase over the next six months is a conservative goal.”

Barrier Cards Policy

The clearest threats to drop the policy front lie. Edwards highlights a 30 to 60 days window to the United States to strike a winding tariff with China and the European Union; Failure can prepare the appetite of risk. It also warns that “Bitcoin’s arbitration in the cabinet”-where companies export low-cost debts of BTC-accumulation-can inflame the negative side in a state of future reduction, although the leverage levels are still manageable at the present time.

However, at the present time, the combination of the solid bull cycle confirmed technical power and improving the basics keeps Capriole “very optimistic about the long -term medium capabilities in the long term of gold and bitcoin.” As long as the market exceeds that weekly axis of $ 104,000, Edwards suggests that investors must – with his final words – “Sarg”.

At the time of the press, BTC was traded at $ 108,005.

Distinctive image created with Dall.e, Chart from TradingView.com