SUI faces $ 96 million if the price reaches this level

SUI recently witnessed 12 % increase in the past 24 hours, restoring some investor confidence. However, this increase in prices may be catastrophic for traders, as it may lead to a large liquidation if Altcoin reaches the main price level.

The last gathering is a double -edged sword with possible consequences for short traders.

Sui merchants face losses

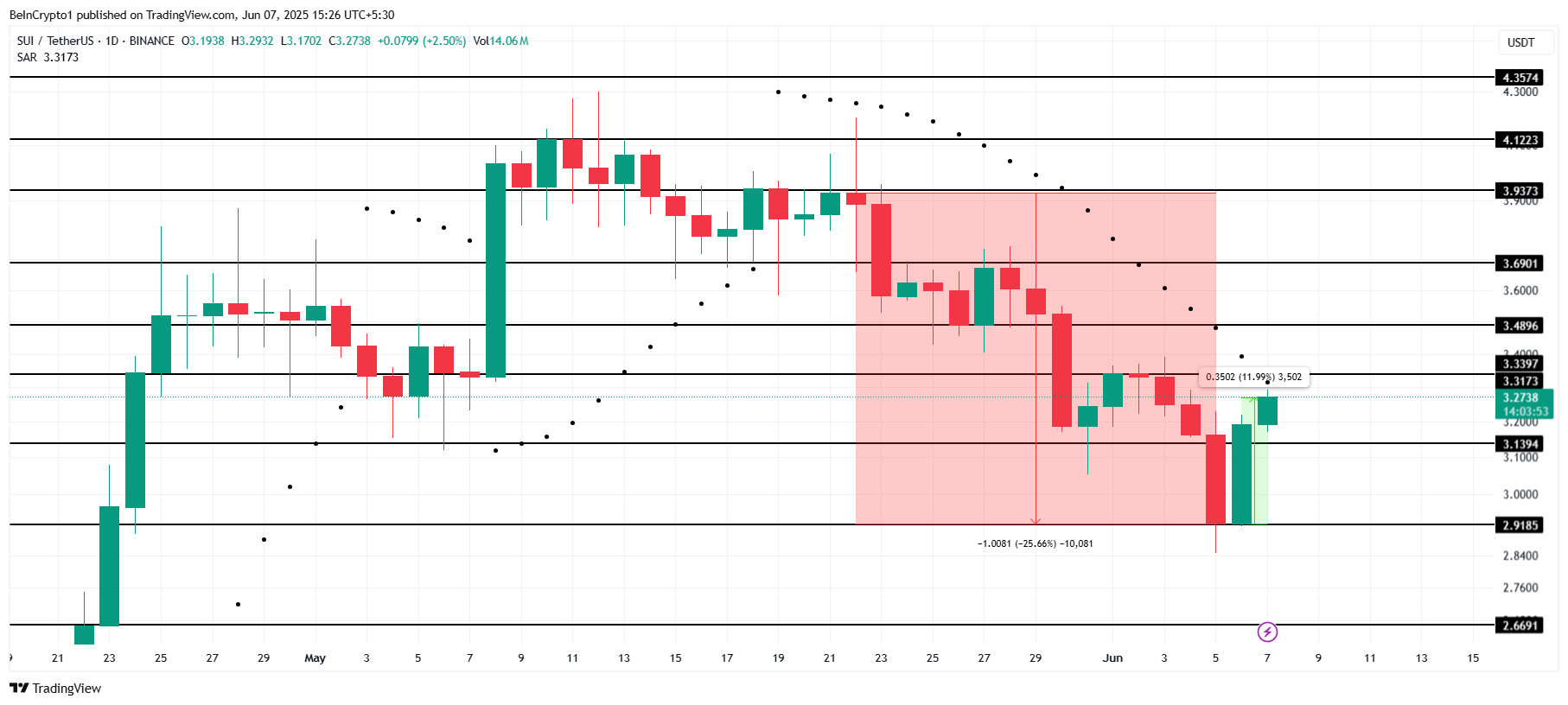

According to liquidation data, SUI faces a potential amount of $ 96 million if its price reaches $ 3.48. This would primarily affect short traders, who put themselves in low prices.

If SUI rises towards this critical level, short contracts will be liquidated, forcing merchants to cover their sites and pay a price increase.

This possible liquidation event highlights SUI fluctuation and the risks involved in merchants who are betting on. With an increase in price, short traders may have to get out of their positions, which inadvertently fueling the upward trend.

As a result, this scenario can exacerbate high prices, putting both short and long traders at the mercy of unexpected price movements.

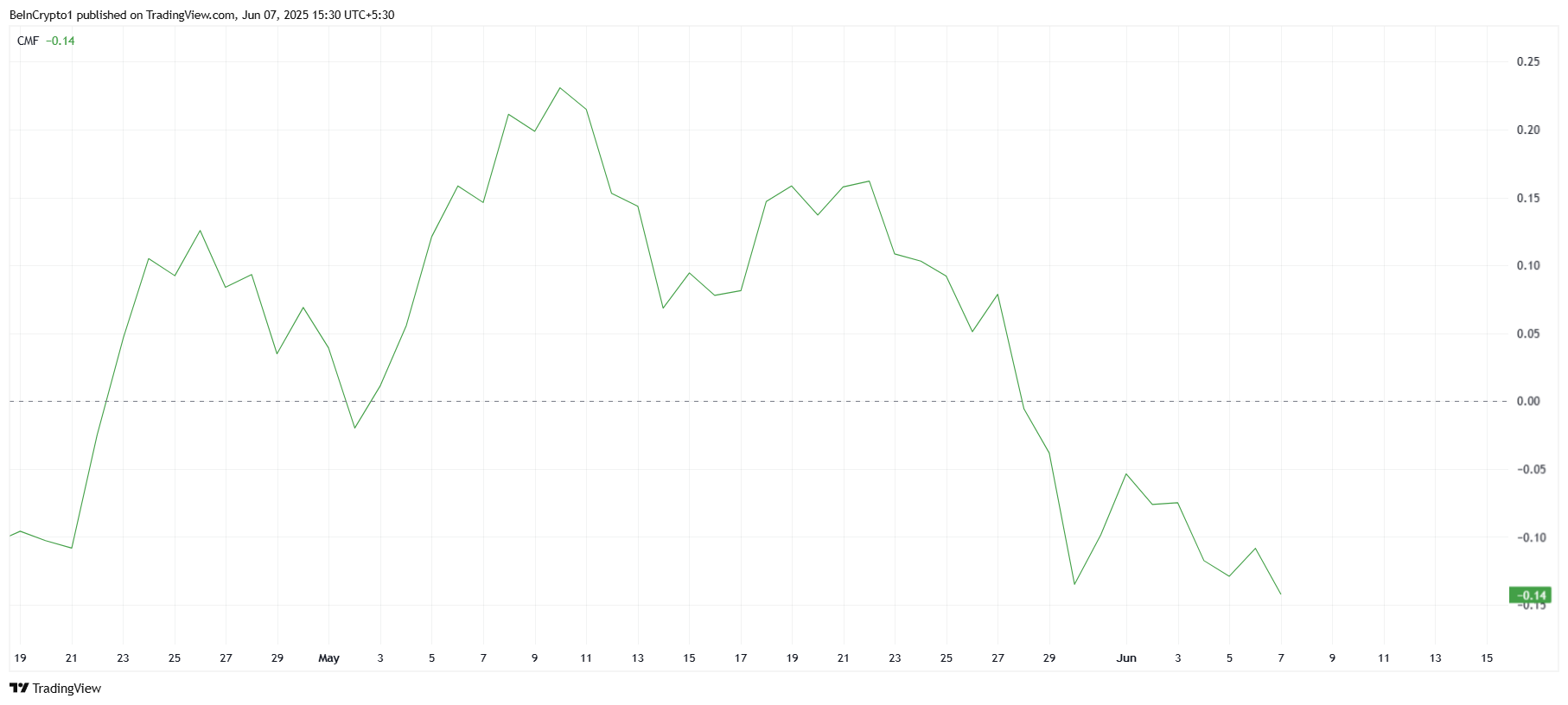

Although the last 12 % increase, the company (CMF) is a decrease, indicating a lack of investment flows. CMF is currently a negative momentum, indicating that investors do not support the high prices of SUI.

Recent gains appear to be paid more through short coverage rather than a wide increase in interest.

If external flows persist, only an additional price may face pressure. There is no strong support for purchase, as well as a decrease in CMF, that the last gathering may not be sustainable.

If these external flows continue, they may lead to price reversal, which reduces optimism resulting from recent gains.

Price attempts sui

At the time of writing this report, SUI is traded at $ 3.27, after increasing by 12 % in the past 24 hours. The price is currently facing resistance at $ 3.33, which has proven to be a great obstacle in the past.

Given the ongoing external flows, SUI appears to be in the short term.

If SUI fails to violate $ 3.33, this may recover to low levels, such as $ 3.13 or $ 2.91, giving recent gains. This would represent a continuation of the standard of monotheism, as the lack of strong purchase pressure prevents more upscale movement.

However, the equivalent SAR index approaches a major level, with a potential heart under the candlestick that can indicate the beginning of the upper direction.

If Sui succeeds in breaking $ 3.33, the price may rise to $ 3.48. The violation of this level will nullify the landfill, which leads to a wave of references in short locations and increase the price.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.