AUD/USD lacks a clear directional bias as prices hover over 0.6440

- Aud/USD Whipsaw on mixed economic data and monetary policy expectations.

- Retail sales in Australia predictions, but low inflation in the United States reduces losses.

- Aud/USD looks at the technical levels of the historical moves of the direction.

The Australian dollar (AUD) is dealing against the US dollar on Friday with the continued forecast of new local data and the expectations of the Australian Reserve Bank (RBA) and the US Federal Reserve (Fed) in paying price procedures.

At the time of writing this report, the Aud/USD pair is struggling to find a direction, kept through a set of soft economic basics and technically.

The Australian economy shows signs of weakness while reducing inflation in the United States

The economic data in Australia came on Friday weaker than expected across the main sectors. Building permits decreased by 5.7 % illiterate in April, a more severe decrease than expected extending to a 7.1 % decrease from March.

Retail sales also decreased by 0.1 %, and expectations were lost to achieve 0.3 % gain. While private sector credit has been marginally captured, the broader ready -made meals is that the demand is still soft and uneven recovery.

Meanwhile, the American economy continues to show signs of flexibility. Friday data confirmed that the basic personal consumption expenses (PCE) remained 0.1 % stable from MOM in April, with YOY numbers modified from 2.7 % to 2.5 %.

The commercial deficit of the goods has been greatly narrowed to -87.62 billion dollars, and the consumer’s morale in Michigan has increased to 52.2, its highest level since January.

These databases reinforce the different monetary policy paths, while the Federal Reserve remains in a “waiting and vision” mode, does not explain any urgency to reduce it, while RBA seems to be increasingly trapped in mitigation.

The technical levels are AUD/USD

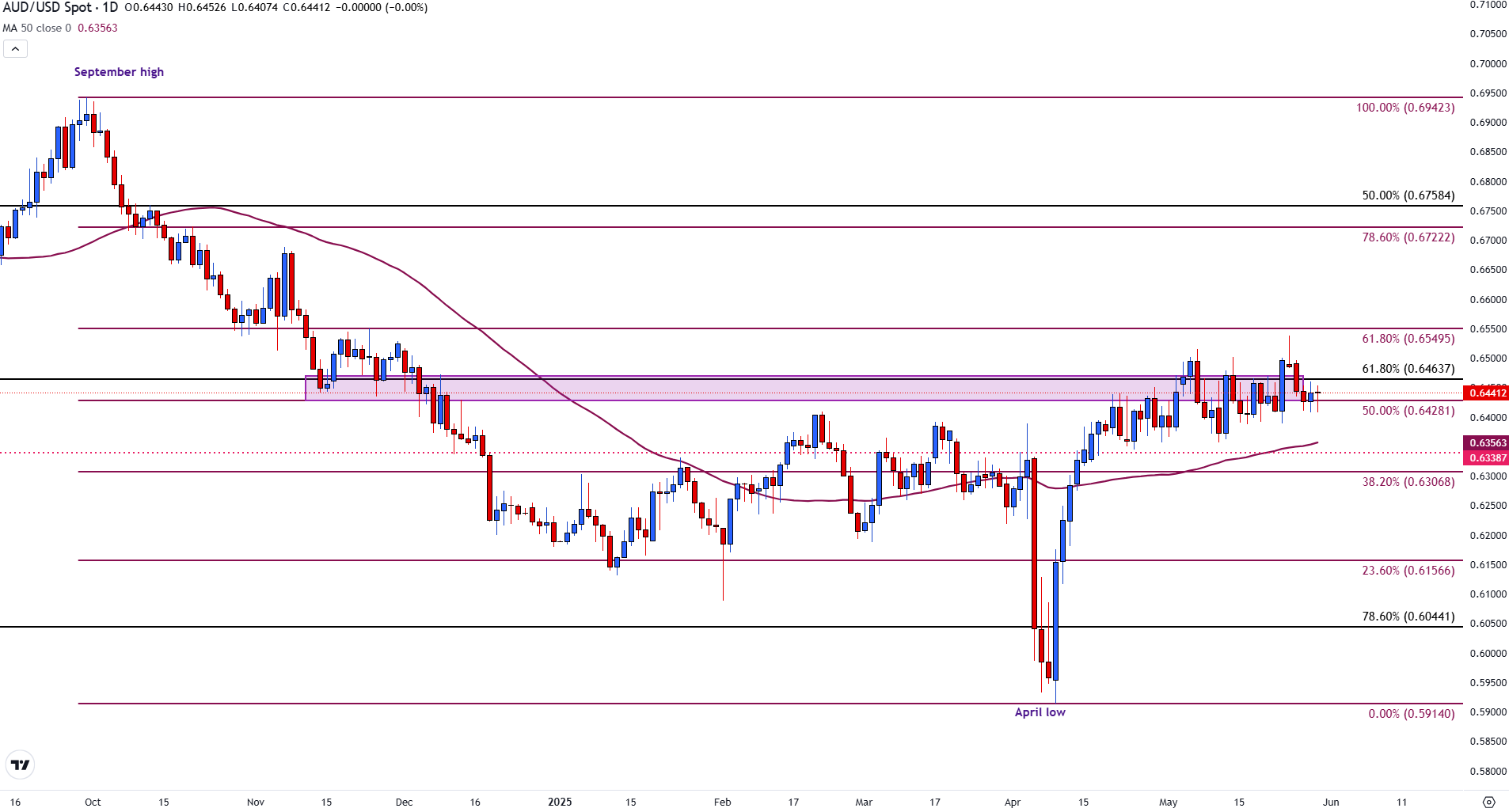

Despite the background of the hibudian macro, the AUD/USD is still technically insecure. The husband currently hovering about 0.6440, stuck slightly less than RERERERDERN by 61.8 % in the 2020-2021 rally, which carries at 0.6464.

Aud/USD Daily Chart

During the past month, the pair failed to keep the momentum over 0.6549, with support also found slightly higher than the decline in mid -September at 0.6428. SMA (SMA), which now rises about 0.6356, provides nearby dynamic support the pressure appeals.

A break less than 0.6428 would increase the risk of the downside to the area of 0.6338 and perhaps 0.6307 (38.2 % Vibonacci from the September to April). On the upper side, it will be needed to be closed above 0.6463 to challenge the top of the range and possibly test 0.6550 again.

Questions and answers in Australian dollars

One of the most important factors for the Australian dollar (AUD) is the level of interest rates set by the Australian Reserve Bank (RBA). Since Australia is a resource -rich country, the other main engine is the largest export price, iron ore. The health of the Chinese economy, the largest commercial partner, is a factor, as well as inflation in Australia, the rate of growth and commercial balance. Market morale-whether investors are eating more risky assets (risk) or searching for safe materials (risk)-is also a worker, with positive risks for AUD.

The Australian Reserve Bank (RBA) affects the Australian dollar (AUD) by determining the level of interest rates that Australian banks can persuade each other. This affects the level of interest rates in the economy as a whole. The main goal of RBA is to maintain a stable inflation rate of 2-3 % by setting interest rates up or down. Relatively high interest rates are supported compared to other main central banks, and relatively low vice versa. RBA can also use and tighten quantitative dilution to influence credit conditions, with previous AUD negative and positive to AUD.

China is the largest commercial partner in Australia, so the health of the Chinese economy is a major impact on the value of the Australian dollar (AUD). When the Chinese economy does a good job, it buys more raw materials, commodities and services from Australia, raising the demand for AUD, and raising its value. The opposite is the case when the Chinese economy does not grow at the speed available. Positive or negative surprises in Chinese growth data, therefore, they often have a direct impact on the Australian dollar and its wives.

Iron Ore is the largest export in Australia, as it represents 118 billion dollars annually according to data from 2021, with China as its main destination. Therefore, the price of iron ore can be an engine for the Australian dollar. In general, if the price of iron ore rises, the AUD also rises, as the total demand for the currency increases. The opposite is the case if the price of iron ore decreases. Iron ore prices also tend to increase the possibility of a positive commercial balance for Australia, which is also positive for AUD.

The commercial balance, which is the difference between what a country gains from its exports in exchange for what it pays to its imports is another factor that can affect the value of the Australian dollar. If Australia produces very required after exports, its currency will obtain a value of the excess demand created from foreign buyers who seek to buy its exports in exchange for what it spends to buy imports. Therefore, the positive net trade balance enhances AUD, with the opposite effect if the trade balance is negative.