Alcoa warns a tariff tariff that may cost $ 425 million annually: “This is the most material effect,” says the executive director – Alcoa (Nyse: AA), Bank: BAC (NYSE: BAC)

Alcoa Corp. AAThe largest aluminum producer in the United States has reported additional costs of $ 20 million during the first quarter, which was promoted from the newly imposed definitions on Canadian aluminum imports last month.

What happened: During which First quarter profits Call on Wednesday, Alcoa Financial Director, Molly BermanThe 25 % definitions, which came into effect on March 12, have already said in the company’s final result, to $ 20 million, and expected to climb the expenses related to the tariff to 90 million dollars during the second quarter.

Follow up on this, CEO William F The tariff said a major challenge to the company. “This is the most physical impact on Alcoa, as nearly 70 % of aluminum produced in Canada is intended for American customers,” said Osbelinger.

It has been estimated that the annual tariff cost of 25 % may reach $ 425 million.

See more: Trump’s tariff can force Ford to the high prices of its cars in the United States, days after the extension of employee prices for all customers

Besides, part of the raw materials obtained from China are now undergoing a higher tariff, according to Oplinger. It is estimated that these added costs will increase the annual input expenditures by 10 million dollars to 15 million dollars, noting that there are no viable alternative suppliers.

However, the company expects to compensate for some of these costs with the rise in the Middle West installment, which indicates the additional costs paid by buyers against aluminum, as well as the basic price. With this premium, Oplgerer believes that the net annual result is $ 100 million negative for Alcoa.

Why do it matter: newly, Bank of America company Pile Analysts have reduced the arrow, from “buying” to “weak performance”, with a reduced price of $ 58 to $ 26, which represents a 55 % declining review, indicating low aluminum prices and tariffs, Reports Baron.

William Oasler, CEO of ALCOA, was a voice critic of the definitions, saying he could erase 100,000 American jobs in February, like I mentioned By Investopedia.

Price work: The Alcoa stock increased by 1.58 % on Wednesday, but decreased by 1.48 % in trading after working hours after issuing the profits of the first quarter, which fell estimates.

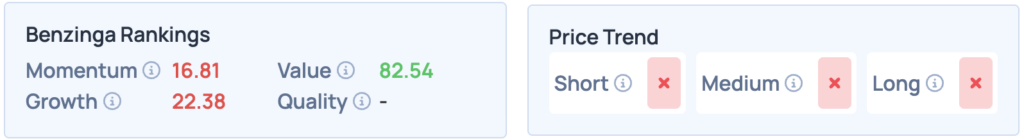

According to the Benzinga’s Edge Stock classification, Alcoa is weak in short, medium and long long in the long run, while registration is good at the value, at 82.54. For more ideas about these shares, his peers and competitors thought about registering in Benzinga Edge shares.

Read more:

Photo courtesy: Wirestock Creators / Shutterstock.com

Market news and data brought to you benzinga Apis

© 2025 benzinga.com. Benzinga does not provide investment advice. All rights reserved.