AUD/USD gatherings with the dollar weakening: Is recovery sustainable?

- summary:

- Aud/USD climbs above 0.6370 with the US dollar weakened. The main levels, market drivers, and what is the next of the Australian dollar?

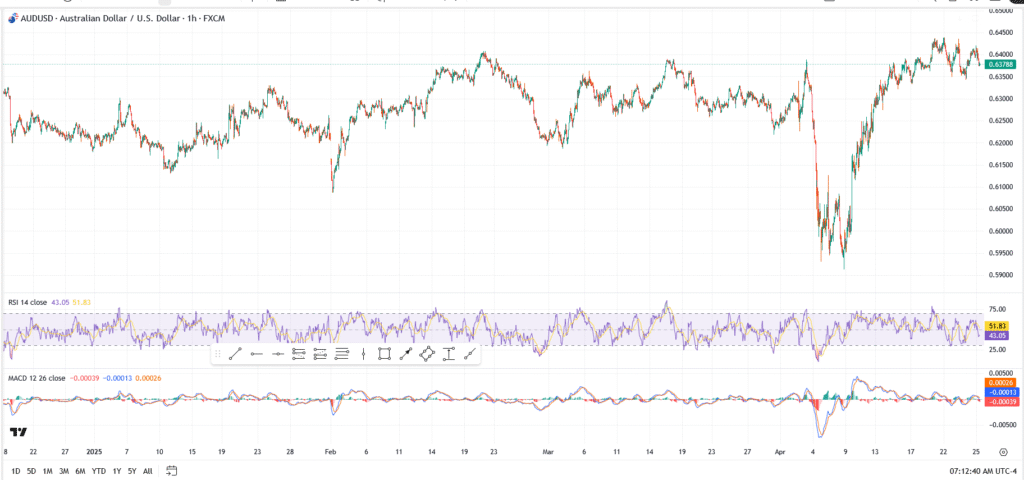

AUD/USD extended its upscale momentum today, climbing above 0.6370, as the US dollar weakened in all fields. The move represents a strong recovery from the sharp decline of April, as the bulls are now looking for a break over the 0.6400 handle, a level that culminated in many modern developments.

The most powerful Australian trade data and elastic commodity prices, both of which tend to prefer Australian, and have strengthened the appetite of risk. However, as the market continues to digest the broader effect of the interest rate in the United States, the husband remains vulnerable to the short -term repercussions, especially if the feelings are fluctuating.

Technical expectations: The main support and resistance levels of AUD/USD

Immediate support:

- 0.6320-Minor, withdrawal area

- Zone 0.6260 men bounce in mid -April

- 0.6200- Double Base Base before penetration

The upcoming resistance:

- 0.6400-psycolical barrier

- 0.6450- The neckline from March collapse

- 0.6525- February peak and trend resistance

The current structure shows a potentially continuing preparation, but the price needs to scan 0.6400 decisively to unlock the room about 0.6450. Failure to keep 0.6320 to the largest outbreak of about 0.6260.

What pays the Australian dollar today?

The Australian dollar has found fresh tail winds, as the power of the dollar begins to collapse. The weakest American PMI data that was tested on Wednesday in the stance of the federal reserve bank erupted, while Australian economic indicators, including basic commodity export data, are still strong.

China, the commercial partner in Australia, has also alluded to more infrastructure spending, which supports Australian iron ore exports. Add in the wrong US yield and a short -term AUD power becomes stronger, although the risk of geopolitical events and nutrition remains the main opposite wind.

Outlook: What is the following for Aud/USD?

The short -term bias turned into construction while restoring the pair after washing last week less than 0.6100. But the bulls need to scan 0.6400- 0.6450 to indicate a real transformation of medium-term momentum. If so, the Australian risk stops or worse in a decline towards a zone 0.6200- 0.6250 if the dollar’s strength returns.