Berarachain (bera) rises 7 % – will the march continue?

Berracein (BERA) has increased by almost 7 % in the past 24 hours, prompting the market ceiling over 900 million dollars. The last price increase is supported by strong technical indicators, with RSI indicators approaching excessive peak levels and DMI shows buyers firmly in control.

If the current upward trend persists, BERA can re -test levels higher than $ 8.5 and may challenge resistance at $ 9. However, if the momentum fades, the main support levels can be tested at $ 6.18 and $ 5.48, and set the next directional step.

Berachain RSI approaches 70

RSI is currently 61.97, rising from 35.9 just three days before staying neutral for eight days. RSI is a momentum that measures the speed and change of price movements, ranging from 0 to 100.

RSI above 70 refers to the conditions that extinguish the peak, indicating a potential withdrawal, while RSI is less than 30 of the sale conditions, indicating a potential recovery. The relative strength index is between 30 and 70 generally neutral, and does not reflect any strong directional bias.

With the presence of RSI in Brarachain in 61.97, the price approaches the peak doorstep, but it is still in a neutral area at the present time. This increase indicates an increase in bullish momentum and the purchase of interest, indicating that BERA can continue to rise if RSI approaches 70.

However, if the RSI crosses to the lands seen, it may follow the phase of withdrawal or monotheism in the short term where traders get profits. The following price movement depends on whether the purchase pressure is continuing or whether the sellers have begun to control with the RSI dealing with the levels of peak purchase.

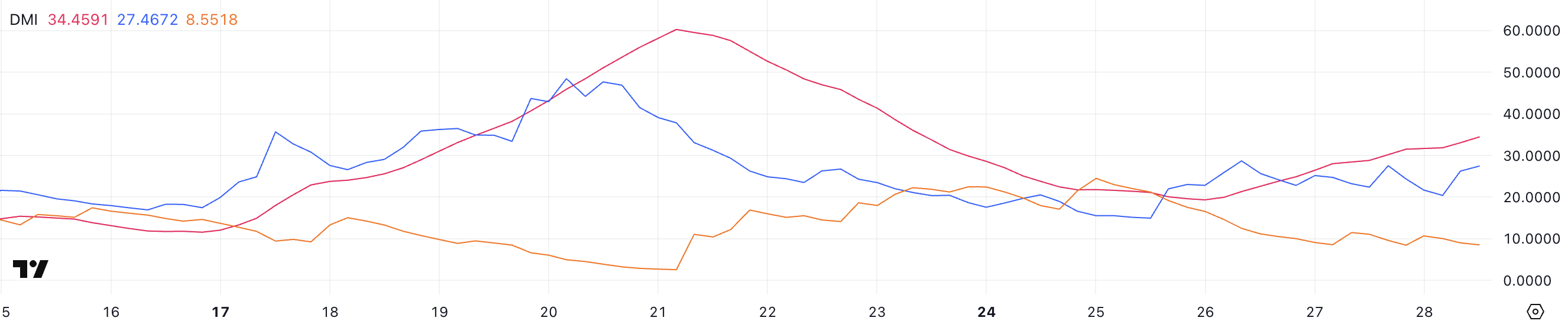

Bera DMI appears buyers in control

DMI from Berachain shows that ADX is currently at 34.4, as it rose from 19.3 two days ago, after it had previously reached 60.2 a week ago when the price of BERA exceeded $ 8.5. The average trend (ADX) measures the strength of the trend without indicating its direction, ranges from 0 to 100.

ADX above 25 indicates a strong direction, while values that are less than 20 indicate a weak or uninterrupted market. The increase in ADX indicates that the current upward trend is gaining strength, which reflects the growing momentum and the condemnation of the market.

Meanwhile, the price of the bera’s +di is 27.4, which indicates a strong purchase pressure, while -Di at 8.55, a decrease from 11.1 two days ago, indicating poor sale pressure.

This configuration confirms that bera is in a bullish direction, with controlling buyers. The widening gap between +Di and -Di +indicates that the bullish momentum is increasing, making a continuation of the rising arrangement more likely. As long as +Di remains above -Di and ADX remains above 25, Bera may maintain its upward path.

Will Bera return levels above 9 dollars in March?

Berarasin (bera) can be on its way to re -test the levels of more than $ 8.5, and if the current upward trend continues to acquire momentum, it may rise more to challenge the resistance that exceeds 9 dollars.

With a maximum market limit of $ 884 million, the threshold of one billion dollars can be a decisive level to see in the coming weeks, as breaking this achievement can attract the increase in the investor’s interest and purchase pressure.

However, if the bullish trend is reflected, Bera may decrease to test support at $ 6.18.

If this level fails to keep it, the price may decrease to $ 5.48, indicating a deeper correction. These main support and resistance levels will play a vital role in determining the following price movement of BERA.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.